Rates and inventory are really low, so on paper it seems like the market should be booming. But it’s not. The truth is sales numbers are down despite rates doing the limbo below four percent again. It’s like the market looks hot on paper, but it’s also a bit lackluster in some ways.

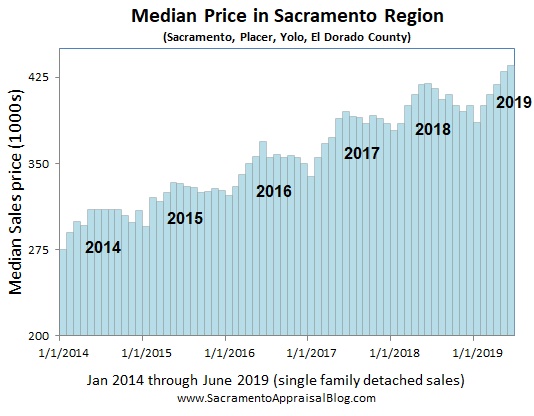

Affordability: A big issue today is buyers are struggling with affordability. After seven years of price increases, we’re seeing the market become too expensive for many prospective buyers since wage growth has not kept pace with price growth. Some buyers feel uncertain about the future also, which is causing hesitancy about whether to purchase.

Hot couple analogy: The market is like a super hot couple that looks great on paper. They’re rich, attractive, successful, and they get a ton of “likes” on Instagram. Everything looks perfect, but then out of nowhere they break up because it turns out their relationship wasn’t as good as everyone thought. In a similar way, the real estate market looks stellar on paper. Rates are low, inventory is sparse, and it’s actually really competitive out there. But we’re also seeing weaker sales volume which shows us buyers aren’t as enthusiastic as we’d assume them to be.

Any thoughts?

—–——– Big local monthly market update (long on purpose) —–——–

Now for those interested, let’s talk about Sacramento trends. If I had to pick a few phrases to describe the market it would be competitive if priced right, modest price growth, slumping volume, and fairly normal stats for the spring.

DOWNLOAD 70+ visuals: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

DOWNLOAD 70+ visuals: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

THE SHORT VERSION:

- Prices are up, volume is down

- It kinda feels normal right now

- Price growth has been modest

- 46% of sales had multiple offers last month

- Sales volume is down for the 14th month in a row

- Low rates have helped change the feel of the market this year

- Inventory is thin, but slightly higher than last year

- The post is long on purpose. Skim or pour a cup of coffee

THE LONGER VERSION:

Here are some of the bigger topics right now:

Normal: The market felt really dull last year, but it’s been a somewhat normal year so far in 2019. There are certainly concerns about affordability, but from a stats perspective it’s been a pretty standard first half of the year. Pendings continue to be strong also, so buyers still clearly have a strong appetite for the market.

14 months in a row of slumping volume: Despite mortgage rates being low we’re seeing somewhat sluggish sales volume. In fact, sales volume was down 11.6% in the region last month and it’s down 8.6% so far in 2019. Moreover, we’ve had fourteen months in a row with lower sales volume compared to the previous year. In my mind it’s still best to say we’re having a slower year instead of a volume meltdown because levels aren’t alarmingly low by any stretch. Let’s watch this carefully.

Dude, rates will never get below 4% again: It’s been a little surprising to see how low rates have gone again, right? The narrative for a while was, “Dude, they’ll never go below 4% again. We’ve bottomed out.” Yet here we are. My sense is if rates keep going down it’ll only increase competition and artificially inflate prices. That would be temporarily nice for buyers, but an unfortunate byproduct is low rates in a wider picture tend to create less incentive for sellers to move. Why sell if you’re sitting on a 3.5% mortgage rate?

Purplebricks & the tech invasion: Last week it was announced that Purplebricks will be exiting the United States housing market after a 75% loss in shares. This company is going to the grave in the U.S., but the reality is we’re still in a market where tech companies are trying to disrupt the traditional real estate model. Next up? Zillow is said to be coming to Sacramento by the end of the year.

Joe Montana’s $49M overpriced listing: Former Quarterback Joe Montana listed his property for $49M and it didn’t sell because it was profoundly overpriced. In fact, the price has now been reduced to $28M. Many sellers are like Joe in trying to attract mythical unicorn buyers who will mysteriously overpay for some reason. My advice? Be aware that today’s buyers are incredibly picky about paying the right price.

The dream of selling at the top: I met a guy who wants to sell because he says the market might top out soon. His concern is a friend sold two years ago thinking the market was at its peak, but it wasn’t. The truth is it’s not so easy to time a market perfectly. We talk about how simple it is to do this, but most people pull it off from dumb luck more than anything. The reality is the bulk of buyers don’t buy based on price metrics, but rather lifestyle and affordability.

This is a fascinating chart, right? It shows a few price cycles over the past twenty years in Sacramento County. I don’t share this to say prices are about to change directions, but at some point that’s probably what we ought to expect because that’s what markets do. They go up and down. For now price momentum has been slowing and we’ll continue to watch this closely to see how it plays out. Let’s remember the collapse we saw in 2005 was not a normal trend that’s now the formula for the next price cycle. That was a market built on fraud and rampant speculation.

The coming recession: There are lots of predictions about a coming recession, and at some point one will happen. But predicting recession specifics is a bit like predicting housing market specifics. At the end of the day we might have ideas, but we don’t know the future if we’re honest. Moreover, the last “great” recession isn’t now the template or formula for all future recessions.

Eyeballs vs offers: Over two years ago I wrote about a $250M listing in Bel-Air. At the time it was the highest-priced property in the United States, and it was called “record breaking”. But today it’s still on the market and priced at $150M. Despite going viral and having global attention this listing did not sell. This reminds us it’s nice to have eyeballs on a listing, but the only thing that matters is offers. Sellers, if you aren’t getting offers, it may be time to adjust your pricing until the market bites.

Preparing for a slower season: At this time of year we typically see the market begin to slow down. The sales stats don’t show it yet, but when July stats come out we usually see it starts to take slightly longer to sell in July compared to June. This is a clue into a slowing market, and eventually we see more slowness in actual prices (but it often takes a few months to see the slow trend show up in actual sales stats). This is a good reminder to pay close attention to pendings today because that’s where we see what the current market is doing. What is similar and actually getting into contract? That is THE question.

I could write more, but let’s get visual instead.

FOUR BIG ISSUES TO WATCH:

1) SLOWER GROWTH: The market has moved forward this year, but it’s been at a slower pace. In other words, the market has felt competitive this year, but price momentum has continued to slow. Remember, “slower” and “slow” are not dirty words in real estate. They are market realities.

2) A QUICK RECAP: All year prices have shown a modest uptick. What I mean is prices are up from last year, but not by much. Keep in mind the lowest prices are likely the “hottest” market in town too.

3) VOLUME SLUMP: The number of sales has slumped in the region for 14 months (and 13 months in Sacramento County). Overall volume is noticeably lower this year, but it’s still not outside of normal low ranges though either (see 2014 and 2015).

SACRAMENTO REGION:

Key Stats:

- June volume down 11.6%

- Volume is down 9.9% over the past 12 months

SACRAMENTO COUNTY:

Key Stats:

- June volume down 13.4%

- Volume is down 9.3% over the past 12 months

PLACER COUNTY:

Key Stats:

- June volume is down 10%

- Volume is down 9.2% over the past 12 months

EL DORADO COUNTY:

Key Stats:

- June volume down 6.3%

- Volume is down 12.4% over the past 12 months

4) PRICES TICKED UP IN JUNE: The market generally showed price increases last month, though they were pretty subtle.

NOTE: Take El Dorado County data with a grain of salt. Stats change significantly month by month.

Thanks for respecting my content: Please don’t copy my post verbatim or alter the images in any way. I will always show respect for your original work and give you full credit, so I ask for that same courtesy. Here are 5 ways to share my content.

Please enjoy more images now.

SACRAMENTO REGION (more graphs here):

SACRAMENTO COUNTY (more graphs here):

PLACER COUNTY (more graphs here):

EL DORADO COUNTY (more graphs here):

DOWNLOAD 70+ visuals: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

Questions: What are you seeing out there? What do you think prices are doing? What are you hearing from buyers and sellers lately?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Love the Yearly Price Cycle chart. Very cool.

Thanks so much Joe. I shared these last year, and I was waiting for the right time to update them for 2019. I figured half the year being done now would be a fitting time. I have a Yolo one too buried in my file download.

I don’t know if I’ve ever downloaded your complete chart set. Might have to take a look…

There are usually a few extras of this and that on top of everything in the post.

As always Ryan, great info. I am very grateful for you sharing this information.

Thanks so much Kevin. I appreciate that – especially since you watch the market so carefully.

The market is like the noisy souped up Honda with a teen driver. It sounds like it’s really going to move but then the soccer mom in the Pigeon wing minivan Tesla blows it away without even knowing they were racing.

This is epic. Haha. It made me laugh out loud. Thanks Gary. On a side note, I once raced a minivan while I was a reckless high school driver in my ’89 Sentra. I’m proud to say I won… And for the record I completely understand why it costs more to insure teen male drivers.

Gary… Hilarious analogy… Thank you for that, it was much needed

Great post and market update Ryan! I love your analogy of the perfect couple being not so perfect. I have been seeing this over the past couple of years in my market. It really defies the principle of supply and demand. It is an interesting time to watch. Keep up the great work! Your visuals are fantastic, as always!

Thank you Jamie. I’m glad you mentioned supply and demand. I constantly hear things like, “Inventory is low, so the market should be really hot.” But it’s never just about supply. There are many other layers to the cake so to speak. Besides, the market has seemed to grow hyper-sensitive to inventory changes too, which means we don’t need too much before the market starts to feel dull. This may not be true everywhere, but it’s certainly true in Sacramento. And the idea that a 5-month supply is normal is definitely false in my market. I’d love to see that generalization retired from our vernacular.

I think buyers would like to go nuts, but at these prices they are being pickier than ever.

In our North San Diego County coastal region, the detached-home sales of the first half of 2019 are only 4% under last year, with pricing a tad lower too – the median sales price is $1,300,000.

But how’s the median days-on-market stat?

It’s 22 days, which is about the same as it has been recently.

Buyers still come running when they see the right house, but it has to be a perfect match now.

Or to use your analogy, that perfect couple is only going to split up if they find someone who really makes it worth it!

Excellent commentary Jim. I love the evolved analogy too. Thanks so much.

I’m seeing the same thing here. The market feels very competitive still, it’s not taking long to sell, and most metrics feel mostly normal. But in the background there is a heightened sensitivity to paying the right price and we’ve seen sales volume slough. It almost offends some people when I say the market is slower these days. I don’t mean it’s dull or declining. I mean it’s not the incredibly aggressive market it used to be in 2013. It is definitely still competitive – especially if it’s priced reasonably.

As I pointed at the Arden/Carmichael Regional meeting on Tuesday, on the Metrolist splash page, there is a pie chart that shows New Listings, Back on Market, Price Increases and Price Reductions. Price Reductions were well over 200, Price Increases were around 20. I did tell them to dig into any particular transaction that they believe is relevant to find out of it was overpriced to begin with, but Price Reductions at that level is definitely an important metric in a stagnant market.

Thanks Bill. Yes, we ought to expect to see more price reductions in coming time. You’re spot on about this. On a different note I’ve had a hard time adjusting to the new pie shape. I just need to get used to it. I suppose it’s a cool visual. I do wish we saw both a 24-hour market watch and a 7-day market watch.

The most significant number of price reductions I’ve seen in recent years was the fall of 2014 where we had 400 or so each day. The market was extremely dull then. Last year we had a really dull fall and it was 200+. I’m anxious to see what this market brings over the next 5 months.

Great market analysis, Ryan. Keep up the great work. Your observations on the market not behaving like we think it should given the low-interest rates and sparse inventory really support the idea that the data really should be analyzed by a live appraiser rather than an AVM and algorithms. A machine can’t get a feel for the market like a veteran appraiser with years of experience.

Thank you Tom. I appreciate it. Markets are complex. There are so many moving parts. In my mind it’s never just about the numbers, but about the story the numbers tell and the underlying issues that are driving the numbers to change over time. I think appraisers are in a great position to be storytellers for the real estate market since we are tasked with being neutral. What I mean is our neutrality is an advantage because there is no agenda when sharing stats (not saying other real estate professionals have an agenda). Nobody is being sold anything. There is no slant.

Hi Ryan,

The market up here in Boston is just like that hot couple. A lot of fooling around, but not much being consummated.

Ken MacDonough SRA

Haha. Thanks Ken. I appreciate you taking the analogy further. 🙂

Ryan, you have done your homework on this market very well and I for one appreciate you doing what everyone should be doing. I have only been appraising sence 1969 and when you think you have it down you get a cure ball. The market is not perfect buy any means but it is what we have and it will always be changing in our favor. When we have a perfect market no one will need us. I wish there was better news but until the Feds screw everything up again which they will and the finger pointing will be at us because we weren’t there to save the politicians assets.

Keep up the good work,

George West, MAI, SRA, SREA

Thanks George. I appreciate you pitching in thoughts here, especially since you’ve been in the profession for so long. I agree too. There isn’t such a thing as a perfect market. I think we learn about supply and demand in high school Economics and expect to see markets where everything can be explained so easily. That just doesn’t exist in the real world. There are many layers that make the market move and at times we even need time to really understand exactly what a market is doing and why.