The market is hot again. Sort of. We’ve been seeing a spring seasonal market for a few months, but we seemed to hit an inflection point locally a few weeks ago, and it’s getting REALLY competitive out there. Let’s talk about it. This is a longer post, so scroll by topic or digest slowly.

UPCOMING (PUBLIC) SPEAKING GIGS:

4/12/23 Q&A at Moksa Barrel House (details coming)

4/13/23 Realtist Meeting

5/4/23 Event with UWL TBA

5/10/23 Empire Home Loans event TBA

5/22/23 Yolo YPN event TBA

7/20/23 SAR Market Update (in-person & livestream)

ICE BATH TO BLOODBATH

The housing market was an ice bath in the fall of 2022, but now it feels like a bloodbath with the level of competition. I was expecting the market to heat up for the spring, but seeing 45% fewer new listings so far in 2023 in the Sacramento region has changed the trend. This meme is the best way I can describe the market right now (images from Captain America).

BUT VOLUME IS STILL WORSE THAN 2007

The market is starting to feel like 2020 competition, but we have 2007 vibes in terms of sales volume. That’s what is so weird about today. In fact, since late 2022 monthly volume has been worse than 2007 levels in the Sacramento region. Thus, when someone says the market is blazing hot right now, there’s a major asterisk next to that statement.

LOW DEMAND & LOW SUPPLY HAVE MET

The issue today is we’ve had lower demand since buyers have stepped back from the market due to affordability. But now sellers have also stepped back, and it’s caused low demand and low supply to meet. If we had a normal number of listings right now, the market would feel way different. It’s frankly striking to see competition like this in the midst of a market with so many missing buyers.

ACTIVES & PENDINGS

Here’s one of my favorite ways to show the market right now. I find it’s key to look at the number of listings and pendings by price range to get a sense of competition. Do you see how tight the market is in some price ranges? At the moment there are more pendings than actives in every price range under $700,000. It’s especially lopsided under $500,000 though. This dynamic is exactly why we are seeing bidding wars.

And here’s a snapshot of actives vs pendings. This doesn’t have any context, which is a weakness, but I think it’s important to get a quick glance at the numbers. I’ll share this here and there if you like it (let me know). In short, having more pendings than actives is a freakish trend for Sacramento County, and that sort of dynamic is not normal (it happened in portions of 2020 through 2022 when the market was blazing).

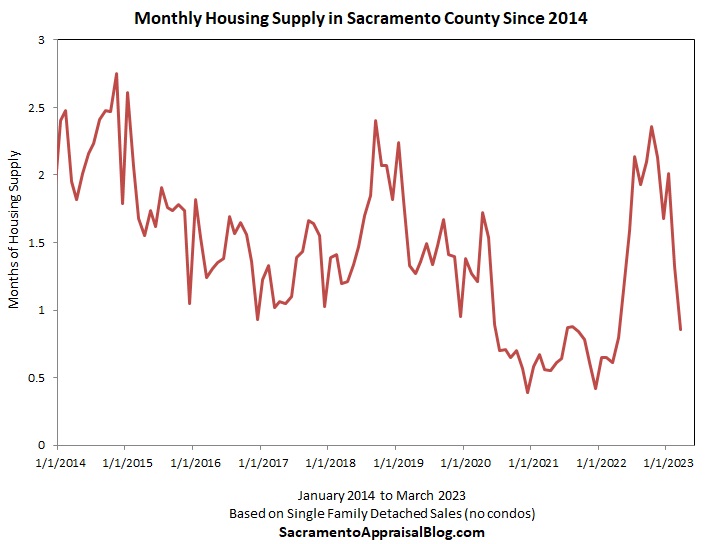

BELOW ONE MONTH AGAIN IN SACRAMENTO COUNTY

We dipped below one month of housing supply in Sacramento County again. This means there is less than one month worth of active listings available to buyers. It’s making it tight to have fewer listings hit the market.

And a few different counties… Basically, every local county has seen inventory drop lately, but only Sacramento County is below one month so far (the entire region is close though at just under 1.2 months).

BRO, I PREDICTED THIS…

Lots of people are acting like it was so expected to see sellers step back from the market like this. I get it because it makes logical sense since the math doesn’t work for sellers. But it’s also okay to be surprised that we’ve seen a whopping 45% fewer new listings in the region in 2023. And it’s no problem to change our narrative when the stats change. For me, the trend right now makes logical sense, but I’m still shocked to see nearly half of all local sellers sitting out. That’s a stunning trend, and it’s made all the difference today. Here’s a tweet from yesterday to tie in predictions too.

TAME PRICE APPRECIATION THROUGH MARCH

We’ve since a spring bounce with prices in the Sacramento region. This is normal to see, and it’s something that happened even in 2007. We’ll see what the future holds as current pending contracts start closing. I’m definitely seeing a higher percentage of multiple offers among pendings in recent weeks, and there are some really lopsided stories about buyers paying above the asking price too. More on that in time.

Anyway, price appreciation through March has been modest at best (county and regional level). In other words, it’s been a slight uptick, and we haven’t seen explosive price growth like early 2022. Pending price data looks pretty modest technically, but we never know how much properties have gone above the asking price until they actually close, so there is a lag in tracking the trend. This is why on the neighborhood level it’s so important for appraisers to talk to agents to understand what current pendings are in contract for. Keep in mind the trend can be way different at the bottom half of the market, so it’s important to look at each neighborhood and price point separately rather than imposing a county-wide trend on every neighborhood.

All that said, one thing I’m hoping to communicate here is the importance of recognizing that intense competition doesn’t automatically mean early 2022 rapid appreciation. We are in such a weird market right now with subdued supply and subdued demand, and we’re going to have to wait to see what happens with prices. One thing that likely isn’t helping is the extra steroid of the Dream for All program. Lower rates lately can bring some buyers back too. Ultimately, the market will figure it out… Well, and Fed and governmental policy will probably be the x-factor in shaping things.

Let’s keep watching.

SELLERS STILL NEED TO PRICE CORRECTLY

It’s really expensive to overpay in today’s market, so overpricing is a glaring mistake. The properties that are getting bid up are units that check all the boxes and/or homes that are priced lower to generate interest. We are NOT seeing overpriced properties getting 10 offers. I’m also not seeing properties with 30 offers when priced at market value either.

THE MARKET IS NOT NORMAL

On the rosy side of the real estate narrative, it’s easy to say the market is back, but that’s not true. It’s still not affordable for a big chunk of buyers, which is why sales volume has been lousy for so many months. Granted, if we start to see fewer listings over time, then sales volume could also be down because of a lack of listings. I find a “hot” market with rising prices is the preferred narrative among many real estate professionals, but the last thing we need right now is higher prices. Moreover, it’s volume that pays the bills. Not prices. Personally, I’d rather see prices go down so more buyers can participate. That seems healthy to me. But I don’t get to make the rules.

NOT ADMITTING THE MARKET IS HOT

I’m finding some doomers are struggling to talk about fewer new listings changing the dynamic lately. My observation is some who perpetuate a doom narrative are so fixated on the idea of the market imploding that it’s hard to admit that it’s getting hot again. I don’t say this as a guy who is a part of the rosy real estate club. I’m on team data, and my goal is to form perspective based on the stats. I’m just saying it’s felt disingenuous lately with social media conversations where some people are so tied to their dark narrative that they can’t seem to be able to talk about a shifting dynamic. Look, we are not affordable, and it would be really healthy for prices to go down. We’ll see what the future holds in this regard. But let’s not miss out on market analysis and conversations right now.

THE DECLINING BOX

Appraisers need to consider which box to check in appraisal reports right now. The market is a mixed bag for sure, and the trend is going to vary by neighborhood. But if we are market experts, we need to be on top of this and let the stats lead us. If the market has changed in recent weeks and months, this means older sales might need upward adjustments if pendings are now higher. I saw an appraisal report this past week where comps from November and December were used without any adjustments, and that seemed off when looking at neighborhood stats. The appraiser said the market was declining, but the trend has changed lately. I would have at least said the trend was flat with some brewing upward pressure. In my mind, the most important thing right now is to really understand what is happening with the listings and pendings rather than waiting for these properties to close in coming months to see the trend then. I’m really against appraisers saying the market is stable if it is declining. Seriously, I despite that. But I’m also against saying it’s declining if it’s not.

I spoke at the ACTS conference this week, and here’s an example of some language I used recently to describe the market.

By the way, it was really nice to meet so many new friends at the ACTS conference. I’m looking forward to being connected.

I hope this was helpful.

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Questions: What are you seeing happen with prices? Up, down, flat? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

That photo looks familiar….

I’ve seen a similar uptick in prices in some places but am scratching my head because there are so few sales so far this year in my markets. In this case, I’ve commented on the latest sales may be signs of a change but not enough yet for me to say the trend has changed. I’m keeping my eyes open to watch what’s happening now.

Thanks Joe. Yeah, it’s a weird dynamic right now. And so far the market has sort of flattened in 2023 with maybe some upward price movement on the county and regional level (modest). No major price appreciation. I’m eager to see the pendings though now since I think we hit an inflection in recent weeks. I think ahead it’s going to test the traditional rule in real estate of low supply means upward prices. 2022 showed us it’s possible to see the exact opposite of that where we can decline even with low supply. We’ll see what happens with 2023. It’s been such a wild ride to see sellers step off lately.

I’m also hoping this is a temporary bump and that prices come down some more. Maybe weird to say that as a realtor, but I work with a lot of buyers, and I want them to find a home that’s a good value, not being too aggressive when faced with 20 other offers. We’ve been looking in the 400-550 range with several buyers, and the competition has gotten nuts in the last month. 10-20 offers on most, and people are going over listing price to “win” them. I hate even saying “win” but it feels like a blend of a lottery and an auction lately! If I can borrow a term from stock market pundits, I’m hoping this is just a dead-cat bounce! And then we can get back to a buyer’s market or even a balanced market.

And then we can get back to a buyer’s market or even a balanced market.

Excellent commentary. Some of this drama over the past week has to stem from the Dream for All program, but the market inflection began before the program (as you said too), so I think it’s a matter of listings becoming so anemic and creating imbalance. It’s been unfortunate because the market needs to heal and become more affordable. If we had a normal number of listings right now, this dynamic would not exist. But that’s not what we have. I was expecting a spring bounce since that is the normal trend, but it’s been such an aggressive dynamic lately in light of a change with sellers. The second half of the year will tell us more about the trend.

Get ready for a V shape recovery if the fed lowers rates.

Tom, this makes me smile. It’s the first time I’ve heard a shape in a long while. It seems like we were talking about V and W shapes for a bit a few years ago. Let’s keep watching. The Fed has a ton of power right now to shape things. My main concern is with sales volume right now. To me that says way more about market health than prices.

I love the statement that volume pays the bills. You’re right, let’s see affordability come back to the market. If prices tick up a bit due to low inventory, that just extends the pain for the market.

Thank you Gary. And I appreciate you reading too. Some real estate professionals talk about how great it would be to see prices stabilize, but that really isn’t the solution here because the bigger issue is we need more affordability. And that can come through price declines, rate declines, financing programs, etc… I’m not on team doom or team rosy, but I do want buyers and sellers to participate in the market. That’s healthy in my mind.

I loved your statement “look at each neighborhood and price point separately rather than imposing a county-wide trend on every neighborhood.”

I cover a 3 county area around Seattle and I can’t identify a city-wide trend, much less county-wide. We are also experiencing extreme variations and clearly defining the neighborhood and “similar and competing” neighborhood is critical.

Thanks Barry. It’s tough out there to see the trend and understand it. I find one of the challenging things about real estate data too is to sift through sensational articles and sometimes sensational stories from the trenches of escrows. Keep me posted with any insights you discover. I really like comparing notes with experts in other locations.

One of the things I’m paying attention to right now is competition vs price. In other words, can we see an ultra competitive market without much price change? Or does the problem with low listings drive prices up? Or do we see the struggle to afford the market as the trump card here and see prices go down? We are in a really interesting time right now. Rates dipped again today, and I’m eager to see where they go in coming time, as that matters too.

One guy I follow on Twitter has a thesis that 6% mortgage rates unlock demand, but it does nothing to unlock supply. We’ll see if he’s right (that’s Michael Zuber for reference (gotta give credit)). There has to be an inflection point for sellers to jump into the market again.

In my uniformed opinion: the dream for all program has $300M which will impact approx 2500 buyers, spread across CA. While I think it doesn’t help the demand equation, that money will run out by this weekend. So, looking back at it in a few months, it’ll hardly show up in the data.

Thanks Steve. Did you see the CalHFA press release today? They mentioned the program is on pause. Buyers basically have until April 12 to lock it in (or until funds are fully committed). I hear you too. I don’t think this is a major driver, but it has put some demand back out there. The market had already hit an inflection point before this program came about one week ago, but this did add some fuel on the top of the fire. I wish there was a solid way to track Dream For All activity, but there’s no way to know for sure when this loan was used during an escrow. I imagine there are many disappointed buyers right now, so we’ll see if they try to figure things out with FHA or some other type of loan.

Press release (PDF): https://www.calhfa.ca.gov/homeownership/bulletins/2023/2023-03.pdf

Yep, definitely saw! That means that the money lasted a little over 2 weeks, lol. Hardly a drop in the bucket (but certainly some dry pine needles on already burning embers).

My bet is that if the program is offered again, there will be a smaller amount given for the downpayment/appreciation share (maybe 10%) so that fewer people qualify and that it lasts a bit longer.

What would really help though in the macro is for prices to come down a bit. My intuition is that if interest rates come down to about ~5% we’ll get some of the frozen sellers back in the game. And also the fed policy seems to be finally having impact on the tight labor market – so we should see those impacts trickle down to housing eventually, too.

Wild times. I’m expecting aggressive offers this weekend under $500K in the Sacramento region. Buyers using the CalHFA “Dream For All” loan need to get into contract before funds are officially dry. There are 28 pendings under $500K since yesterday, and 26 have multiple offers.

Agreed on prices too. Affordability can happen through lower rates, changes in financing, lower prices, etc… Nothing wrong with prices coming down so buyers can afford the market. Prices are often sacred in real estate, but higher prices don’t help buyers afford, and higher prices with limited volume doesn’t pay the bills for real estate professionals either.

I wish this program did 10% from the get-go. 20% seems excessive. Just my opinion.