Assumable loans are eye candy in today’s housing market. The idea of taking over somebody’s 2.5% loan sounds amazing, right? It’s technically possible on paper for some loan types, but it’s challenging to pull off in the real world. Yet, if mortgage rates remain high, this is something we’re likely going to hear more about, so it’s important to know the process.

UPCOMING (PUBLIC) SPEAKING GIGS:

8/29/23 Elk Grove Regional MLS Meeting

9/06/23 KW Roseville Big Market Update (register here)

9/26/23 Orangevale MLS Meeting

9/28/23 Yuba City Big Market Update (in Yuba City (details TBD))

10/4/23 KW Sac Metro Big Market Update (register here)

10/6/23 SAR Think Like an Appraiser (TBD)

10/27/23 AI Fall Conference (San Francisco)

IT’S RARE TO ASSUME A LOAN (FHA, VA, & USDA)

I’m not a loan officer, so I won’t step out of bounds here, but it’s basically possible to assume an FHA, VA, or USDA loan from a current owner if the loan servicer is cooperative and everything else lines up between the buyer and seller. Conventional loans are NOT assumable, but I’ll defer to loan officers if there are rare cases where that can happen (seriously, talk to a loan officer). In short, it has to be the perfect storm of the right buyer, right seller, and right loan servicer to make an assumption happen.

UPDATED NOTE: A few people have said current FHA loans are not assumable, but everything I’m reading online from lenders and HUD directly seems to show FHA loans are assumable. My advice? Talk to a loan professional and the loan servicer. I defer to them.

HOW MANY LOCAL LOANS CAN BE ASSUMED?

Here’s a snapshot of FHA & VA transactions since 2009 in the Sacramento region. Of course, some of these properties have sold again already, but this is a general picture of how many potential assumable loans are out there. The real prize for a buyer would be purchasing from a seller who bought during the past few years when rates were really low (though many of those owners are sitting instead of selling).

WHAT PERCENTAGE OF THE MARKET IS ASSUMABLE?

Okay, but what percentage of the market has sold in recent years with loans that could theoretically be assumed in the future? In 2020 nearly one out of every five homes sold with FHA or VA, and since then it’s been about 15% of loans.

A LOCAL LISTING EXAMPLE

Here’s a property in West Sacramento that was purchased in 2020 with FHA financing, and the listing advertises, “Seller offering a possible loan assumption at 2.75% as part of purchase price.”

BIGGEST HURDLES TO ASSUMING A LOAN:

1) Paying the difference: The buyer has to pay the difference between the loan amount and the equity the owner has. This means if a property has a $400,000 loan, but it’s worth $525,000, there is a big chunk of change for the buyer to bring to the table. Some loan officers tell me it’s possible to get a HELOC (Home Equity Line of Credit) to pay the difference, but I’ll defer to lenders on that. All that said, it seems like buyers putting 20% down are often decent candidates to assume a loan because they can absorb the difference between the loan and value in many cases.

2) It can take a long time: I mentioned loan assumptions in a Facebook thread a few days ago. I heard about one local loan assumption taking FIVE MONTHS, another taking three months, or a quick one at 30 days. Look, maybe this process can be seamless once in a while, but can you imagine being in contract for five months without a guarantee of success? That is going to take a very particular seller and buyer, right? Moreover, if there are multiple offers, the seller is unlikely to choose the buyer wanting to assume the loan. This reminds us market conditions can either foster more or less loan assumptions.

3) The loan servicer isn’t always cooperative:

There are situations where the loan servicer simply denies the loan assumption. One real estate agent told me loan assumptions are basically a buzzword because they’re difficult to pull off. Sounds about right.

THIS MARKET REQUIRES CREATIVITY:

There is no sugarcoating assuming a loan as an easy process, but I think this market requires creativity. My advice is to understand the process, advertise the idea of an assumption if the seller is on board, talk to the loan servicer prior to listing, and help educate everyone on the process. Oh, and realize this is still a unicorn event that requires the perfect storm of everything coming together. This isn’t for the faint of heart, but it will work in some situations.

OKAY FINE, MORE NEW VISUALS

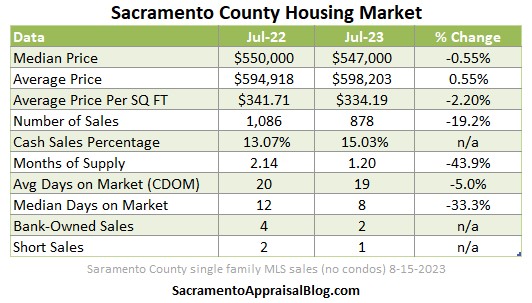

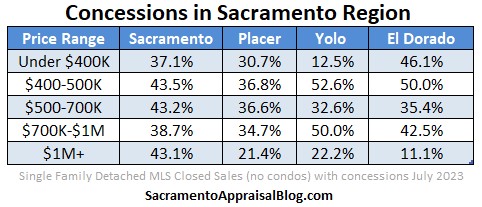

You wanted more visuals? This post is getting longer already, but okay. I put these together a few days ago, and I hope you like them.

CLOSING ADVICE:

My advice? Don’t put much hope in loan assumptions, but know how it all works so you can at least be aware of options. Like I said, it’s going to take the right buyer, right seller, informed real estate professionals, and a cooperative lender. When loan assumptions do happen locally, try to find out how the deal came together. The truth is buyers are starving to afford the market, and assuming a seller’s loan is going to help a small sliver of buyers out there. Ultimately, if rates remain high, this is going to be something more people are thinking about, and it’s possible we could see more loan assumptions ahead for that reason. If the market gets more competitive though, loan assumptions are the last thing sellers are going to target.

I hope this was helpful. Thanks for being here.

Questions: Anything to add about loan assumptions? Any stories to share? Could it matter for comps if we start seeing more loan assumptions? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.