Could you live in a tiny home? Or what about a skinny home? I’m talking where walls range anywhere from eight feet to twelve feet wide at their maximum. Well, let’s talk about a super thin unit that sold recently in Sacramento.

Think Like an Appraiser Class: I’m teaching my favorite class on April 28 from 9am-12pm. We’ll talk through choosing comps, making adjustments, and lots of practical scenarios. Hope to see you there.

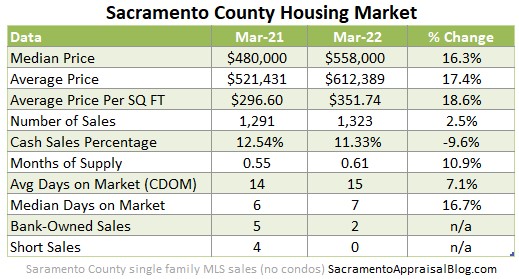

MARKET STATS: So much to talk about right now. I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

THE SKINNY HOUSE:

The “skinny house” is sort of a neighborhood landmark in South Land Park, and I think it’s a great conversation piece. I’m not aware of any house that is actually skinnier, so I’m open ears if you know about something. Most websites no longer have photos of this house, but Compass still does.

- Lot size: 2,040 sq ft

- Square footage of house: 1,019 sq ft

- Built in 2006

- Walls range from 8-12 feet (SacBee)

- Modern design

- Sold recently for $494,000 with multiple offers

You don’t need much: This property is a testament that you don’t need much land to build a home. The boxy modern design works well to maximize the footprint too. This house was built in 2006, so it was ahead of its time before modern units became all the rage. When this home was under construction, The Sacramento Bee actually quoted the developer as saying he put up a sign that said, “It’s a house.” Apparently, lots of curious residents kept stopping to talk to workers. The SacBee wrote about this home again recently (paywall).

HOW DO WE VALUE SOMETHING SO SKINNY?

Good luck finding three model match sales in a one-mile radius. That’s just not going to happen for something unique.

A few questions I would ask:

- Are there any other unique homes that have sold in the neighborhood or other neighborhoods? Maybe those can give clues into value.

- Has the subject property sold previously? If so, what did it compare to at the time? These could be clues.

- What are similar-sized properties selling for in the neighborhood? The subject might not compete with these units, but we need to at least understand what buyers have been paying for similar sizes.

- What is the price position? In other words, where might a property like this fit into the market price spectrum? I know, this sounds really subjective, but we have to ask. Is a property like this poised to compete toward the highest prices or the lowest prices?

Sold twice (see black dots): This property has now sold twice on the open market. The first time was during the foreclosure crisis, so we probably don’t want to give too much weight to that sale. With that said, each time this unit sold, it competed toward the lower end of the competitive range.

Don’t get stuck on 90 days of sales: It’s easy to get trapped looking at only a few months of sales, but sometimes we need more context, so it’s a good idea to step back and let the past give us insight. Of course, we have to be really careful about locking a property into whatever price position it had in the past, because it’s possible the market could change its perception today. But for now, with a property like the subject, the two prior sales help give weight to the idea that this unit tends to have a price position toward the lower end of the competitive range. The black dots help substantiate this.

A murderous example: Two weeks ago, I talked about Scott Peterson’s house. Being that this property has sold four times in the past twenty years, we have some insight. Why not check out the previous sales to understand the market? It’s easy to talk about this home like it’s damaged goods, but I think market stats say otherwise in this case. By the way, this property got into contract in less than a week recently with over ten offers.

OTHER SKINNY HOMES:

Single family home in Citrus Heights: This property was built a few years ago on Antelope Road, and it has a small footprint for building. Modern architecture isn’t for everyone, but what I like here is it’s not just another dull ranch home. In other words, this pushes the envelope – especially for Citrus Heights. Image: Google Street View.

Skinny modern halfplex in Midtown: These two attached units are only seventeen feet wide on each side, and there are three stories of living space (and an extra fourth story of bonus area). I wrote a blog post about this halfplex a couple of years ago. It’s amazing to fit a total of over 3,000 sq ft of building area on such a tiny lot. Photo: Brian McMartin.

Anyway, that’s what’s on my mind today.

Thanks for being here.

Questions: What do you think of such a skinny house? Would that work for you? Would modern in general work for you?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Skim or digest slowly.

Skim or digest slowly.