The market is going to crash. This time it’s going to be even worse. Have you been seeing more doom and gloom housing headlines? I sure have. This week I’ve had quite a few articles emailed to me. What do you think of this one? What do stats actually show? What do I say to my buyer who feels concerned? Let’s chat about this.

This is me holding a shabby chic doom sign I made this past weekend.

UPCOMING PUBLIC SPEAKING GIGS:

- 2/25/2022 Placer Assn of Realtors market update (details)

- 3/15/2022 NARPM Luncheon (details)

- 3/22/2022 SAFE Credit Union market update (details)

- 4/28/2022 SAR Think Like an Appraiser (details)

TEENAGE BLOG: My blog turned thirteen years old on Sunday. I’m definitely going to be watching the car keys and liquor cabinet closely…

NOTE: This post focuses on breaking down what I tend to see in so many doom and gloom real estate articles (and YouTube videos). If you’re looking to read about market ups and downs, check out a piece I wrote a few months ago, “Is the housing market going to crash?”

THE ANATOMY OF DOOM & GLOOM ARTICLES

Sensational title: These posts start with a sensational title such as, “We’re going to see a massive implosion,” or “It’s going to be worse than 2008.” I get it. A great title helps people click.

Other: What did I miss?

CONCLUSION:

I’m not saying all housing articles predicting demise are bad, but the doom niche tends to be formulaic with much of what I mentioned above. The truth is we should be talking about the current housing market as well as the future. Let’s keep doing that. But be careful not to get swept away by weekly articles that don’t add substance to the conversation. Know what I’m saying?

TWO RECOMMENDATIONS:

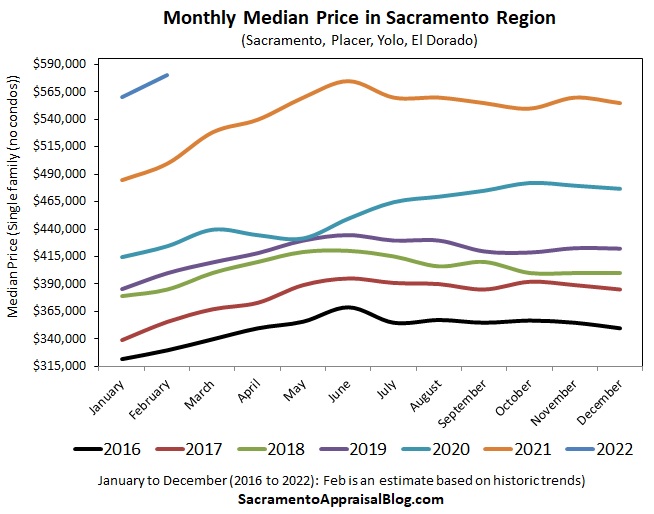

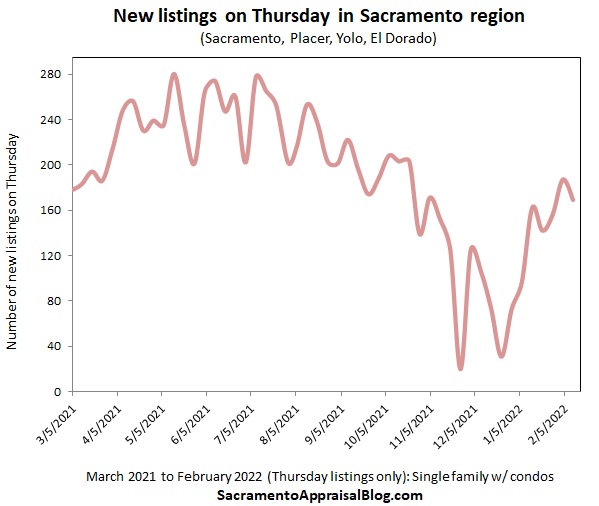

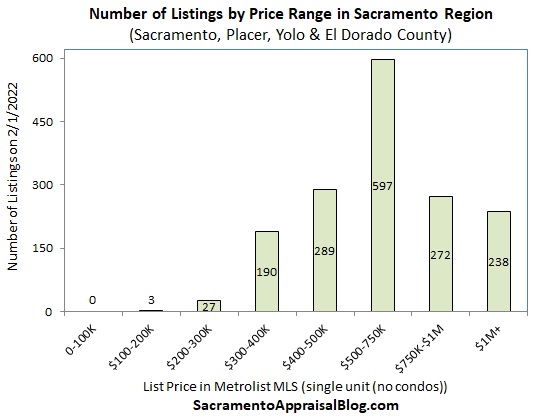

1) Know the numbers: Pay attention to actual stats and let the numbers form your perspective and narrative. Ultimately, without a good sense of seasonal trends and current stats, it’s easy to get tossed around by each new sensational headline. Moreover, a quick way to lose credibility in real estate is to habitually share articles that lack merit. I know, that sounds so judgy, but it’s the truth. If you feel like you’re not in tune with stats in your market, maybe start pulling them yourself, find a few people who are doing a good job (and devour their stuff), or even check out what a source like Redfin puts out there.

2) Read mostly everything: I recommend reading from a variety of sources and following lots of different people who talk about housing. Having a well-rounded perspective is important as a system of checks and balances too. On a related note, if someone has a positive-only or negative-only housing outlook, don’t waste your time. All that said, I appreciate hearing what Ivy Zelman has to say lately because she’s been more contrarian than most other housing analysts (which piques my curiosity). Some of my favorite housing voices include Calculated Risk, Altos Research, Odeta Kushi, Jonathan Miller, Len Kiefer, Daryl Fairweather, Steven Thomas (SoCal), Patrick Carlisle (Bay Area), etc…

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Thanks for being here.

Questions: What are you seeing out there in the market? What doom and gloom articles have you read lately? What housing sources are you listening to right now?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Skim or digest slowly.

Skim or digest slowly.