If the median price goes up by 2% in one month in a zip code, does that mean you have 2% more value for your property? Should you add that 2% to a new listing or appraisal? Or since the median price rose by 75% from early 2012 in Sacramento County, does that mean you have 75% more value? Not necessarily.

NOTE: Understanding how the median price works is important for valuing properties and communicating with clients.

What is the median price? If you lined up all sales in a county or zip code from lowest to highest price, the median price would be the sale in the middle. Over time this figure can help us see how a market is moving, but applying median price increases from a zip code to a particular home can get us into quick trouble.

5 reasons why median price increases don’t translate to actual dollar for dollar increases:

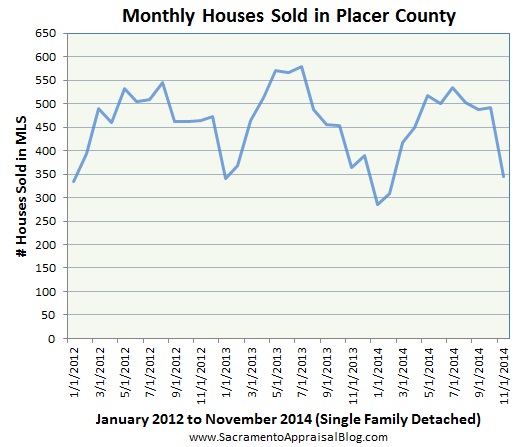

Sales Volume: The monthly median price is based on how many sales there were in a given month. If there are few sales in a market, the median price could see a huge swing, which means it can go up and down very quickly (which means we should be very careful about applying the increase or decrease to our property’s valuation).

Sales Volume: The monthly median price is based on how many sales there were in a given month. If there are few sales in a market, the median price could see a huge swing, which means it can go up and down very quickly (which means we should be very careful about applying the increase or decrease to our property’s valuation).- Less junk sales at the bottom: In 2012 and 2013 cash investors gutted the distressed market (low-priced short sales and foreclosures), and then flipped many of these low sales at higher levels. This essentially means the bottom of the market was removed. Now imagine the median price again, which is the sale in the middle of all sales if you lined them up by price. All of the sudden the sale in the middle got much higher because the bottom distressed part of the market was removed in a short period of time. Thus the market on paper shows very significant median price increases, but that’s really because of the bottom disappearing, right?

- Seasonal Moods: The median price tends to see a huge uptick during the early Spring.. For instance, imagine the median price increased by $25,000 from January to March. Does this mean values increased by $25,000? Not necessarily. It’s just the stale sales from Fall were much lower in price, and now current values are in high gear for the Spring (which is normal for Spring). Sometimes values in the beginning of the Spring are aggressive and they seem incredibly high, but in reality they might be picking up where the market left off at the end of Summer (or maybe slightly above). This is why we need to look at sales well beyond just the past 90 days.

- Larger Homes: Imagine there were larger-sized homes that sold last month compared to the previous month. We might look at the median price and say, “Wow, look how much the market increased last month”, but in reality there were simply bigger homes that sold at higher levels that made the median price increase.

- Zip Code vs Neighborhood: Not every neighborhood is experiencing the same trends as the entire zip code, and not every price range behaves the same way either. The zip code might show a 2% monthly increase in median price, but are neighborhood listings being priced higher or lower than recent sales? Are listings spending longer or shorter times on the market? Are sellers getting what they ask for? We have to be sure to take a hyper-local look at sales and listings in the immediate neighborhood before blindly applying zip code trends. The zip code might show a 2% median price increase, but maybe after looking at the numbers in the neighborhood itself, values in the neighborhood increased very modestly by maybe 0.50 to 1.0% in actual value over the month.

I hope this was helpful. As always, thank you sincerely for reading.

Question: Anything else you’d add? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

It took one more day last month to sell a house compared to the previous month (10 more days since July 2014). It’s important to be in tune with the trends of each price range too since the market is not the same at each segment.

It took one more day last month to sell a house compared to the previous month (10 more days since July 2014). It’s important to be in tune with the trends of each price range too since the market is not the same at each segment.

Neighborhood Boundaries: Are the neighborhood boundaries listed in the appraisal correct? It can make a big difference if the wrong comps are used from inferior or superior neighborhoods.

Neighborhood Boundaries: Are the neighborhood boundaries listed in the appraisal correct? It can make a big difference if the wrong comps are used from inferior or superior neighborhoods. Square Footage: Is square footage in the appraisal report relatively similar to official records or to what you know to be true of the property? There are

Square Footage: Is square footage in the appraisal report relatively similar to official records or to what you know to be true of the property? There are  Upgrades: Were all improvements listed in the appraisal report and accounted for in the final value? The appraiser won’t make a dollar adjustment in the report for every single update, but the final value should consider improvements. Keep in mind of course that not all improvements contribute to value. For example, a 10-ft Yoda statue in the backyard probably won’t be a huge plus (even though you think it’s awesome).

Upgrades: Were all improvements listed in the appraisal report and accounted for in the final value? The appraiser won’t make a dollar adjustment in the report for every single update, but the final value should consider improvements. Keep in mind of course that not all improvements contribute to value. For example, a 10-ft Yoda statue in the backyard probably won’t be a huge plus (even though you think it’s awesome).