The FHA flipping rule has changed this year. Since 2010 investors were able to buy a home, rehab it, and then re-sell the home to an FHA buyer as soon as they wished. But now in 2015 FHA has re-instituted their traditional 90-day rule so investors need to wait at least 90 days before selling their properties to an FHA buyer.

Is this a big deal or not for the housing market? I have 5 points below to consider and maybe share with clients when they ask. I’d love to hear your take too.

5 things to consider about FHA’s anti-flipping rule for 2015

1) An Inconvenience for Investors: This 90-day rule will be an inconvenience for investors since it limits the pool of existing buyers for their product. Some investors who are flipping at price ranges prime for FHA financing will definitely feel the impact of this rule.

2) Missed Opportunities: Some would-be FHA buyers will miss out on properties since investors will be more prone to accept a conventional buyer instead of waiting 90 days for FHA. In Sacramento, FHA financing has a higher volume at the lower end of the market under $200,000, so buyers at the bottom end could actually be more burdened by the rule.

3) The Reality of Less Cash: We no longer have a foreclosure epidemic both locally and nationally, which means there are fewer houses being flipped. Thus a rule like this carries far less impact in today’s market compared to the beginning of 2010 when it was absolutely beneficial. For reference, when FHA first eased their 90-day rule in 2010, bank-owned sales represented about 40% of the entire market in Sacramento, but now they’re only 5% of all sales.

3) The Reality of Less Cash: We no longer have a foreclosure epidemic both locally and nationally, which means there are fewer houses being flipped. Thus a rule like this carries far less impact in today’s market compared to the beginning of 2010 when it was absolutely beneficial. For reference, when FHA first eased their 90-day rule in 2010, bank-owned sales represented about 40% of the entire market in Sacramento, but now they’re only 5% of all sales.

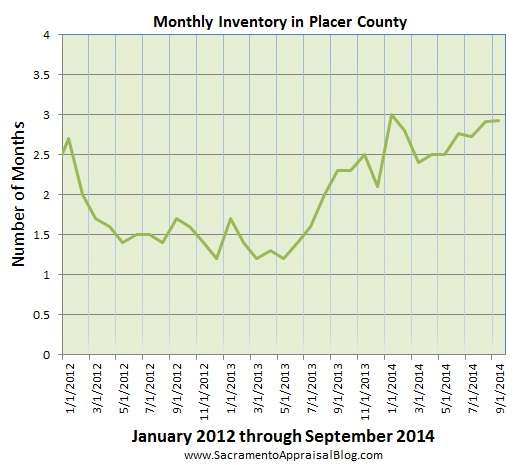

4) It’s taking Longer to Sell Anyway: Realistically since many investors are going to take 30 to 60 days to flip a property, and then have a property on the market for 30+ days, this means some homes will still easily qualify for FHA financing. Agents will simply say in MLS something to the effect of, “90 day flip rule expires on such and such date”. For context, in November it took an average of 45 days to sell a house in Sacramento County and 50 days to sell in the region (though flips often sell more quickly since they are more marketable).

5) Boosting Conventional Loan Products: Lastly, removing FHA as an option within 90 days of acquisition will help steer some buyers to use conventional financing. Like I said two days ago when talking about trends to watch this year, we can expect to see some more creative financing options emerge as the market softens (and also as buyers need a different option to buy a quick flip without FHA financing).

I hope this was helpful. It’s so important to keep our finger on the pulse of the market so we can serve clients and make informed real estate decisions.

Questions: Do you think the 90-day flipping rule is a big deal or not? Anything else you’d like to add? I’d love to hear your take in the comments.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

The Wright Report: By the way, I contributed a few thoughts to

The Wright Report: By the way, I contributed a few thoughts to