Does the housing market really have price cycles? Yes. But these cycles aren’t always so rigid and perfectly predictable like so many people think they are. Let’s talk about this today. I’d love to hear your take also.

UPCOMING PUBLIC SPEAKING GIGS:

- 3/15/2022 NARPM Luncheon (details)

- 3/22/2022 SAFE Credit Union market update (details)

- 4/28/2022 SAR Think Like an Appraiser (details)

THE MARKET FROM 1975

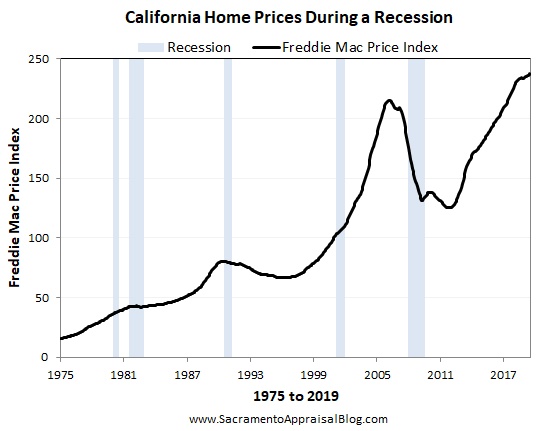

Last week I wrote about doom and gloom articles, and today I wanted to follow up by looking at some visuals using the Freddie Mac Price Index.

Limited data: I have stats from 1998 through the local MLS, but it’s really difficult to get older stats. However, Freddie Mac does have a price index from 1975 for Sacramento, so that’s what I used here to help tell the story of value.

Is the Freddie Mac Price Index accurate? Yes, I think so. I lined up the median price for Sacramento County (my stats) over the past twenty years (red), and compared the Freddie Mac Price Index on a separate axis (green). I would say the trend looks really similar, so this makes me trust the trend from the 70s, 80s, and 90s also. If you have a better source, speak up.

NOT ADJUSTED FOR INFLATION

When looking at the Freddie Mac Price Index it’s clear there are multiple price cycles over the years since 1975. And when we don’t adjust for inflation, the current price (nominal price) is way above the previous peak.

ADJUSTED FOR INFLATION

What happens when we adjust for inflation? We can still see market price cycles, but we also see the current price point is so much closer to the previous peak in 2005 instead of being way above. There isn’t anything magical about being “back to peak prices” of course. I’m just saying when we start comparing today with really old prices, it becomes important to consider inflation because the value of the dollar hasn’t stayed the same.

I dig this graph especially. When we adjust for inflation, it sort of smooths out the trend a bit. In other words, it makes the trend a bit less extreme.

I hope you liked the visuals.

STUFF TO CONSIDER ABOUT PRICE CYCLES

1) Not the new template: What happened last time isn’t the new template for every future market correction. It’s easy to look at prices today and say, “We’re about ready to implode just like we did back then,” but the truth is there isn’t a market formula where prices always drop by the same amount. I hear things like, “The market will drop again by 50%,” or “The market will likely dip by 10%.” Both of these statements have one thing in common. They are guesses about a future that has not happened. As I always say, nobody has a crystal ball. That doesn’t mean we ignore trends today, but it does mean we are humble about our ability to know the future. But if you do want to test your prophet skills, tell me this. Who is going to be president in two years? What will bitcoin be worth in three months? And will mom jeans be more or less popular next spring?

2) Fixation on last time: I think in some cases we get so fixated on the previous bubble that we start saying a correction like that is locked in for the future. Look, I’m not glossing over rapid price growth lately that feels unsustainable. All I’m saying is when we back up and look at a few more price cycles, it’s clear not all up and down cycles have unfolded the same way. In my mind it’s like having multiple kids. There are similarities, but there can also be big differences.

3) The previous peak doesn’t matter: Getting back to the previous price peak doesn’t hold any power for the market today. In other words, there is nothing magical about crossing that threshold – especially since that market was full of fraud. The truth is we are way beyond the peak already when you consider prices without being adjusted for inflation. This is true on the national level also. But there isn’t anything noteworthy about getting back to the peak when adjusting for inflation either. Case-in-point. Around 2002, we were back to the prior peak from the 1990s in Sacramento. People could’ve said, “Bro, we’re about to drop because we’re back!!!” But then the market kept going for three more years…

4) No seven-year rule: The market doesn’t have to behave a certain way every seven years. Bottom line. Some people talk about a seven-year price cycle where prices go up for seven years before they go down. Well, here we are in year eleven of price growth in Sacramento.

5) There is a cycle: There really is a rhythm where prices go up and down, but it’s not so easy to perfectly predict either. In many locations the market tends to change every decade or so. But keep in mind some markets are flat over time rather than super cyclical like California. Here’s a post I wrote called, “Is the housing market going to crash?” The goal of the post isn’t to say YES or NO, but rather to think through some of the bigger issues.

Data Sources:

FRED CPI

Freddie Mac Price Index

How to adjust for inflation (YouTube video)

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Thanks for being here.

Questions: What stands out to you most in this post? What did I miss? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

The inverted yield curve (and hesitancy): Lots of people are talking about the

The inverted yield curve (and hesitancy): Lots of people are talking about the

Questions: Are there any national metrics you pay attention to? Any you’d recommend avoiding? Did I miss something? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.