There is some serious pent-up demand building. The number of sellers who have not listed their homes this year is really starting to add up – not to mention a growing pile of buyers. And speaking of building, new construction has been glowing this year. Let’s talk about it.

UPCOMING (PUBLIC) SPEAKING GIGS:

9/26/23 Orangevale MLS Meeting

9/28/23 Yuba City Big Market Update (in Yuba City (register here))

10/4/23 KW Sac Metro Big Market Update (register here)

10/6/23 How to Think Like an Appraiser at SAR (register here)

10/27/23 AI Fall Conference (San Francisco) (register here)

13-MINUTE INTERVIEW WITH NPR

I did a 13-minute interview last week with our local NPR station, Capital Public Radio. And yes, I mentioned Taylor Swift when talking about inflation.

PENT-UP DEMAND IS BUILDING

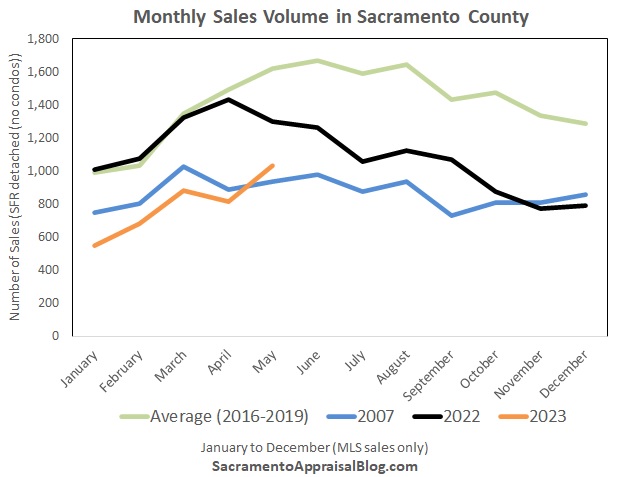

I hear many real estate professionals say things like, “Bro, if rates drop to 6%, it’s going to be wild.” I get it because there have been so many buyers and sellers on the sidelines. This year we’ve seen 7,700 fewer new listings in the Sacramento region compared to last year and nearly 12,000 compared to the pre-2020 normal. In short, even if we take the smaller number here, there are close to 8,000 people who did NOT list their home this year through August (and about 7,000 fewer sales compared to the pre-pandemic average). So, yeah, there is some serious pent-up demand among both buyers and sellers, and at some point these people are going to want to move when affordability works for them (or their lifestyle or economic situation warrants a move).

10,000 HOUSEHOLDS

Look, we talk about pent-up demand all the time, but let’s put some numbers to the conversation. By the end of 2023, it’s very likely we’re going to see about 10,000 fewer new listings compared to last year (which was already a low year). It’s sobering to think there are potentially ten thousand households who may want to move as soon as circumstances allow. This certainly doesn’t mean they are all going to jump in the market at once. I’m just saying in the background we have some serious unmet demand building.

STUBBORN RATES

By the way, rates have been stubborn above 7%, so it seems wise to plan on them being higher, and delighted if they go lower. I’m all for being optimistic in life, but a sharp rate downtrend seems really hopeful. I could be wrong, but I’m a big fan of being realistic about the market that actually exists and not getting too hyped about what could happen in the future.

GLOWING NEW CONSTRUCTION

Now I’d like to share some new construction numbers. I’m excited for these visuals, and I put these together thanks to stats from North State BIA.

A SOURCE FOR PERMIT DATA

First, here is a cool source for permit data from the US Census Bureau. You can look up any state and county, and I pulled four local counties. The wild part to me is to see how close Sacramento County and Placer County are right now considering such a vast population difference.

NEW VS OLD

New construction volume has been robust this year. It’s been the second highest year of new sales over the past decade besides 2021. This has been stunning to watch, and I don’t recall many in December 2022 predicting new construction volume would be so strong. Yet, here we are.

SAGGING OLDER SALES

In contrast, the existing sales market (older homes) has shown the exact opposite trend with sagging volume. Keep in mind the existing market is so much larger, so higher new volume hasn’t been able to make up for all the missing buyers today. In other words, new home construction isn’t the savior for total volume. One last thing. There have been nearly 12,000 sales so far this year, which reminds us buyers are still here. I mention this because sometimes the narrative is that nobody is buying, and that’s fake news.

WHERE ARE PEOPLE BUYING?

Here’s a look at the top cities for new builds last month. I feel like a broken record to say Roseville took the top spot again. I find Roseville typically represents about 25-29% of total volume.

NOT THE HIGHEST YEAR EVER

It’s been a solid year overall for new homes, but years like 2002 through 2005 were higher. I know, I’m such a killjoy, but I wanted to share some wider context. It would be great if we could see levels like 2002 again, but it’s not in the cards at the moment. Besides, there likely isn’t enough labor to build that fast anyway.

NEW HOMES ARE A BIGGER CHUNK OF THE MARKET

New homes sales represent over 25% of the entire regional market so far this year in 2023. What I mean is when we add the existing market (blue) and new construction (yellow), new homes this year are 25% of everything. This is why I keep emphasizing new construction in my market talks. If you’re a real estate professional and not in tune with new construction, why not?

Here’s another way to look at it. I prefer the bar chart above, but we can fight about it in the comments if you think otherwise. And remember, it’s not that there are vastly more new homes this year, but the issue is the number of new homes is a greater percentage of everything.

TWO MORE GRAPHS THAT NOBODY ASKED FOR:

I know the top one is chaos, but I wanted to share the madness of what putting two decades on one graph looks like (don’t do this at home, kids).

THE ASTERISK NEXT TO GLOWING STATS:

Without concessions and rate buydowns, we would NOT be seeing strong new construction volume. Bottom line. I know, builders have the benefit of attention from consumers since there are less sellers listing their homes, but in my opinion the stronger force for creating potent volume this year has been concessions to buyers. A few weeks ago, I talked with a buyer who got a $20K price discount, 2% credit for closing costs, and a rate buydown. It’s stuff like this that is making ALL the difference.

TWO PEOPLE TO FOLLOW:

Here are two individuals on the cutting edge of talking about new construction. I highly recommend following both on Twitter (X) or LinkedIn.

– Rick Palacios Jr with John Burns RE Consulting

– Ali Wolf with Zonda

I hope this was helpful.

Questions: Any thoughts about pent-up demand or new construction? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.