Pulling comps in 2024 is tough. Think about it this way. If we have 40% fewer sales happening, that means there are 40% fewer comps. Yikes. Let’s talk about this. I also have some market recap visuals to unpack what’s been happening in 2024 so far.

UPCOMING SPEAKING GIGS:

2/19/24 Matt the Mortgage Guy YouTube Live

3/11/24 Yolo Association of Realtors (YAR only)

3/19/24 WCR Gold Country (details TBA)

3/21/24 2024 Market Update for Brent Gove Team (big event free)

3/26/24 Orangevale MLS meeting 9am

3/27/24 SAFE Credit Union Lunch & Learn (TBA)

4/11/24 Lindsay Carlisle Event (private)

4/25/24 HomeSmart iCare Realty (details TBA)

5/9/24 Empire Home Loans (details TBA)

5/15/24 Investor Meetup (details TBA)

6/11/24 Elk Grove Regional MLS Meeting 8:30am

6/13/24 Sacramento Realtist Association (details TBA)

(and you are the baby daddy)

TWO THINGS I’M DOING FOR COMPS IN 2024

1) GO BACK FURTHER IN TIME:

One of the things I’m doing more often today is looking at older comps in the immediate neighborhood. I find myself scouring 2021 onward especially. The truth is there are portions of 2021 and 2022 where prices are exactly the same as today too, so if I use an older comp, I don’t always need to adjust for the way the market has changed. But backing up, I can look at older stuff for the sake of research, but this doesn’t mean I’ll use a super old comp in a report. In short, it’s not enough today to go back 90-180 days because there just aren’t enough data points in so many cases. We probably need to go back much further, and there is nothing wrong with looking at years of data to help us understand the trend. My suggestion is to do this in bite-size chunks though because it would be overwhelming to pull up three years of sales at one time. This is why I might start with the past 6 months, then the prior 6 months, then time before that, etc…

EXAMPLE 1:

There were only five competitive sales since late 2022 in the Rollingwood neighborhood (black dots). It helps that these sales are recent, but five isn’t much to work with either, right? This is why I wanted to look much further in time. For me, it really helped to dig into 2021 and 2022 to understand how prices have changed over time. And if you don’t make graphs, that’s no big deal. I would recommend using the MLS map search so you can dig through various time periods. Do you see how it looks like prices are lower than the peak of 2022? Could that be helpful to know? Maybe so.

PRO TIP: WATCH THE MEDIAN TREND

The median price for the region doesn’t translate rigidly to neighborhoods, so be careful about saying stuff like, “The median is up 3% this year, so neighborhood prices are up 3%.” Maybe. Maybe not. Look to the comps most of all. In my experience, some people get really upset when I share median trends because the sentiment is the median isn’t a perfect metric (true). But here’s the thing. The median trend locally has tended to be the pattern in so many neighborhoods where we’re still down from the peak in 2022, we’re up from one year ago, and early 2024 is tending to compare to a few different times in the past.

2) EXPAND TO OTHER NEIGHBORHOODS:

Looking up other nearby neighborhoods is something I’ve done much more of lately since sales volume has plummeted. The ideal is to compare areas with similar prices, but even if the price point is a bit different, it can be valuable to see what is happening in a different nearby neighborhood. I may or may not use comps from a different neighborhood. I’m just trying to understand what the market is doing. When using the MLS map search, I typically draw boundaries around a neighborhood, but then I find myself drawing a couple of other boundaries in nearby areas in many cases too. That maybe wasn’t as necessary in previous years, but today I’m doing it all the time because there just isn’t much to work with to understand the trend.

EXAMPLE 1:

With only five duplex sales over the past 18 months, it can be tricky to understand where value is at when there isn’t much of a frame of reference. In this scenario, I included duplex sales in South Land Park on a graph of Pocket area sales. Is that ideal? I don’t think so. But this helped me to see the market a bit more. I also included single family detached units in the background of this graph just to try to see where prices have gone over time. Of course, the trend could be different for single family units, but I was basically looking for whatever context I could find to help understand the market.

EXAMPLE 2:

Here’s a different example where I was working on a larger duplex in the Larchmont Riviera neighborhood, and there just wasn’t much context since there was only one recent sale at the time in the neighborhood. So, I took this graph back multiple years to look at older sales in the immediate area and compare three different neighborhoods. Look, some neighborhood comparisons could be awful, but sometimes when we put neighborhoods together, we end up seeing the market a bit better. I think when I started as an appraiser, I was way too focused on only looking at the immediate neighborhood, but what I’ve found over time is there is tremendous perspective when we back up and look a little wider.

MAKING GRAPHS

The visuals above are scatter graphs, and I have a free tutorial here to learn how to make a template (or watch below). There is a learning curve here, but it is highly doable. It changed my career to start getting more visual in real estate, and I’m always hopeful people will learn.

Anyway, I hope that was helpful.

2024 HOUSING MARKET WILL SUCK LESS (HOPEFULLY)

“Far from normal volume, but hopefully a little more.” That’s the theme for 2024, and it’s what we hope to see with the number of new listings and sales. Or in layman’s terms, the market sucked last year, but hopefully it will suck a little less this year.

GOOD NEWS TO START THE YEAR:

In January, we saw more new listings, more pending contracts, and more sales compared to one year ago. We are still very far from normal levels, but this is the direction we want to go. The x-factor of course is what happens with mortgage rates. If rates rise much more, can that slow down the momentum we’ve had so far? Possibly. Sellers and buyers have thawed out very slightly, but that could change if rates keep going up. Only time will tell.

It’s nice to see most local counties had more volume in January. This isn’t much, but more is the direction we want to go because it’s healthy when more buyers and sellers can participate in the housing market. Bottom line.

STILL FAST, BUT MUCH CLOSER TO NORMAL:

When looking at days on market, it’s definitely not 2021 any longer, but we are still a bit more competitive than usual. We should see days on market tick down in the stats in coming time too as the spring season lifts off the ground. Here’s the thing though. If you’re not priced right, you’re going to sit instead of sell. Buyers are very sensitive to paying the right price.

PRICES DIPPED IN JANUARY AS EXPECTED

Prices dipped between December and January as expected. That normally happens. January is often a low point for the year before prices start to rise again for the spring. Remember, closed sales in January actually got into contract in December mostly, so these sales tell us more about December than anything.

NINE LOCAL COUNTIES:

Here are some visuals. I’m not crazy about the smaller counties here, and I have pause about pushing out this data. Let me know what you think. By the way, I’m posting these on the STATS tab each month.

NOTE: See stats tab for month-to-month visuals

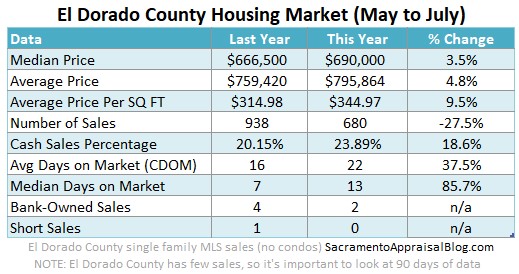

Please take smaller counties with a grain of salt. In other words, prices are not up 15% in El Dorado this year.

Thanks for being here.

Questions: What are you doing for comps right now? Any stories or insight to share? What stood out to you about the stats above?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

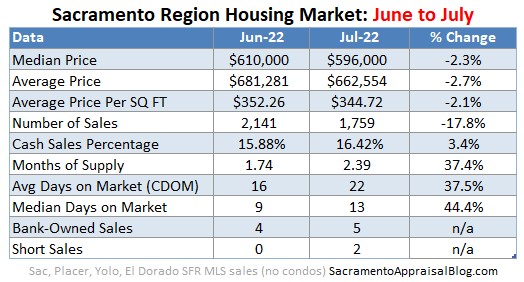

Here are some quick thoughts about home prices and stats for July / August so far. There is so much to talk about.

Here are some quick thoughts about home prices and stats for July / August so far. There is so much to talk about.