I have a few things on my mind. Let’s talk about me being asked to recruit for a brokerage (really), price per sq ft, and the Governor’s new digs.

1) WHY I SAID “NO”:

A brokerage recently asked me if I would help them recruit agents. The idea was I could use my influence to attract agents to a certain brand and then get a commission for each person I recruited.

I said NO, and my answer will always be NO. I probably don’t even need to mention this, but I want to communicate clearly. As an appraiser I won’t take sides. I’m neutral in my work, but my independence also extends in the way I interact with the real estate community. This is why you’ll see me speaking in many different places and real estate offices. I’m here to educate, not advocate. The truth is if I said yes I would’ve instantly destroyed my credibility.

2) PRICE PER SQ FT:

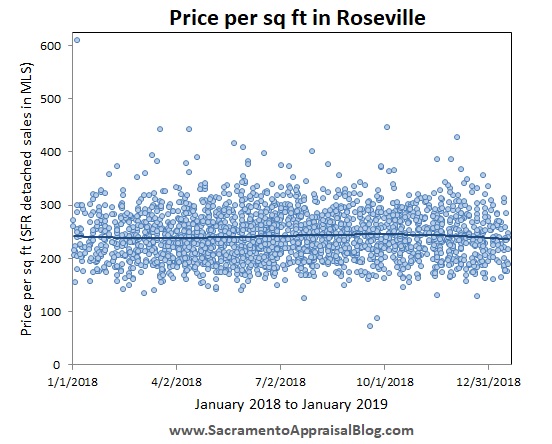

Here’s a look at price per sq ft trends in a few local areas. I plan to share more graphs like this throughout the year if people like them. Does anyone want to see a video tutorial for how to make these? Let me know. What do you see?

Two Takeaways:

1) RANGE: There’s always a price per sq ft range, which means there’s never just one price per sq ft figure that applies to every property in a neighborhood. Sellers often want to hijack a price per sq ft figure from a sale down the street, but that’s one of the quickest ways to overprice. My advice? Pay attention to price per sq ft, but most of all ask yourself what the comps are selling for. That’s exactly what appraisers are going to do.

2) OUTLIERS: There are clear outliers. As an FYI, usually the highest price per sq ft figures end up representing the smallest-sized homes or over-the-top unique properties.

3) THE GOVERNOR’S NEW DIGS:

Gavin Newsom is the new governor of California and he just bought a $3.7M house in Fair Oaks. This price point isn’t much in many areas of the country, but it’s actually the fifth highest residential sale ever in Sacramento County. This home is said to have over 12,000 sq ft and it’s located on 8 acres. It’s near the American River, but not on the river. Now two of the top five sales in the county have a connection to a governor (the other was the mansion Ronald Reagan started to build in Carmichael in the 1970s).

Here’s a picture I took of the front gate this week, and here’s a video from a previous listing if you wish to see the home. Not too shabby, right?

Value thought: In the future we’ll have to consider whether there will be a price premium or not for this home because a governor owned the property.

CLASS I’M TEACHING: I’m teaching my favorite class at SAR called How to Think Like an Appraiser on January 31st from 9-12pm. We’ll dig deep into comps and adjustments (and have some fun). I’d love to have you come out.

I hope this was helpful or interesting.

Questions: Would you pay more if a governor previously owned the home? What do you think of my recruiting story? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

In case that appraiser gig ever dies, you can fall back on head hunting….

Funniest thing I’ve read in a while. Thanks for sharing.

Thanks Joe. Yeah, if I said yes I could’ve updated my LinkedIn skills. Missed opportunity.

Wow, Ryan! Alot of good stuff in this post! I would love to see a video on how to make graphs. Not so much for price per sq. ft. I think showing graphs can offer great insight to what is really going on in the market. I LOVE that you are taking a “neutral” stance and refuse to compromise your integrity. The person who asked you lacks integrity for sure. Finally, I wouldn’t pay more for a home that a celebrity lived in. However, I believe there are those who would place a greater value on such a property.

Thanks so much Cheryl. I appreciate you reading the post too. Thanks for your kind words too. My job really is to be neutral.

Here is a tutorial on how to make a basic scatter graph. The benefit to this tutorial (if you haven’t seen it) is I show everyone how to make a template so you can make nice-looking graphs without reinventing the wheel every time. In my mind this saves lots of time.

I’d be tempted to pay slightly more for a house that comes with a cool story. Though I’d be really hesitant if it was a house that was a tourist trap. For instance, the last time I visited Seattle I went to check out Kurt Cobain’s old house. I can’t imagine how many people do this…. In my mind I would not want to own a house where I felt like privacy was going to be an issue because of all the interest.

Opps, I didn’t post that tutorial. Here it is. Doh!! https://youtu.be/eWZs2J5ryH4

Thank you for this!

My pleasure. Thanks Lorraine.

So you passed on a business opportunity because of integrity. Let me think about this for a while. okay I am good with that, plus it fits with your values and that is all that is important. If you loose those you loose everything. Whether you sold your sole and helped someone who apparently needs help or not I would still read your work blog because I know what is behind the curtain; A good man. As to the graphs apparently I am still not as smart as you. need a little more work time on the charts. Take good care and Happy New Year.

Thanks Brad. Yeah, I didn’t want to sell my soul here (and simultaneously ruin my business). The person asking was thankfully understanding with my response, which I’m grateful for. I told the person I’d actually bring more value to the organization by remaining neutral instead of being part of their team. Our worth as appraisers really hinges on our neutrality, so I was glad they seemed to understand that. And full reference, some of this verbiage has been influenced by none other than Jonathan Miller (gotta give credit where it’s due).

Keep up the great work Brad. Talk to you soon I’m sure.

Yep Jonathan is another good man.

Good post. So what is happening in Roseville?

Thanks Gary. Good eye. I only used one year of data for Roseville, so in part that’s why it shows a flat trend. For context I ended up adding an extra graph to help show three years. This new graph reveals an uptick from the past few years, but still a flat trend this year. In truth some of the other graphs would also flatten out if I only showed 12 months. It just goes to show the number of years we show can make a big difference in what the graph ends up looking like.

It’s hard to say exactly what’s going on here without digging further, though the market has slowed this year, so it’s not surprising at all to see many graphs look more flat for 2018. Yet my first question when looking at price per sq ft graphs is whether larger or smaller homes have sold more recently. If there has been a change in the size of homes, that could make the trend line look different. For instance, if there were larger homes that sold (that tend to have a lower price per sq ft), that would push the trend line down. With that being said, the median price and average sales price were both up in 2018 in Roseville. The average price per sq ft was very slightly up too, though it was basically best considered flat. This is exactly why I look at a few metrics to get a bigger picture of price trends. Sometimes certain metrics tell a slightly different story. Which is the more accurate story? Well, that’s the question…

I really enjoyed you points about being neutral and price per sq foot! Being neutral is so important in our business on many levels. With regards to price per sq ft, I have also found that often the highest price per sq ft sale is often the smaller homes or an outlier. This is often seen with vacant land. Often the smaller the lot the higher the price per sq ft..

Thanks Jamie. Excellent point about land too. We do see that where the more land there is, buyers tend to pay less for each acre / sq ft. Thus the price per sq ft ends up being lower for the larger parcels (and higher for the smaller ones as you said). So if we use the price per sq ft from a larger parcel to value a lower parcel, we can come in really low for the small one. Or if we use the price per sq ft from the smaller parcel we can get a really inflated value for the larger parcel. We have to be really careful with this, and it’s exactly why we need to be sure we’re looking at the comps and not just price per sq ft figures.

Thank you! Exactly right! It can be deceiving to those who don’t understand how these kind of things work.

It will be interesting to see if that person who asked you or even that office is around next year. Shady marketing tactics will never prevail in the long run. Honesty, and more important integrity, is what people look for and appreciate. I appreciate the breadth of knowledge you bring to the industry and have learned a lot from the neutrality of information you share. Keep it up!

Also, I would be interested in learning how you make your graphs.

Thank you so much Richard. That’s a high compliment, and it’s exactly why neutrality is so key. Well said too on integrity.

Cool beans. If I get a few more requests I’ll be sure to make that tutorial. I do have another tutorial here for how to make a different type of graph with just neighborhood sales (instead of price per sq ft). https://youtu.be/eWZs2J5ryH4

I just joined the local MLS board and have been wrestling with my role (as an appraiser). Your post was timely for me, good decision from my view. Before I looked at the graphs, I would have anticipated the price per square foot to drop with size, most interesting, “R” value might clarify price per sf is not a good metric for value. Thanks for the post.

Thanks Mark. Good for you to join the board. That’s excellent. I believe we ought to be involved. Too many appraisers are hiding out in their appraiser dungeons and not interacting with the rest of the real estate community. I’ve been involved in the local Realtor association for about ten years now. I’ve had very few experiences like the one I mentioned above thankfully.

Yeah, price per sq ft is one way to see the market trending. Though it’s a dangerous way to value properties. If you have any further thoughts on R, I’m open ears. I’d be curious to hear what any R gurus have to say here and how they might use data presented above.

As always the closer to “1” the better fit for the regression. Looking at it, it looks closer to “.1” which indicates not such a good fit.

Mark is referring to R Squared.

Here’s a good primer.

http://blog.minitab.com/blog/adventures-in-statistics-2/regression-analysis-how-do-i-interpret-r-squared-and-assess-the-goodness-of-fit

George Dell teaches in his classes that R Squared is not that important for real estate because of the nature of the data we use. The Appraisal Institute teaches that R Squared is important. Those who know me will know who I listen to.

Thanks Joe. I figured it was such. I really don’t know much at all about R. I need to get up to speed at some point here. I’m glad you’re helping George teach too.

Certainly not the place to prolong this, but my stats from 1978-79 era indicate any metric measuring the veracity and utility of data is worth noticing. Maybe another column?

There is always room for more. Crunching numbers is like peeling back layers of an onion. There is always more to see and always another way to look at it. If you have a suggestion for another column, do speak on.

“Understanding the realtor and mortgage broker end of what we do”. Many appraisers do not get what other disciplines do in our business (including title). I have found this invaluable.

Thank you for your info and insights Ryan. I agree that even the appearance of bias can discount credibility. In the long run, it adds credibility to your reputation if it is unshakable.

I have been putting together graphs but find in that in my market (Sonoma County), the data level is often low and in many cases not sufficient and/or easily skewed by property diversity. Still working on solving that one.

I am limping through my scatter graphs and would love to see your tutorial. You mention “here is my tutorial” to Cheryl but I don’t see where here is. Forgive me if my blog skills are lacking.

Thank you for keeping it real. I personally would not pay extra for the privacy factor but I do believe some others would. Thank you again for your wit and presentation skills. Keeps things interesting.

Thanks Debbi. I appreciate your take. Yeah, I forgot to post it, but I just did that. Here is the link I intended to post. I would recommend doing this tutorial first and then the price per sq ft one later (if I do that one (I probably will since a few people have asked so far)). https://youtu.be/eWZs2J5ryH4

In a market with limited data it might not be very useful to look at a huge scatter graph of sales. It could end up being useful to look at price per sq ft since when we look at price per sq ft it tends to tighten up the trend a little. But if there isn’t much data then it’s a struggle. At the least hopefully you can look at many years of information at once, which could maybe help. Maybe.

Hate to sound jaded, but how does a professional public servant make money to buy such a house?

Thanks Joel. I think you’re saying out loud what many are thinking. I hear he married rich. I don’t know for sure. If anyone knows the scoop, speak up. $3.7M is no small chunk of change. They paid cash of course.

He’s been a partner in a successful wine and food business in SF for a while. He’ll actually put the wine cellar to use. Here’s something about his business.

https://www.sfchronicle.com/politics/article/Gavin-Newsom-putting-businesses-in-blind-trust-13482344.php

But yes, it’s nice to be connected.

Thanks for the skinny Joe. I appreciate it. I’ve not known much about his background. Extra points for wine, but it would’ve been better if he was involved in craft beer…

Would not shock me if he has beer in his portfolio.

Nice post, Ryan. Looks like Tahoe Park price per square foot is increasing at a good rate. I totally agree about price per square foot and shared with some agents this week that they should be cautious when only using price per square foot to price their listings. Keep up the good work.

Thanks Tom. Good eye. Tahoe Park is a great little neighborhood. It’s actually the first area my wife and I ever lived when we moved to Sacramento many years ago.