It’s easy to get into valuation trouble when we focus too much on price per sq ft. Seriously, this can be a massive problem leading to major heartache during escrows. Okay, that sounds so dramatic, but it’s important to know how to explain how price per sq ft works. Let’s talk about this by using my favorite analogy – Starbucks cups. I wrote about this six years ago, but it’s time to expand some thoughts. Here’s round two.

NOTE: These are Sacramento prices. Are they different in your area?

BIG POINT: The larger the cup, the less you pay for each ounce of coffee. Or let’s say it differently. Smaller cups of coffee tend to cost more per ounce. This is an example of economies of scale, and we see this principle all the time when buying products of different sizes. If you don’t believe me, check the labels when you go to the store. But this isn’t just about buying drinks or chips. This is also something to keep in mind in real estate.

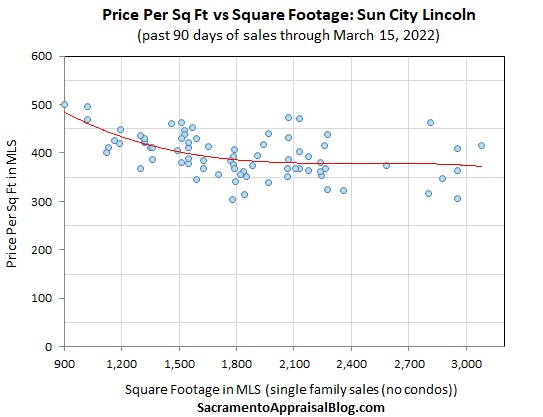

BIG REAL ESTATE TRUTH: The larger the house, the less you tend to pay for each square foot. That’s a huge point, and let’s say it a different way. Smaller homes tend to have a higher price per sq ft compared to larger homes. This is a principle we see when looking at county stats, but it’s also something we tend to see in neighborhoods (assuming we have enough data). Just like coffee costs less per ounce the more you buy, it tends to cost less per sq ft for the more house you buy. That’s the big idea.

95757 Example: This visual shows a ZIP code with conforming tract homes. Do you see how smaller homes tend to have a higher price per sq ft? And larger homes have a lower price per sq ft? That’s the big point.

PICK YOUR POISON: This example isn’t intended to tackle all aspects of price per sq ft, but only help stir conversation. I’ve used Dad bods and Lamborghinis too. My advice? Use what works for you.

THE PRICING PROBLEM: We can miss value in residential real estate when we hijack a price per sq ft figure from a dissimilar house down the street. Imagine, for instance, using the price per sq ft from a 1,000 sq ft house to price a 4,000 sq ft property in the ZIP code above. After looking at the visual, we’d probably end up with a really inflated value, right?

A VIDEO: I forgot about this, but I made a video about abusing price per sq ft. Here’s some rationale and word pictures (added 3/30/22).

UNSOLICITED ADVICE: Pay attention to price per sq ft, but don’t forget to look at similar properties (comps) when trying to figure out value. And feel free to use the Starbucks cups analogy. I use it frequently in conversation to help paint a word picture when talking about real estate. Here’s 5 things to know about price per sq ft in case you wanted to read more.

REAL WORLD EXAMPLES: I’ve included some examples in various neighborhoods around the Sacramento region. The truth is there is always a price per sq ft range, size matters for value, and property characteristics can make a massive difference in the price per sq ft.

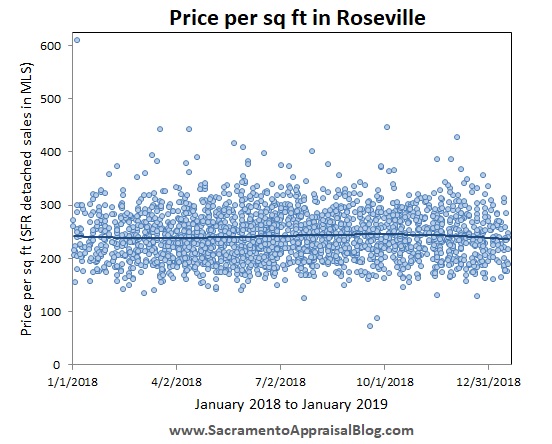

PROBLEM VISUALS: Okay, you might not care, but I wanted to mention that price per sq ft visuals can be problematic. When an area has a huge variety of prices or custom homes, this means price per sq ft can be ALL OVER THE PLACE (just like the comps are all over the place).

AN ASTERISK: Sometimes the higher end of the price market doesn’t always follow a perfectly predictable trendline for price per sq ft. What I mean is a 5,000 sq ft custom home won’t always sell at the lowest range possible just because it’s larger in size. I think some of the graphs below show this. But Gary hit the nail on the head in the comments as he said, “I think if a larger home doesn’t drop in price per square foot, then you’re likely seeing extras like view, site size, quality features like pools or elaborate finishes/design, etc…” Bingo.

TWO THINGS: 1) We need to be careful about imposing a trendline from tract homes on custom homes (preach it brother). In other words, the trendline for tract homes doesn’t mean anything for custom homes because these are two different products; 2) Sometimes buyers pay a higher amount per sq ft for larger custom homes simply because they recognize the quality of the home, location, view, etc… Of course, that’s something we would hopefully see in the comps too.

Here are a few examples where some of the larger homes have a huge price per sq ft. Do you see what I’m talking about? The largest homes still aren’t at the very highest price per sq ft in the market, but it does look like these homes are able to command a higher price per sq ft than the overall trendline from all other sales would maybe suggest.

FREE MARKET UPDATE NEXT WEEK: Next week I’m doing a free market update on Zoom for SAFE Credit Union. It’ll be one hour and I hope everyone leaves with lots of nuggets. This will focus on the Sacramento market, but you don’t have to be local to attend (sign up here for free).

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Thanks for being here.

Questions: What is the best way you’ve found to explain how price per sq ft works or doesn’t work? What sort of problems have you encountered with price per sq ft in real estate?

If you liked this post, subscribe by email (or RSS). Thanks for being here.