A quick change in rates has led to a quick change in the housing market. We didn’t see much difference right away in the stats, but we are finally getting some good numbers now. Let me show you what I mean.

UPCOMING (PUBLIC) SPEAKING GIGS:

7/15/2022 Lunch & Learn Market Update (sign up (for real estate agents))

7/20/2022 Beer & Stats at Out of Bounds (sign up (for real estate agents))

7/26/2022 Navigating the Shift (sign up here (for real estate community))

BEER NEWS:

I just finished two years without alcohol. I gave up alcohol for health reasons, and it’s been a good experience. I’ll be adding another year now, so if anyone wants to join, let me know.

FIVE THINGS TO WATCH IN TODAY’S MARKET:

We’ve seen quick change in the stats lately. Check out how steep the line is between May and June in some of the visuals below. This is what I mean by “sharp” change. Let’s keep watching while staying objective.

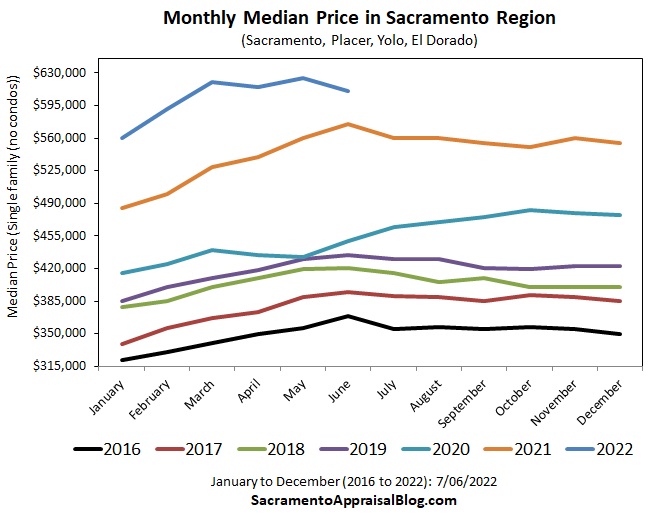

1) PRICE GROWTH IS SLOWING

Price stats aren’t as sexy as they used to be. This visual doesn’t necessarily look sensational, but instead of being up 15-20% from last year, prices in most counties are now “only” up about 6-7% instead. In short, we are seeing price growth slow down. Right now, the growth actually looks somewhat normal at 6-7%, but let’s keep watching this line to get a sense of the direction of prices. In a normal year we should see prices soften for the next few months and then flatten out for the rest of the year.

2) BUYERS ARE FINALLY PAYING BELOW THE LIST PRICE

For seventeen months in a row buyers paid at or above the list price on average. This is profoundly atypical, but it’s been our normal for so long that I think we’ve gotten used to it. This visual shows buyers in June 2022 on average paid about one percent below the original list price (or $7,254 less on average). Look at how sharp the change was from the previous month. For now, the stat is actually very normal compared to 2018 and 2019, but let’s keep watching to see where the line goes in months ahead.

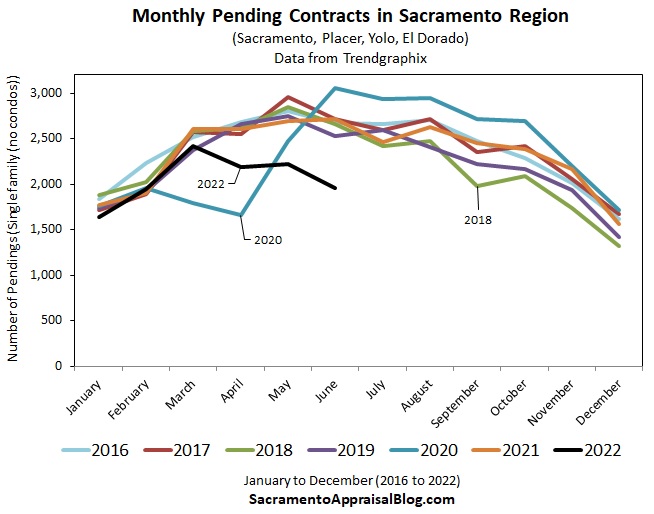

3) FEWER PENDING CONTRACTS ARE HAPPENING

One of the bigger ways we are seeing a shift in the market is with the number of pending contracts dipping for three months in a row. In most local counties in June, we were down a whopping 25% in volume from last year at the same time. On the positive side, this means 75% of pendings are still happening, but there is no ignoring the reality that we had over 1,600 fewer pending contracts over the past few months compared to last year. The black line below represents 2022, and this June was the lowest year in recent time. This isn’t a big surprise because mortgage rates doubling in a short period of time has given affordability a beatdown. This means fewer buyers are able or willing to play the game right now.

4) A SHARP INCREASE IN LISTINGS

5) LOTS OF PROPERTIES STILL SELL ABOVE THE LIST PRICE:

It’s easy to say everything is selling below the list price, but that’s fiction. In truth, almost 53% of sales last month sold above the list price, so it’s safe to say about half the market went above the original list price. Of course, this is a sharp change from last year when 76% of sales sold above the list price, so we’ve clearly moved beyond that honeymoon market. And I know, it would be helpful to have more years on this visual, but I don’t have that (yet).

6) OTHER VISUALS:

Okay, here are some other visuals in case that’s your thing. The stats are finally showing some bigger changes. I remember someone arguing with me in April that the market hadn’t shown much of a temperature change. The truth is the market did change, but we didn’t see change in the stats…. yet.

OKAY, ONE MORE:

May to June median price change: This last visual shows median price change from May to June from 2004 onward. This is a bit geeky, but it’s atypical to see the median price dip between May and June. I mean, it happens, but typically this takes place when the market is declining or in a year where there was dullness in the marketplace. For this year, keep in mind the 2022 real estate season crested early, so we are now comparing subdued stats today to heightened stats last year. I’m not sugarcoating at all here. It’s just key to know what we are comparing and how that makes a difference with the numbers.

On a related noted, for many in real estate prices are sacred, but I don’t take that view. Markets go up and down. That’s just what happens. Thus, my role here is to tell the story of the market without any bias. I’m not here to protect prices or promote doom. I want to sling the straight dope and help convey what is happening.

Anyway, I hope my explanation for May to June change makes sense. I’m happy to talk about that more in the comments. We need a few more months to understand price trends more definitively.

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Thanks for being here.

Questions: What stands out to you the most above? What did I miss? Anything else to add?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

So much to absorb. The sale price to list price trends is a striking visual. The market is getting back to normal in a snap it seems. Hopefully not snapping too far.

Thanks Gary. Yeah, that one visual is wild. It’s an interesting time because lots of stats are basically at normal levels on paper, but the number of pendings is definitely not normal. What a time. Let’s keep watching.

As always, thank you Ryan! Your data and interpretation of the market trends is greatly appreciated. In my personal business, I have definitely felt a shift; however, it feels like it was a long time coming and perhaps needed. Great job on giving up alcohol by the way! Especially during the craziest market ever and COVID – kudos!

Adriana

Thank you Adriana. I appreciate hearing your take. Things have been total chaos for about two years, so I think a shift on some level is needed personally. Real estate professionals have been stressed and maxed out for so long. And thanks. It’s been good over these past two years. Now if I can just give up eating nachos…

Thank you for your informative info on real estate.

You are so welcome. My pleasure. Thanks Charles.

Ryan, the charts and graphs are beautiful. Where do you get the time to appraise?

As sales volume slows down, there may come a time when the most recent relevant sales are over 3-months old.

In which case the Pending’s and Under Contract prices may be more reflective of what is happening now. If the market starts to decline, it will show up first in these two Tiers of Market Data, along with New Listings.

When I call on Pending’s or those relevant sales that are Under Contract; I ask the agent if it sold at full price, more, or less than full price. Sometimes the answers are revealing.

When the market starts to change as it is, and I am doing my due diligence and contacting agents to Verify terms, motivations, concessions, personal property Packed into the Sales Price, a closing question I always ask is “If you had this home back on the market today, could you sell it for the same price without any concessions or sweeteners?”.

If the market has downturned, you get one answer, if it is still strong, you get another answer.

To me the key to measuring what is happening in a changing market is to use the Multi-Tiered Market Data Analysis.

Ah, time. That’s something I wish I had more of… Thanks for the commentary Steve. I always appreciate your take. I completely agree about gauging pendings to help us understand current dynamics. Love your final question too. Thanks as always, Steve.

Ryan- excellent information and thank you for all the effort. Most seller’s have gain a ton of equity so giving up some of it makes sense. My hope is listings agents use financing options verses price reductions. A permanent rate buy down helps buyers more and can cost seller’s less. A $10,000 price cut has little impact on the numbers. Of course a price reduction gets noticed on MLS easier than a “seller approved rate buydown”.

Cheers to your good health!

Thank you so much Bruce. I appreciate it. There are many tools available for sellers. In my mind the best available thing for a seller is to simply price it reasonably based on similar properties that are actually getting into contract and selling. Sellers have been in the driver’s seat for so long, so it’s nice to start to see buyers gain power.

Hey Ryan! Great analysis. I was watching the live June stats in Trends as it was hinting at this sharp change as we were feeling it throughout the brokerage. Thank you for keeping it real with price!

Thanks so much Jon. Yeah, there were clues, and it’s good to see something definitive now. That way we have more to work with and better language to describe the market too. Hope you are well.

The up-ladder started in March 2020 (lockdown) for Appetite (Pend/New), Turnover (Sold/Active) and the combined Consumption (Pend+Sold)/(New+Active) and started coming down in March 2022 (two years to flatten the curve?). It’s nicely shown here: https://jayemerson.com/averages/

Thanks Jay. It’s been a wild ride.

You forgot giving up those double pumps, crazy coffee drinks you use to get. Me personally I think giving up the coffee was a bigger deal. But hey what do I know. Know we can meet and have two cups of Tea, ain’t that a hoot. As to the data, not yet, but things are getting interesting. Will keep you updated on a transaction I am familiar with directly. Will be interesting to see what happens with an upper end home listed for sale. My mother-in-law’s estate is selling her home. That will be a telltale for me on what is going on as the appraiser prior to this mess appraised it higher than the listing agent wants to go. So that is sign #1. Will keep you update. Now go have a cup of tea my friend.

Yeah, no espresso for me. I still remember that time we met for coffee. That was smack in the middle of my cappuccino heyday. I’m actually with you that espresso drinks / coffee is much harsher on me than alcohol. Tea for me. Tea for you. Let’s be happy with that… or at least try.

Keep me posted. Yes, it is indicative of market change when we starting hearing more and more about a suggested list price below value. What a different market from six months ago where buyers were offering way above value.

Amen to that.

Bottom line is affordability got crushed with rates doubling so what we saw last 12+ months was absolutely no way sustainable. The biggest consumer expenses went up substantially: mortgage/rent, food costs, gas. I agree with what the feds stated that the housing market will need a reset of sorts and as homes take longer to sell and panic sellers come out, we will see inventory levels come back to normal and prices level out. I think – just like any other previous market cycle- there will be some sort of a price correction to bring affordability up. Funny thing about affordability, when we reach those critical levels of 17%, the market doesn’t just go back up to 25% or something sustainable, it whipsaws back to 30,40, or even 50%+ like it did from 2007 crash until 2012. As you mentioned, it will be interesting to see what happens next few months and how the feds handle changes.

Thanks Paul. Affordability is the issue right now. I would add that some buyers feel uncertain, so there is that too. The percentage change with affordability will hinge on what the market does. As we know, there is no precise formula. I’ll push out some new affordability images soon. I use CAR data, so I’m waiting on their quarterly stats (which should go down in light of rates ticking up to 5-6% during Q2). Let’s keep watching. Keep me posted with what you are seeing on your side of things. Thanks.

Paul Bozek whipsaw comment illuminated a pathway to the future.

I observed the 2007-2012 period really began in April 2005 in my own listings when I listed a perfectly okay house at $699,000, which was what it comped at. That house sold for $629,000 in August that year. A 10% drop. Lower price ranges took a few more months than the higher ranges, but by 2006 the downward trend was every range. Even so, it took a long time for statistics to catch up with the trend.

One reason for this is that sellers, who were mostly banks and short sellers controlled by lenders, moved properties from default to closing at (pre-global warming) glacial speeds. Some homes were held off the market for a full five years after going vacant, delaying realization of the loss of value. By mid 2008 the market had corrected. That prices continued to slide for the next 3 years was overcorrection.

This was the period when lucky market timers picked up real bargains. I accumulated a small portfolio of rental homes 2008-2012 because the fully leveraged loan payment plus utilities and property taxes were entirely paid by the monthly rental incomes leaving a strong positive cash flow even with 100% leverage. The immediate downside is that my profits from the homes that I flipped in that period were skinny in hindsight. I was thrilled to make any profit at all in what I saw to be a stagnant but no longer crashing market.

A market correction would see prices drift lower by 10 to 20%. But once the ball starts rolling downhill, it stands a good chance of bouncing on down past what would logically be a plateau based on affordability (Bozek’s measure) and rent versus buy comparisons (my measuring stick)

Thanks Jim. I always appreciate your take on things. Yes, 2005 was the start, and then 2007 was the explosion. You are correct about prices too. There wasn’t much impact at first. In fact, in Sacramento County most price metrics were only down 4-6% or so between August 2005 and August 2006. Yet in the background we saw massive change during this same time period because volume fell off a cliff. In fact, volume was down over 40% when comparing August 2005 and August 2006. It does take a bit for the trend to show up in the prices, but it often shows up in other places first… For any onlookers, I wrote more about this here. And Jim, thanks for taking the time to share your story. Please keep doing so. https://sacramentoappraisalblog.com/2022/05/02/dude-stop-obsessing-over-home-prices/

It’s always been like this. The media, thus the public, looks at past statistics and then projects them forward. Media stories always say stuff like “rates are going to go up” after they have already gone up. “Prices are going to go down” after they have been sliding for months. Your May 2, 2022 blog was very insightful (or as a real estate reporter might write: “inciteful”)

Ha. Yeah, there is often a big lag. This is especially true for anyone focused on the Case-Shiller index that is pushing out stats for about 90 days ago. That’s ancient when it comes to market data. There is so much more to talk about today by focusing on pendings, listings, and other interesting tidbits. On a related note, I find a sentiment in real estate that sometimes blames the media for housing narratives and changing buyer perceptions, but the truth is media isn’t always reporting fresh stuff. Thanks, Jim. Let’s keep comparing notes. My inbox is always open.