Let me get straight to it. I’m excited to share some new visuals. I’m geeking out because these new images help tell a compelling story of seven years of price increases. Whether you’re local or not, I hope you can dig these.

A FEW QUICK THINGS THIS WEEK:

1) Loan Limits: You probably heard conforming loan limits were raised for the third year in a row. This basically helps buyers continue to afford higher prices. I’m not saying that’s bad, but it would be nice if wage growth more than anything was helping people afford the market.

2) Sign the Petition for Appraisers: Last week I wrote about a move to start getting rid of appraisers. This is a big deal with huge implications for the housing market and future escrows. I co-wrote a petition through change.org and I want to ask you to please sign it. SIGN HERE.

3) Cool Graphing Link: On a lighter note, Freddie Mac launched a new graphing tool where you can make quick visuals and even compare different markets throughout the United States. Not every city is listed, but it’s worth checking out and getting lost for a few minutes.

4) My Blue Kitchen: I talked about blue being the rage in kitchens, and I guess my post inspired me. During Thanksgiving break I built a new kitchen island and we painted it blue. Woodworking is definitely a passion and it’s something I do to help keep my sanity. Anyway, this was a fun project and I wanted to share.

SEVEN YEARS ON ONE GRAPH (NEW VISUALS):

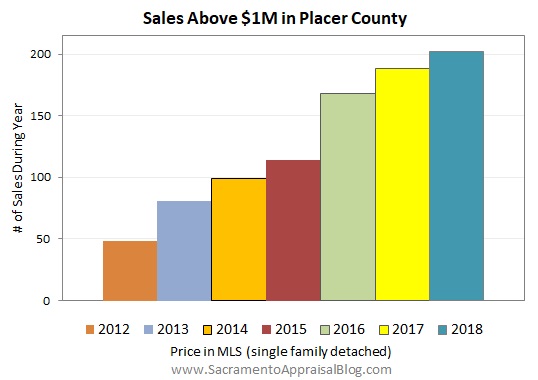

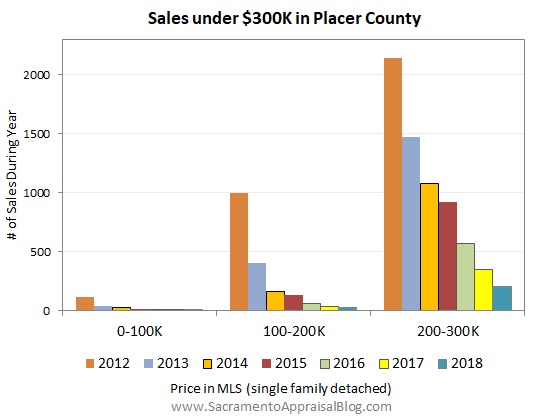

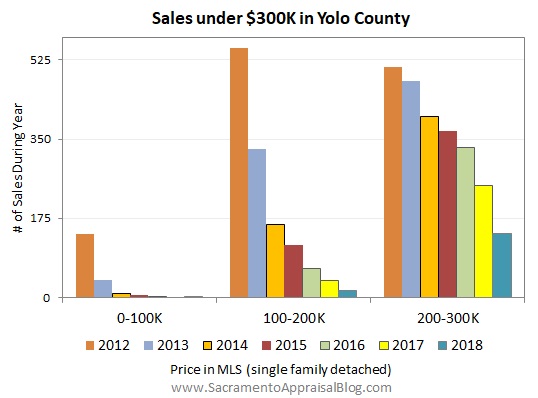

Here’s some images for four counties (Sacramento, Placer, Yolo, & El Dorado). What I like is we see price trends for seven years on one graph. It may take a moment to figure out how to digest these images, but look for changes in price and volume over time. So far people who have seen these have noted rising prices and definitely vanishing affordability. Keep in mind they don’t include most of December for 2018, and that could change the look slightly by next month.

What do you see?

SACRAMENTO COUNTY:

SACRAMENTO REGION:

PLACER COUNTY:

EL DORADO COUNTY:

YOLO COUNTY:

SHARE THESE IMAGES: You are welcome to share any of these images in your newsletter, on social media, or on your blog, etc… See my sharing policy for details and 5 ways to share (please don’t copy my post verbatim).

I hope that was interesting or helpful.

Questions: What do think of these images? Which ones do you like best? Any suggestions for improvement? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.