I’ve been saying things like, “How did you get so big?” lately to my kids. Sometimes I look at them and just wonder where the time has gone, and how it’s even possible that my oldest is starting to look more like a teenager every day. It’s both sobering and exciting. The truth though is it’s taken 12 years for all this change to happen in my son, but I don’t always see the growth every single day until all of the sudden he looks bigger or older. Can you relate?

No way, the market isn’t slowing: The same thing happens with real estate. It’s easy to plug away and use all the normal cliches to describe the market, but when we pause to really take a closer look, we begin to notice things are different. Let’s take a deeper look into the numbers below. If you’re local, absorb what is here and feel free to share some of the talking points with your contacts. If you’re out of town, I’d love to hear about your market. Email subscribers, I recommend reading this big monthly post on the blog instead of email.

Two ways to read THE BIG MONTHLY POST:

- Scan the talking points and graphs quickly.

- Grab a cup of coffee and spend a few minutes digesting what is here.

DOWNLOAD 51 graphs HERE (zip file): Please download all graphs in this post (and more) here as a zip file (or send me an email). Use them for study, for your newsletter, or some on your blog. See my sharing policy for 5 ways to share.

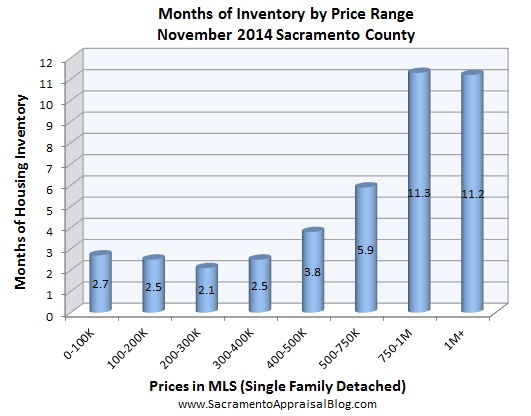

One Paragraph to Describe the Sacramento Market: The housing market has had an aggressive feel for most of the year. Pending sales have been a good 10-15%+ higher than normal, sales volume in the Sacramento region is up 10% this year, and values have seen a modest seasonal uptick too. Overall the market is still quite competitive in some price ranges because inventory and interest rates are still low, but there have been some subtle changes lately that help us see the market is beginning to slow down. Remember, it is normal for markets to slow, and the past two years have seen a very definitive seasonal market where the Spring is hot and the Fall is soft. For instance, it took 2 days longer to sell a home last month compared with the previous month, price reductions are growing in number, the median price in Sacramento County has been hovering at the same level for 90 days, interest rates have seen a minor increase, and housing inventory has seen a slight uptick. As housing supply presumably continues to increase over the next few months, watch out for more price reductions, unrealistic expectations from sellers, and buyers gaining more power.

I’m NOT saying the market is declining. I’m simply saying the strong seasonal market is showing signs of beginning to slow. Those who take notice can make informed real estate decisions and/or help clients price their homes properly (see 3 points below about pricing).

Sacramento County Market Trends for July 2015:

- The median price has been hovering at $290,000 for 90 days.

- It took an average of 31 days to sell a house last month (30 in June).

- Cash sales were 16.7% of all sales in July (very normal level).

- Short Sales and REOs were only 4% of sales last month.

- FHA sales were 26.5% of all sales in Sacramento County in July.

- Sales volume is 8.6% higher so far in 2015 compared to last year.

- Sales volume was 12% higher in July 2015 compared to July 2014.

- There is a 1.9 month supply of homes for sale (1.6 in June).

- The average price per sq ft is 185 (6% higher than last July).

- The average sales price is $320,732 (slightly lower than previous month).

Sacramento Regional Trends for July 2015 (Sac, Placer, Yolo, El Dorado):

- Sales volume was up 14.5% in July 2015 compared to July 2014.

- Sales volume for the year is up 10.3% compared with 2014.

- The median price at $330,000 is up 6% from last year, but down 1% from the past two months.

- Cash sales were 17% of all sales last month (very normal level).

- It took an average of 35 days to sell a house last month (33 days in June).

- FHA sales were 23.1% of all sales in the region last month.

- There is 1.98 months of housing inventory (up from 1.85 in June).

- The average sales price is $367,775 (6.8% higher than last year, but down slightly from previous month at $370K).

- It took 5 less days to sell a house this July compared to July 2014.

- Distressed sales were less than 4% of all sales last month (REOs / Short Sales).

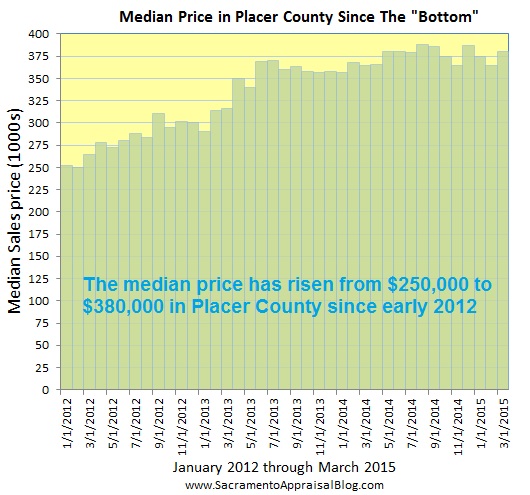

Placer County Market Trends for July 2015:

- The median price in Placer County is $395,000 (it’s been hovering between $391,000 to 401,000 over the past few months).

- The median price is 4.2% higher than one year ago (July 2014).

- It took 40 days on average to sell a house last month (4 more days than June, but 5 less days than last year).

- Cash sales were 16% of all sales last month.

- FHA sales were 18.8% of all sales in Placer County last month.

- Sales volume was 14% higher this July compared to last July.

- Sales volume is up 17.8% in 2015 compared to last year.

- There is 2.17 months of housing inventory (up from 1.88 months in June).

- The average price per sq ft is is 202 (up from 182 last July).

- The average sales price is $430,599 (5.4% higher than July 2014, but lower than June).

I hope this was helpful. Thank you so much for being here.

Quick Pricing Advice:

- Price according to the most recent listings that are getting into contract rather than the highest sales from the Spring.

- Remember how price sensitive the market is right now. Despite inventory and interest rates being low, buyers are not biting on overpriced listings.

- Price according to the neighborhood market rather than county-wide trends. The county-wide market may show increases or declines, but your neighborhood might be more or less aggressive compared to the entire county.

DOWNLOAD 51 graphs HERE (zip file): Please download all graphs in this post (and more) here as a zip file (or send me an email). Use them for study, for your newsletter, or some on your blog. See my sharing policy for 5 ways to share.

Questions: How do you think sellers and buyers are feeling about the market right now? What are you seeing out there?

If you liked this post, subscribe by email (or RSS). Thanks for being here.