What do you get when you ask 12 Realtors one question? I know it sounds like I’m setting you up for a lame joke, but I’m actually going to share some insider perspective on the local housing market. I asked a handful of Sacramento area Realtors to describe the market in just a few sentences. This is first-hand insight straight from the trenches, and I hope it helps paint a picture of how the market unfolded in 2013 and what is happening right now. Enjoy.

Any thoughts? How would you describe the housing market right now?

Steve Ostrom – Roseville Realtor: The 2013 housing market was a roller coaster ride, with crazy turns the whole way, powered by years of government interference.

Steve Ostrom – Roseville Realtor: The 2013 housing market was a roller coaster ride, with crazy turns the whole way, powered by years of government interference.

Barb Lebrecht – Realtor: It appears for now that the cash dragon is in hibernation. The  decrease in competition and increase in inventory makes it a great opportunity for buyers that feel a little tattered from recent market conditions.

decrease in competition and increase in inventory makes it a great opportunity for buyers that feel a little tattered from recent market conditions.

Jeff Grenz – Realtor: While we are looking at a little slow down, some of which is due to normal, but forgotten  seasonal trend, I am encouraged when I look at the suburbs, where the dollar volume is pretty significant, average prices are almost double and are hitting 2004 levels (vs 2003 for Sacramento)…. I’m thinking it is due to a return of confidence and ability to get loans in the higher price ranges, not necessarily income growth but I’m speculating.

seasonal trend, I am encouraged when I look at the suburbs, where the dollar volume is pretty significant, average prices are almost double and are hitting 2004 levels (vs 2003 for Sacramento)…. I’m thinking it is due to a return of confidence and ability to get loans in the higher price ranges, not necessarily income growth but I’m speculating.

Angela Jones – Realtor: I felt like 2013 was headed for the same disaster of a situation we experienced in the mid-2000s. Huge price increases, investors beating out owner-occupants, double digit multiple offers creating a feeding frenzy! Glad to see the values for the most part stabilize.

Angela Jones – Realtor: I felt like 2013 was headed for the same disaster of a situation we experienced in the mid-2000s. Huge price increases, investors beating out owner-occupants, double digit multiple offers creating a feeding frenzy! Glad to see the values for the most part stabilize.

Keith Klassen – Realtor: The market in 2013 began with a hopefulness and turned into an upward, turbo-propelled rocket. People who were upside down in their mortgage and investors who were hanging on for dear life, now could sell – and that’s what many did! During the later part of the year the mood changed as investors hit the brakes and many have pulled out of the market. It’s no secret, but at this moment at the end of the year, the savvy investors that have stuck around and are not too busy with holiday shopping may get some good deals. Busy-with-life home buyers will most likely get back on track come the end of January 2014. We are primed for more balanced, but slowly increasing market in 2014.

Keith Klassen – Realtor: The market in 2013 began with a hopefulness and turned into an upward, turbo-propelled rocket. People who were upside down in their mortgage and investors who were hanging on for dear life, now could sell – and that’s what many did! During the later part of the year the mood changed as investors hit the brakes and many have pulled out of the market. It’s no secret, but at this moment at the end of the year, the savvy investors that have stuck around and are not too busy with holiday shopping may get some good deals. Busy-with-life home buyers will most likely get back on track come the end of January 2014. We are primed for more balanced, but slowly increasing market in 2014.

Doug Reynolds – Realtor: The market was in full sprint mode from January through July with prices skyrocketing, multiple offer competition, no inventory to speak of and cash buyers everywhere. As 2013 comes to an end, the market is taking a holiday breather where many cash investors have pulled back, inventory is trickling up and buyers are taking a bit more time to make a decision, as balance of power is being restored.

Doug Reynolds – Realtor: The market was in full sprint mode from January through July with prices skyrocketing, multiple offer competition, no inventory to speak of and cash buyers everywhere. As 2013 comes to an end, the market is taking a holiday breather where many cash investors have pulled back, inventory is trickling up and buyers are taking a bit more time to make a decision, as balance of power is being restored.

Erin Stumpf – Realtor: In 2013 the Sacramento real estate market started off with a high fever, and the only cure was higher interest rates and rising prices and waning investor demand. As 2013 ends, we have higher interest rates, higher prices, and lower investor demand — and a low fever but still solid demand. It’s nice to see your average joe have a legitimate chance to actually purchase a house!

Erin Stumpf – Realtor: In 2013 the Sacramento real estate market started off with a high fever, and the only cure was higher interest rates and rising prices and waning investor demand. As 2013 ends, we have higher interest rates, higher prices, and lower investor demand — and a low fever but still solid demand. It’s nice to see your average joe have a legitimate chance to actually purchase a house!

Craig Dunnigan – Realtor: Investors dominated the residential market the first half of 2013….The last half of 2013 has seen the market returning to normalcy, with more “move up” and first time homebuyers.

Craig Dunnigan – Realtor: Investors dominated the residential market the first half of 2013….The last half of 2013 has seen the market returning to normalcy, with more “move up” and first time homebuyers.

Bruce Slaton – Realtor: Market had overcorrected, Hedge Funds saw increasing need for rentals,  lower gains in stock market, housing undervalued.. Hedge buys until their internal data shows they may have priced themselves out, left to better markets…we captured equity, was best time to sell…2014 will be the year of no smoke and mirrors, the market will have to face reality and novel things such as Appraised Value, Condition, Pricing At Something Called Comparables…The difference between Listing Agents and Marketing REALTORS will be defined in 2014…looking forward to a medicated market in 2014…

lower gains in stock market, housing undervalued.. Hedge buys until their internal data shows they may have priced themselves out, left to better markets…we captured equity, was best time to sell…2014 will be the year of no smoke and mirrors, the market will have to face reality and novel things such as Appraised Value, Condition, Pricing At Something Called Comparables…The difference between Listing Agents and Marketing REALTORS will be defined in 2014…looking forward to a medicated market in 2014…

Eric Peterson – Realtor: The market accelerated through the spring with higher than expected price appreciation across all segments. Unfortunately, on the 1st of July the market began to cool and once the numbers are in for the final months of 2013, I believe roughly half of the appreciation gained in the first six months of 2013 will have been given back in the second half of the year.

Eric Peterson – Realtor: The market accelerated through the spring with higher than expected price appreciation across all segments. Unfortunately, on the 1st of July the market began to cool and once the numbers are in for the final months of 2013, I believe roughly half of the appreciation gained in the first six months of 2013 will have been given back in the second half of the year.

Gena Riede – Realtor: The real estate market in 2013 saw most homes in multiple offers with buyers willing and able to pay the difference in appraisal amount & buyer’s offer. By the end of 2013 with low inventory & freezing temperatures, buyer rush somewhat cooled with fewer multiple offers & some reduction in listing prices where sellers continued thinking prices were on an upward trend. Typically, this time of year more buyers are dealing with the holidays so I believe we will see multiple offers again in 2014 even though lending will be tighter and home sellers are preparing their homes for sale.

Gena Riede – Realtor: The real estate market in 2013 saw most homes in multiple offers with buyers willing and able to pay the difference in appraisal amount & buyer’s offer. By the end of 2013 with low inventory & freezing temperatures, buyer rush somewhat cooled with fewer multiple offers & some reduction in listing prices where sellers continued thinking prices were on an upward trend. Typically, this time of year more buyers are dealing with the holidays so I believe we will see multiple offers again in 2014 even though lending will be tighter and home sellers are preparing their homes for sale.

Lori Mode – Realtor: Although the real estate market in Sacramento has been challenging at times this year because of many changes and shifts in the market, I have great expectations for an incredible 2014. I see many more homeowners being able to move up or downsize due to added equity in their homes, which makes 2014 a very promising year.

Lori Mode – Realtor: Although the real estate market in Sacramento has been challenging at times this year because of many changes and shifts in the market, I have great expectations for an incredible 2014. I see many more homeowners being able to move up or downsize due to added equity in their homes, which makes 2014 a very promising year.

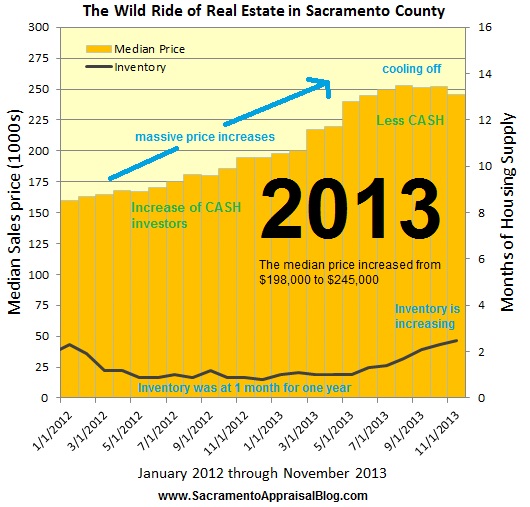

As an FYI, here is a quick video I put together to talk through the image above. It’s amazing to see that the median price in Sacramento County increased by 53% over the past two years. That’s NOT a typo.

Closing Comments: Thank you everyone for your thoughts. I sincerely appreciate the array of insight and experience represented here. As an appraiser it’s my job to pay close attention to market trends in the Sacramento area, and a big part of that involves digesting what I hear from trusted Realtors who are riding the waves of the market with buyers and sellers. Thank you again friends.

Question: Any thoughts, insight or stories to share? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

When hunting for and evaluating homes for my flipper clients, garage conversions have a negative impact. In plain English, I calculate the cost to remove the conversion and restore the garage to original usage in 100% of cases. Why? Most conversions are unpermitted and ultimately that would have to be resolved. Most conversions are poorly executed, have issues with HVAC and access to bathrooms. Buyers want garages for vehicles and storage. While the conversion may have added temporary value for the seller, paraphrasing some of my favorite rock and roll: “you’re fooling yourself if you believe” it adds value for a buyer.

When hunting for and evaluating homes for my flipper clients, garage conversions have a negative impact. In plain English, I calculate the cost to remove the conversion and restore the garage to original usage in 100% of cases. Why? Most conversions are unpermitted and ultimately that would have to be resolved. Most conversions are poorly executed, have issues with HVAC and access to bathrooms. Buyers want garages for vehicles and storage. While the conversion may have added temporary value for the seller, paraphrasing some of my favorite rock and roll: “you’re fooling yourself if you believe” it adds value for a buyer. I believe that if done well, they are a wash. They add some value by increasing the size of the home, but at the same time detract value by removing the garage. If done poorly, they can absolutely remove value. This includes if they are done with shoddy workmanship, but also if they are done when there is a lack of other parking or storage space. I have seen numerous examples of homes with converted garages that have little on street or driveway parking and/or have nowhere to store the junk that would normally go in a garage. If someone were to want to do a conversion, they should have ample additional parking and a shed or some other type of storage space for typically garage stuff. I also think that when people do a permanent conversion that removes the garage door and replaces it with an exterior wall, it definitely detracts from the curb appeal and lowers value.

I believe that if done well, they are a wash. They add some value by increasing the size of the home, but at the same time detract value by removing the garage. If done poorly, they can absolutely remove value. This includes if they are done with shoddy workmanship, but also if they are done when there is a lack of other parking or storage space. I have seen numerous examples of homes with converted garages that have little on street or driveway parking and/or have nowhere to store the junk that would normally go in a garage. If someone were to want to do a conversion, they should have ample additional parking and a shed or some other type of storage space for typically garage stuff. I also think that when people do a permanent conversion that removes the garage door and replaces it with an exterior wall, it definitely detracts from the curb appeal and lowers value. There are several factors that I take in to consideration when trying to determine what adds or subtracts value — OR — adds or subtracts to the desirability of a home in general. Best case scenario with a garage conversion that will add value = good workmanship, done with permits, and the presence of available garage parking that is consistent with the surrounding neighborhood. Worst case scenario with a garage conversion that will subtract value = poor workmanship, done without permits, and no available garage parking that is consistent with the surrounding neighborhood (See more of Erin’s thoughts on conversions

There are several factors that I take in to consideration when trying to determine what adds or subtracts value — OR — adds or subtracts to the desirability of a home in general. Best case scenario with a garage conversion that will add value = good workmanship, done with permits, and the presence of available garage parking that is consistent with the surrounding neighborhood. Worst case scenario with a garage conversion that will subtract value = poor workmanship, done without permits, and no available garage parking that is consistent with the surrounding neighborhood (See more of Erin’s thoughts on conversions  I can definitely shed some light on how they could possibly add value, for the right buyer. I find that the older, tiny detached garages like ones found in East Sac or Land Park barely fit a car in them as is. When converted to a game room, man cave, or office, it creates a completely private place to escape to. The best example I can think of was an episode of Interior Therapy by Jeff Lewis. In the episode, Jeff converted a backyard garage into a home office and lounge type area. This garage was previously used as junk storage and by the end of the conversion you could see how much it brought to the property.

I can definitely shed some light on how they could possibly add value, for the right buyer. I find that the older, tiny detached garages like ones found in East Sac or Land Park barely fit a car in them as is. When converted to a game room, man cave, or office, it creates a completely private place to escape to. The best example I can think of was an episode of Interior Therapy by Jeff Lewis. In the episode, Jeff converted a backyard garage into a home office and lounge type area. This garage was previously used as junk storage and by the end of the conversion you could see how much it brought to the property. In my experience, garage conversions typically do not add value to a home. Right off the bat, a large handful of buyers will not even be interested in the property if it does not have a garage. Therefore, the seller is missing out on about 60% of the potential buyers. So now your competition/interest in the home has already dropped. Next, the question screams: “Was it done with a permit?” Most of the time, garage conversions were not done with permits. This causes red flags for buyers and also eliminates more buyers who are using financing that will not allow non-permitted garage conversion purchases. Additionally, most garage conversions have a step down into the room and it typically does not “feel” like the rest of the house. Due to this, it does not add value for the extra square footage. You lose a garage and in place have not as good quality extra square footage. This leads to using the original square footage when trying to value the home with recent sales. With all of this factored in: In most cases garage conversions decrease the value of a home. At best, the conversion equally cancels out the loss of the garage. The only time it would add value is if you are adding a bedroom and/or bathroom that was done with permits, does not have a step down, the central heat/air is tied into the space and gives the same “feel” as the rest of the home.

In my experience, garage conversions typically do not add value to a home. Right off the bat, a large handful of buyers will not even be interested in the property if it does not have a garage. Therefore, the seller is missing out on about 60% of the potential buyers. So now your competition/interest in the home has already dropped. Next, the question screams: “Was it done with a permit?” Most of the time, garage conversions were not done with permits. This causes red flags for buyers and also eliminates more buyers who are using financing that will not allow non-permitted garage conversion purchases. Additionally, most garage conversions have a step down into the room and it typically does not “feel” like the rest of the house. Due to this, it does not add value for the extra square footage. You lose a garage and in place have not as good quality extra square footage. This leads to using the original square footage when trying to value the home with recent sales. With all of this factored in: In most cases garage conversions decrease the value of a home. At best, the conversion equally cancels out the loss of the garage. The only time it would add value is if you are adding a bedroom and/or bathroom that was done with permits, does not have a step down, the central heat/air is tied into the space and gives the same “feel” as the rest of the home. All I’d really say on the subject of whether garage conversions add value is: It depends. Are they common to the neighborhood? Some older neighborhoods of mostly two-bedroom homes have seen a large number of garages converted to additional living or bedroom space, and in neighborhoods like this it makes sense. Generally speaking, though, I think most people want a garage and are willing to double an office as a guest bedroom instead of looking for two rooms. More often than not when I take clients through homes with garage conversions I get comments like “this is kind of funky” and we have the discussion about how difficult it would be to convert it back to a garage.

All I’d really say on the subject of whether garage conversions add value is: It depends. Are they common to the neighborhood? Some older neighborhoods of mostly two-bedroom homes have seen a large number of garages converted to additional living or bedroom space, and in neighborhoods like this it makes sense. Generally speaking, though, I think most people want a garage and are willing to double an office as a guest bedroom instead of looking for two rooms. More often than not when I take clients through homes with garage conversions I get comments like “this is kind of funky” and we have the discussion about how difficult it would be to convert it back to a garage. Buyers want bedrooms, bathrooms, nice living spaces and in most cases, a garage. In the past 12 years I’ve sold 3 homes with converted garages. These are their stories: 1) A single mother; 2) An investor looking for his next rental, and he liked the converted garage so he could charge more for rent (since it was called a “bedroom” – never mind that the driveway drainage was poor and it slanted down into the garage); 3) An elderly librarian who was also a first time home buyer, who had 12 cats. Yes, the converted garage was for the cats. So for those potential buyers, go ahead and convert those garages! Otherwise, please leave a garage as a garage. I haven’t even gotten into the hassle on the lending side if this conversion was done without permits. If you want to make your home appeal to the most buyers, and sell for more money, leave the garage intact.

Buyers want bedrooms, bathrooms, nice living spaces and in most cases, a garage. In the past 12 years I’ve sold 3 homes with converted garages. These are their stories: 1) A single mother; 2) An investor looking for his next rental, and he liked the converted garage so he could charge more for rent (since it was called a “bedroom” – never mind that the driveway drainage was poor and it slanted down into the garage); 3) An elderly librarian who was also a first time home buyer, who had 12 cats. Yes, the converted garage was for the cats. So for those potential buyers, go ahead and convert those garages! Otherwise, please leave a garage as a garage. I haven’t even gotten into the hassle on the lending side if this conversion was done without permits. If you want to make your home appeal to the most buyers, and sell for more money, leave the garage intact. I think conversions would really be on a case by case basis… and mostly dependent on the needs of the buyer. I am a strong believer that each sale is unique, and if you are in the right place at the right time, you could sell a property for significantly more than you would at a different time. This definitely includes conversions, as some people try to maximize on their living area. Not having a garage though will definitely have a negative impact on the value. Another big factor would be the neighborhood. Many of the lower priced neighborhoods may even benefit from having a conversion (kind of like diluted price per square foot), so it may have a positive impact on the overall price. Higher end neighborhoods, however, don’t necessarily look at the total square footage to determine the price but more on the outlay, condition, and lot. It would also have a much larger negative impact in a higher end neighborhood as it’s not necessarily seen as “desirable” to live in a conversion. Maybe a cheaper alternative to an in-law quarter. 🙂

I think conversions would really be on a case by case basis… and mostly dependent on the needs of the buyer. I am a strong believer that each sale is unique, and if you are in the right place at the right time, you could sell a property for significantly more than you would at a different time. This definitely includes conversions, as some people try to maximize on their living area. Not having a garage though will definitely have a negative impact on the value. Another big factor would be the neighborhood. Many of the lower priced neighborhoods may even benefit from having a conversion (kind of like diluted price per square foot), so it may have a positive impact on the overall price. Higher end neighborhoods, however, don’t necessarily look at the total square footage to determine the price but more on the outlay, condition, and lot. It would also have a much larger negative impact in a higher end neighborhood as it’s not necessarily seen as “desirable” to live in a conversion. Maybe a cheaper alternative to an in-law quarter. 🙂 As far as conversions, we usually convert them back. We’ve found that most people value a garage more than an additional bedroom. The need for extra storage space along with the reality that most conversions aren’t done very well leaves us converting about 90% back to garages.

As far as conversions, we usually convert them back. We’ve found that most people value a garage more than an additional bedroom. The need for extra storage space along with the reality that most conversions aren’t done very well leaves us converting about 90% back to garages.

Please note if you have a chain link fence, nobody is targeting you or saying you’re bringing down the neighborhood. These are simply the opinions of experienced real estate agents and investors. Of course, it may be worth considering what they are saying since they are constantly buying properties to fix and sell on the open market. Clearly they’re in touch with the perceptions of buyers, what makes a difference in property value and the reality of how important impressions are for a neighborhood. If certain elements of fence design give off a negative impression for the community, what can be done about it? What options exist?

Please note if you have a chain link fence, nobody is targeting you or saying you’re bringing down the neighborhood. These are simply the opinions of experienced real estate agents and investors. Of course, it may be worth considering what they are saying since they are constantly buying properties to fix and sell on the open market. Clearly they’re in touch with the perceptions of buyers, what makes a difference in property value and the reality of how important impressions are for a neighborhood. If certain elements of fence design give off a negative impression for the community, what can be done about it? What options exist?