The pile of listings is growing, and it’s taking longer to sell. That’s what so many housing markets across the country are experiencing right now. We’re on the cusp of seeing some real change in the stats over the next few months. Here are some things on my mind. Anything to add?

Why have we seen a spike in listings?

We have almost 3,400 active listings today in the Sacramento region. This is actually still lower than a normal level, but over the past two months there has been a dramatic uptick. What is causing this change? It’s not that sellers have rushed to list, but rather we’re seeing fewer buyers. Since April we’ve easily had over one thousand fewer pendings in the region. Instead of getting into contract, these properties have essentially stayed active. In short, we’ve seen a rise in listings due to a fall in demand.

It’s taking longer to sell (check out the actives):

I think this is a helpful way to show market change. Sales in June have gone quickly, it’s taking longer for pendings to get into contract in recent weeks, and active listings are really starting to sit. And when actives close eventually, that’ll really affect the stats. Do you like this visual?

NOTE: Sales in June got into contract in May, so they really tell us more about what the market was like in May.

The stats are hot, but that’ll change more in July:

The market has been changing, but we haven’t seen too much change in actual sales stats yet. The truth is it takes time for temperature change to show up in the numbers. This dotted line projects days on market through July based on pendings so far in June. The black line (2022) is going to get a whole lot closer to the red line (pre-pandemic average). We are still not back to a normal days on market, but that can happen quickly. As I’ve said, we’ve waived goodbye to the most aggressive market ever. This is key to recognize since it’s simply going to take longer to sell today.

Duh, it should be taking longer:

Some of what we are seeing is seasonal because it should take longer to sell at this time of year, but we’ve also experienced a market shift since affordability has been given a severe beating in recent months. So, what we are seeing isn’t just seasonal. This is about a bigger change where buyers are struggling to afford and stay in the game.

I’m exhausted and out of quarantine:

I just got out of quarantine. Covid finally got me after all this time. My family actually had to cancel a New York vacation last week because of this, so that was a real bummer. I honestly so needed a vacation, but that’s water under the bridge now. Anyway, I’m grateful for health, and I’m also really tired, so I’ll be inching back to work and trying to pace myself.

Thanks for being here.

—–——– MORE VISUALS FOR THOSE INTERESTED ———––

GLOWING AND SLOWING:

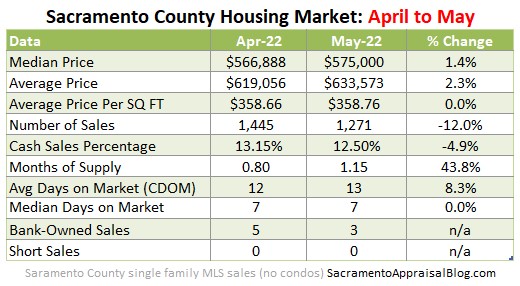

There are two housing markets right now. Glowing sales stats from May. And slowing stats in June. This is important to recognize because we want to understand sales from the past while not ignoring listings and pendings today. The stats from May are still quite elevated in that properties sold a few percent above the list price on average. On one hand this reflects a market that is still statistically above the normal trend, but on the other hand let’s remember sales in May really tell us more about pending contracts in April (that closed in May). My advice? Recognize hot stats from previous months, but don’t ignore slower metrics right now with fewer offers, increasing days on market, dropping sales volume, more price reductions, etc….

There are two housing markets right now. Glowing sales stats from May. And slowing stats in June. This is important to recognize because we want to understand sales from the past while not ignoring listings and pendings today. The stats from May are still quite elevated in that properties sold a few percent above the list price on average. On one hand this reflects a market that is still statistically above the normal trend, but on the other hand let’s remember sales in May really tell us more about pending contracts in April (that closed in May). My advice? Recognize hot stats from previous months, but don’t ignore slower metrics right now with fewer offers, increasing days on market, dropping sales volume, more price reductions, etc….

SHARING POLICY: I welcome you to share some of these images on your social channels or in a newsletter. In case it helps, here are 6 ways to share my content (not copy verbatim). Thanks.

Some visuals…

YEAR OVER YEAR:

Annual stats are important to digest, but don’t forget to look at month to month stats. But remember, sales in May really tell us what the market used to be like in April when these properties got into contract. Also, not every location and price range have the same trend.

MONTH TO MONTH:

Looking at sequential months is key too so we don’t just get stuck or hyper-focused on last year (the past).

OTHER VISUALS:

Just in case you’re hungry for more…

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Thanks for being here.

Questions: What are you seeing out there in the market? What did I miss? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

I’m so sorry to hear about Covid and the particularly bad timing of it. Get well. Thank you for all the great stats.

Thanks so much, Gary. Yeah, this was really classic timing. We’ve been talking about this vacation for so long, and then Covid struck. Haha.

Thanks for letting me pick your brain this morning. I’m seeing a significant rise in inventory, too. Haven’t seen price changes yet until this morning….

Hope you’re able to get that vacation in soon.

Thanks Joe. Good to chat earlier. Let’s stay in close touch as we’re looking at value. We are starting to see bigger changes with CDOM and inventory. There is no mistaking that. We have a Tahoe weekend away soon, so I’m rejoicing in that. We actually hope to make up New York in November if possible. Let’s hope plane tickets aren’t too crazy. 🙂

It’s not surprising to see the mortgage rates having this impact on housing. I’m not seeing a significant increase in our housing inventory in my market. Although our market is a little more affordable. I do expect inventory levels to rise here soon.

Thanks Jamie. It just goes to show the market isn’t doing the same thing in every location and price range. Curiosity killed the cat, so I looked up Cleveland stats in Redfin’s database, and the trend is quite different from Sacramento. And it’s just like you said. No real increase in inventory (and no real drop in pending contract volume either through last week). I tend to concur with you though. One would have to expect an increase at some point in inventory. https://www.redfin.com/news/data-center/

It is interesting to see. Thanks for the link to Redfin. I usually pull my stats directly from our MLS. It’s good to know that Redfin’s data is in-line with the MLS. The next month or so should be telling.

Right on. I pull my stats from MLS too. I don’t like to rely on third-party sites. However, I do like to check out Redfin and Altos in particular as supplementary sources. It’s incredible how much information is out there.

I’m really bummed for you about the NYC trip and covid! Thanks for such great market information, and importantly, I want to thank you for not engaging in the hype. You’re always so careful to be measured in tone and stick to the facts. I remember a few years ago, I told you I’d plan to sell my home near the peak and rent for a while. Well, now rents are so damn high, that plan doesn’t work anymore!

Thanks Steve. Yeah, that was a real drag. Thanks for kind words. I really appreciate it. We have to stick to the facts. I think it’s far too easy to be swept away by sensationalism, and I’ve watched many real estate professionals and consumers do just that through the years. And it’s no joke about rents. This goes to show it’s not so easy to time a market perfectly. On paper it sounds easy to buy at the bottom and sell toward a top, but in real life finances and lifestyle don’t always easily align with market conditions.

Here’s a sobering rhetorical question for onlookers. If you own a home, could you afford to buy your existing home at the current value and a mortgage rate around 6%? My guess is the bulk of people could not afford, and that’s a wild reminder of how lopsided conditions have been out there.

Hi Ryan,

As always, lots of great data. Sorry about you missing your trip to NY. Maybe later. We like to go to NY in November.

Thanks for all you do in providing us with a lot of great information. With rising interest rates, we are seeing a slow down especially with entry level buyers who have been hurt by rising prices mixed with rising rates for a double whammy.

Thank you Rick. We may try to go in November. I hope it works out. This is a bucket list thing for my wife, so we’ll see. I hear you on entry-level buyers. I really feel for buyers. There is a profound appetite for housing, but affordability has become a real issue.

Love that you included your “sharing policy”….you work hard and provide us such great information…you should always be given credit…in a manner that can easily be seen. Glad to hear you’re feeling a better…but take it easy…don’t overdo!

Thanks Janet. I love when people share, and I want to make it easy for people to share my content. It’s a huge honor. Most people get it right, but some need a little prodding that sharing doesn’t mean copying verbatim or removing my blog address on my images. Haha. 🙂 I’ll try not to overdo it. Sitting still is not my forte.

Ryan, I honestly don’t know how you do it. But I am grateful you do! Thanks for another great report and lots of helpful data. Glad you’re getting over covid (took me about a month to get 100%). Hope you eventually find New York to be as hoped!

Thank you so much Dan. I appreciate the kind words. That’s what I keep hearing about one month. This hit me pretty good. It wasn’t just a little cold for me unfortunately. I was leveled and had some serious Netflix time (I’m so done with TV). 🙂

Great market recap, Ryan. I’m starting to hear some comments by local agents about market activity changes as a result of the recent changes in interest rates. We’ll definitely need to keep an eye on things so that our appraisal reports reflect current market conditions. Maybe the weather will be better (not as hot!) later in the year when you go to New York

Thanks Tom. Way to keep your ears open. We are really starting to see some changes with pending contracts and volume especially (I’m talking numbers – not so much prices). Hope you and the family are well.

Sorry about you getting covid, I’m in the same boat today. Managed to avoid it for 2 years!

In Seattle we are definitely seeing a cooling market in many neighborhoods, although some are still creeping up! Inventory definitely has increased, and I’m seeing an amount of price reductions I haven’t seen in years. I’m also seeing many more homes fall out of contract due to financing. It will be interesting to watch the market over the next year.

Thanks Shea. I’m so sorry to hear that. I hope you are getting rest. Hang in there. I’m the same with you. I avoided it all this time… until before vacation.

What you are describing sounds very similar to Sacramento (and likely many markets across the country). Let’s keep comparing notes.