It feels like a gut punch to housing demand to have 8% rates. So many predictions said we’d be at 6% or below by now, yet here we are. I think it’s really important to stay grounded and realistic, so let’s talk about this. I also have some market recap visuals (and a few insane graphs). I hope this helps.

UPCOMING (PUBLIC) SPEAKING GIGS:

10/27/23 AI Fall Conference (San Francisco) (register here)

11/16/23 Big Event TBA

11/30/23 Safe CU “Preparing for a Successful New Year”

1/30/24 Joel Wright & Mike Gobbi Event 9am TBD

JUST DATE THE 8% RATE

First off, I want to say that “date the rate, marry the house” is a terrible slogan in my opinion. I’m not a fan of promising the future. Look, it might work out really well for some people. But then again, maybe not. Amy Tremayne told me that dating the rate is like marriage advice she got from her mom. “You need to marry the person for who they are, not who they might become.” Such a solid word picture for buyers being comfortable with the mortgage payment today instead of banking on what it might be in the future.

JUST PLUG IN NEW NUMBERS

“Dating the rate” is a comical narrative though because new numbers just plug into the slogan. “Date the 6% rate.” “No, date the 7% rate.” “Bro, D8 the 8.”

8 THINGS ABOUT 8% RATES

1) Higher rates will take more demand out of the market.

2) We’ve seen an increase in active listings lately due to fewer pendings. This could start to increase more. Time will tell. It’s so important to watch this trend closely.

3) We’ll have to see if 8% is a psychological barrier for buyers causing more pause.

4) There will always be some buyers and sellers in any market. Someone told me there would be 0% demand at 8% rates, but that’s fiction.

5) It seems like mostly everyone got their rate predictions wrong this year, so maybe it’s best to not predict. Even the Mortgage Bankers Association had a 6.3% rate projection for this quarter (they’ve since changed the projection).

6) Sellers, do what the market requires. Reduce the price, give credits to buyers, buy down the rate, negotiate… There is a smaller pool of buyers right now. It is NOT 2021 where you had total control, and buyers are going to need more help to make things work if rates keep ticking up.

7) If you work in real estate, you have to be intentional about increasing the size of your network. This is a housing market where you will hear NO more than YES because supply and demand are so limited. Who are the gatekeepers to the types of work you want to do? Who do you need to get to know? What is your action plan for getting in front of people this week? Who needs your expertise? What types of transactions are happening today, and how can you connect with that target audience? How do you need to diversify your practice?

8) Last but not least, be full of hope in life, but be realistic about the housing market. Expect low volume and low new supply ahead as we are still in a market where many buyers and sellers feel stuck and unable to move.

QUICK MARKET RECAP STATS

Some local stats for those interested.

YEAR-OVER-YEAR:

MONTH TO MONTH:

AND SOME CHAOTIC GRAPHS

I’m starting to add some different counties into the mix. I’m getting requests and speaking gigs in other places, so it’s spurring me to add some new stuff. I know these visuals are a hot mess and likely too chaotic to be meaningful. But I’m intrigued by the juxtaposition of different areas.

Thanks for being here.

APPRAISER PRIVATE WORK FOCUS:

I haven’t forgotten about the free Zoom class I mentioned for appraisers. I’ll get a date together soon. I’m thinking November at some point or very early December. Thanks to Joe Lynch for helping me with this.

Questions: What are you seeing happen with active listings? Are they taking longer to sell? What is open house traffic like? I’d love to hear.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

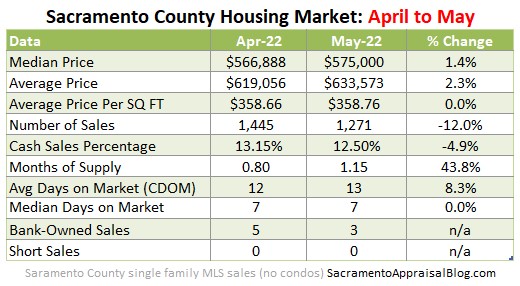

There are two housing markets right now. Glowing sales stats from May. And slowing stats in June. This is important to recognize because we want to understand sales from the past while not ignoring listings and pendings today. The stats from May are still quite elevated in that properties sold a few percent above the list price on average. On one hand this reflects a market that is still statistically above the normal trend, but on the other hand let’s remember sales in May really tell us more about pending contracts in April (that closed in May). My advice? Recognize hot stats from previous months, but don’t ignore slower metrics right now with fewer offers, increasing days on market, dropping sales volume, more price reductions, etc….

There are two housing markets right now. Glowing sales stats from May. And slowing stats in June. This is important to recognize because we want to understand sales from the past while not ignoring listings and pendings today. The stats from May are still quite elevated in that properties sold a few percent above the list price on average. On one hand this reflects a market that is still statistically above the normal trend, but on the other hand let’s remember sales in May really tell us more about pending contracts in April (that closed in May). My advice? Recognize hot stats from previous months, but don’t ignore slower metrics right now with fewer offers, increasing days on market, dropping sales volume, more price reductions, etc….