Sellers have been sitting out of the housing market, and it’s made a massive difference in 2023 so far. Today I want to show what’s happening with new listings and talk about concessions. I hope this is useful, whether you’re local or not. Scroll by topic or digest slowly.

UPCOMING (PUBLIC) SPEAKING GIGS:

5/4/23 Housing Market Q&A 12-2pm

5/10/23 Empire Home Loans event TBA

5/18/23 SAFE Credit Union event TBA

5/22/23 Yolo YPN event (only for YAR members)

6/1/23 DJ Lenth Event TBA

7/20/23 SAR Market Update (in-person & livestream)

I’M A BROKEN RECORD

Inventory is low. It’s tight out there. Buyers have few options. Blah, blah, blah. We’ve heard it all before. But that’s where we’re at, so let’s talk about it.

NEW LISTINGS HAVE LEFT THE BUILDING

A lack of new listings in 2023 has altered the feel of the market in many locations around the country. In the Sacramento region we’re missing about 4,400 new listings from last year (and last year was already lower).

The good news is we’re seeing a seasonal uptick in new listings so far in 2023, but the bad news is the number of listings is really low.

April was even lower than 2020 during the thick of the market stalling during the beginning of the pandemic. Do you remember how the market paused during that time? Well, it’s been worse than that lately.

LOW SUPPLY MEETS LOW DEMAND

I added this portion after publication because I’m getting a few comments about demand. Yes, demand is still low. We have a weird dynamic right now where low supply has now met low demand. This is why the market is so competitive. It is NOT that we have a normal number of buyers.

STATS > SENSATIONAL HOUSING NARRATIVES

We have to keep letting the stats form our perception of the market. My advice? Be intentional about cultivating objectivity by being open to the stats, and letting the numbers shape what you say about the market.

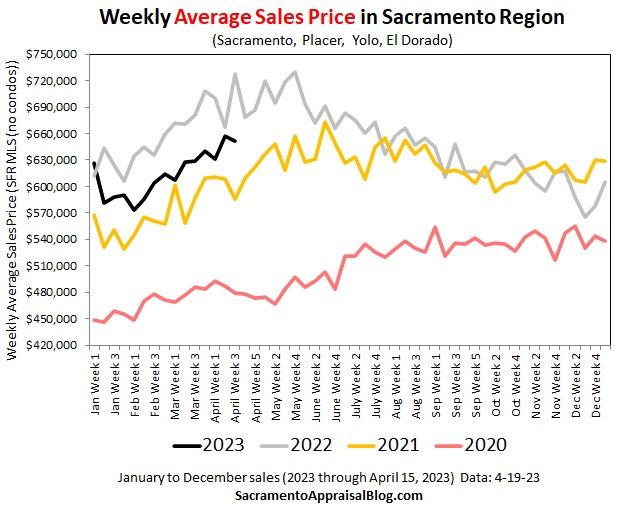

WILL WE HIT A SEASONAL PEAK SOON?

I’ve been starting to hear a few agents tell me they’re seeing slightly less traffic at open houses lately. I’m careful with what I hear because a few stories don’t mean it’s a trend. However, the word on the street in real estate is so important because the stories of today become the stats of tomorrow. Thus, it’s key to listen to what market participants are saying (while sifting subjectivity). This is why I did a poll on my Instagram stories the other day. Look, I’m not putting all my perception of the market on this one poll, but the results are lining up with what I’m hearing from agents overall. Traffic is steady and the market is hot, but some agents are starting to report a bit less traffic. We’ll see if this holds. Keep in mind the market normally hits a peak in demand in the region in April with the percentage of multiple offers, so it’s not a shocker to see demand start to pull back around this time. Also, this doesn’t mean the market isn’t ultra-competitive or that some open houses aren’t packed, so thanks for saving your hate mail.

MULTIPLE OFFERS NORMALLY PEAK IN APRIL OR MAY

Just for context. The percentage of multiple offers typically peaks in April or May each year. However, these are for closed sales, which tells us the hottest time for multiple offers technically peaks about one month earlier in March or April each year. Prices typically peak around June in the region, which reminds us pendings are at their high in April or May before closing in June.

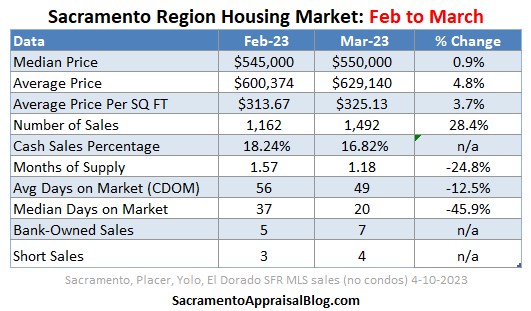

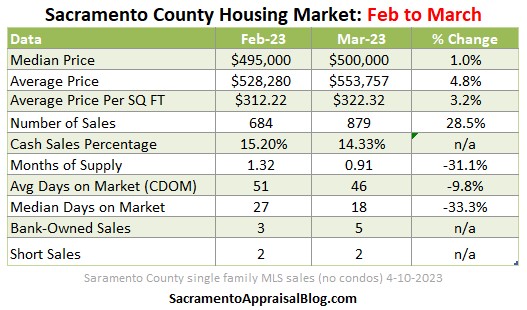

HOT MARKET = CONCESSIONS DECLINING

It’s normal to see concessions go down in the spring as the market heats up, but it’s also been a sharper change over the past few months in light of the housing temperature changing so much. Keep in mind it’s normal for concessions to rise in the second half of the year as the market softens.

NEW CONSTRUCTION IS A DIFFERENT ANIMAL

Here’s a local builder ad I saw last week where the builder was advertising buying down the mortgage rate and assistance for closing costs. Builders have had two months of volume rebounds, which is not the trend happening in the resale market. In short, offering concessions is a massive factor in luring buyers back into the game. Of course, we have to ask, would these properties padded with concessions be selling for that amount without the concessions? This is where appraisers are going to have to carefully analyze the market. The truth is concessions can inflate prices, which is something to watch.

CONCESSIONS AREN’T THE SAME BY PRICE RANGE

This is a new graph. Is it a keeper or not? Let me know. Basically, we tend to see more concessions at lower prices, and most concessions are under 3% too (topping out at 6%). Concessions are less common at higher prices, and they’re also lower in the amount.

And if you wanted to see the dollar amount instead… What I like about this is we can see the vast bulk of concessions are under $10-15K.

BRO, WHAT ABOUT MULTIPLE OFFERS?

What about properties with multiple offers? Does the seller still have to give concessions? In April, 56% of properties with multiple offers had concessions to the buyer. This is good for sellers to keep in mind. The bulk of these properties were under $550K though, which tells us sellers at the lower half of the market should still be ready to meet buyers with credits if needed.

THE MARKET OR THE MARKETING?

There are some really lopsided stories right now about properties going above the asking price, but the market isn’t always the culprit. Sometimes it’s the marketing. In short, if a seller prices 5-10% below market value, a property will naturally get bid up. This week someone asked me how much she might need to offer above the asking price, but that’s a hard question to answer because it really depends on the reasonableness of the original price. Look, lots of stuff at the lower half of the market is legitimately getting bid up because there are so many buyers competing, but some of it has to do with pricing too.

FLIRTING WITH A NORMAL RED LINE

It’s still early to pull monthly stats, but I want to give a preview. In April, 41.2% of sales sold above the original list price. The black line shows the trend in 2023, and it’s basically now flirting with normal levels (red line). Some people are saying it’s 2021 in the stats (orange line), but that’s not what the numbers are showing. But next month should be more aggressive as pendings from April start closing, so I expect the black line to go above the normal trend (which is bonkers to see in a market that is struggling with affordability).

And here are properties that sold below the original list price (black line). It’s a similar trend where stats are flirting with the pre-pandemic normal.

NOT EVERYTHING IS SELLING ABOVE

I know this is a hot mess, but I love this visual because it helps show how every property sold compared to its original list price. Look, the market is ultra hot right now, but that doesn’t mean everything is selling above either. Let’s look to the stats to help form our narrative. What we don’t want to do is impose one narrative on the market, whether that’s doom and gloom or glowing.

I hope this was helpful.

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Questions: What are you seeing right now in the trenches of escrow? What are you seeing with concessions? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.