The iBuyer model got destroyed last year when the housing market shifted, but is Opendoor starting to turn things around? Today I want to look at some stats in the midst of a market full of drama.

SERIOUS REAL ESTATE DRAMA

It’s been drama this past week with debt ceiling conversations and rates above 7% again. It honestly feels like a soap opera at times with plot changes and big cliffhangers. My advice? Stay grounded in the stats, don’t get swept away by the flavor of the week, stop listening to voices that perpetuate fear, and be patient since we need time to see the trend.

UPCOMING (PUBLIC) SPEAKING GIGS:

6/1/23 Thrive in Real Estate (register here)

6/07/23 SAFE Credit Union event for agents (sold out)

6/08/23 Made 4 More event (in-person & Zoom)

7/20/23 SAR Market Update (in-person & livestream)

OPENDOOR’S CHANGING STRATEGY

One year ago, Opendoor owned over 300 units in the Sacramento region, but right now they only own 50 units. It’s tempting to think they’re selling everything due to failure, but they’ve acquired 12 units since April, so they are still buying. Look, this company is not a poster child for health, but they’ve dealt with loss on their books, they’ve slowed acquisitions, and it looks like they’re being more discerning about what they buy. In short, they are pivoting. To be fair, Opendoor has had the benefit of a more competitive market lately, which helps.

LISTINGS ARE LOOKING BETTER:

As of last week, Opendoor had nine active listings in the Sacramento region, and nearly all listings are still above the acquisition price. Honestly, this wouldn’t even be newsworthy for a typical flipper because selling at a profit is a basic part of business, but the iBuyer model has been notorious for overpaying and selling at a loss. Ultimately, assuming their listings are not overpriced, this tells us Opendoor has been buying at a discount. Or put another way, sellers have been selling at a discount to Opendoor.

Some of these units might still sell at a loss, but four listings are currently over six figures above the acquisition price. Opendoor is known for doing modest improvements at best, so it’s unlikely these properties had extensive upgrades to increase their value.

GETTING DESTROYED THIS PAST YEAR

There is a flicker of hope for Opendoor when looking at their listings, but this past year has been brutal. Since September 2022, only 25% of Opendoor’s properties in Sacramento sold above the acquisition price. Numbers like that are not something a mom-and-pop investor could survive, so still being here is a testament to Opendoor having deep pockets. To be fair, my graphs show the difference between the sales price and acquisition price, and I did not include a 5% credit that Opendoor likely got when acquiring properties. However, these visuals also don’t include holding costs, real estate fees, credits to the buyer, and money spent on repairs. In short, a 5% credit during acquisition doesn’t really change the outcome here. It’s been ugly.

CLOSING THOUGHTS

1) Failure & Pivoting: The iBuyer model hasn’t cracked the code yet, and other iBuyers such as Redfin, Zillow, and Offerpad have all left the Sacramento market. We’ll see if Opendoor is successful or not. For now, they are trying to pivot to survive (something every real estate pro needs to do).

2) Selling for less due to convenience: Sellers can very likely make more money on the open market right now in light of a shortage of supply creating so much competition. However, sometimes convenience is more meaningful, so sellers will leave money on the table for the sake of a smooth private transaction (I hope they know how much they’re leaving though). On that note, I’ve been hearing about more private transactions off MLS lately where sellers have not wanted crowds going through homes, or where buyers found a property to purchase before it hit MLS. This just goes to show a segment of the market wants to transact privately.

I hope this was interesting.

MARKET STATS: I’ll have lots of market stats out this week on my social channels, so watch Twitter, Instagram, LinkedIn, and Facebook.

Thanks for being here.

Questions: What are you seeing with the iBuyer model right now? Why do you think some consumers would sell at a discount to an iBuyer?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

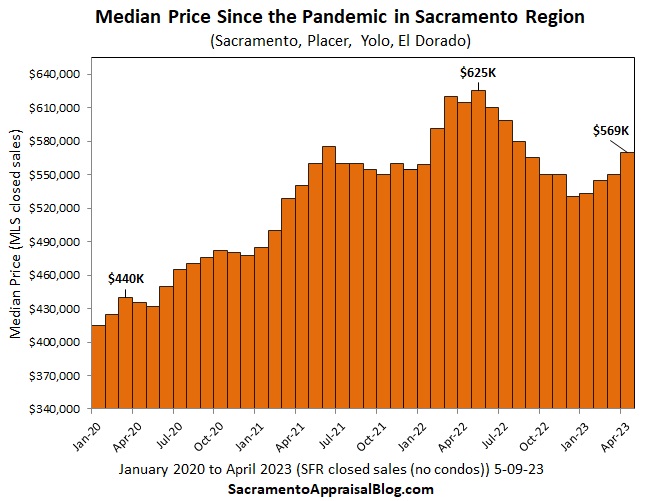

The spring started out more subdued, but it’s really become competitive. When looking at median price change from January to April, we’ve seen about 7% growth so far in the region. This is pretty decent for the time of year (slightly lower than normal). Based on what I’m seeing in the pendings, we should see some standard if not strong growth ahead in May closed sales. Keep in mind this does NOT mean prices are up 7% for every property. Please look to the comps. The median price does NOT translate rigidly to every parcel or area.

The spring started out more subdued, but it’s really become competitive. When looking at median price change from January to April, we’ve seen about 7% growth so far in the region. This is pretty decent for the time of year (slightly lower than normal). Based on what I’m seeing in the pendings, we should see some standard if not strong growth ahead in May closed sales. Keep in mind this does NOT mean prices are up 7% for every property. Please look to the comps. The median price does NOT translate rigidly to every parcel or area.