Let’s talk about housing doom. Particularly, I want to get into the viral idea about the demise of the Airbnb market. But first, I have a few visuals to kick off hot graph summer (sorry). I’d love to hear your take in the comments.

A meme I shared this week as I talked about the concept of a forever home. It’s a forever home until it’s not… This meme was born from conversation around the topic. Too real at the moment…

UPCOMING (PUBLIC) SPEAKING GIGS:

6/30/23 Halftime report with Ben Johnston 10am (Zoom)

7/20/23 SAR Market Update (in-person & livestream)

7/26/23 Fair Mortgage (details TBD)

8/18/23 Details TBD

10/23 SAR Think Like an Appraiser (TBD)

HOT GRAPH SUMMER

I’m excited to track stats this summer. The market has been a wild ride lately. Here are a few new visuals and thoughts in my brain right now. Or scroll down if you want some juicy Airbnb thoughts instead.

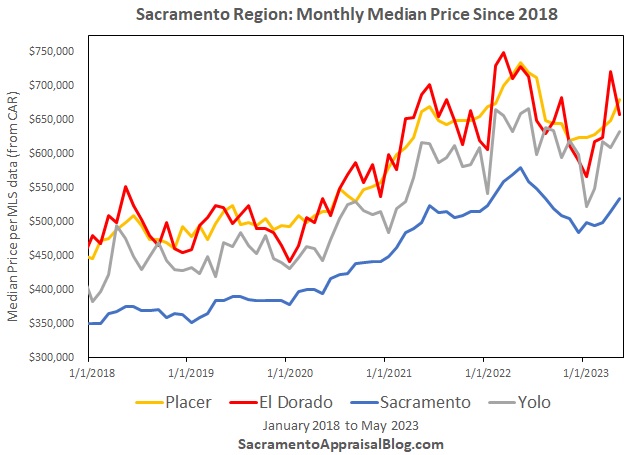

PRICES MEETING LATER IN THE YEAR FOR COFFEE

If we have a normal seasonal slowing ahead, it’s possible we could see the median price for 2023 meet up with 2022 and 2021 levels in the fall. Time will tell, so I’ll keep reporting on the black line. If this does occur, it will show 0% price change from the year before. I can hear it now, “Bro, the market is back. Prices are the same as last year.” However, this will NOT mean we are back to peak prices from May 2022 (gray line). It will simply mean prices in October 2023 are the same as October 2022. The market is in a weird place right now and anything can happen ahead, but a drop like the second half of 2022 seems unlikely unless something really alters the trend.

And a California visual in case that’s your thing. This one does not have preliminary data for June (dotted line).

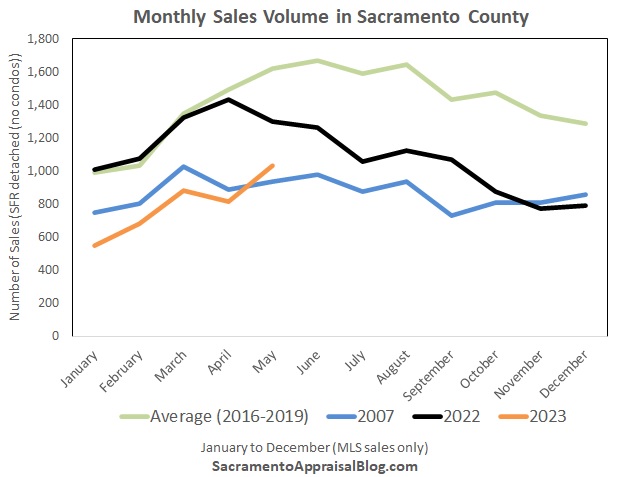

HOW IS VOLUME REALLY DOING?

Here’s a new visual to help show what’s happening with volume in the Sacramento region. I know this is a hot mess, but I think it packs a punch. The orange line is sales volume in 2023, the black line is sales volume in 2022, and the green line is the pre-pandemic average (2016 to 2019). The percentages here show the difference between the past year and pre-pandemic monthly volume. This gives us a baseline for “normal” so to speak. The problem is comparing volume today to last year gets awkward since last year was starting to be lower. Ultimately, a visual like this gives us more context.

AIRBNB DOOM THOUGHTS

There’s a prominent narrative on social media about the Airbnb market imploding. In fact, this week there was a viral tweet from Nick Gerli about a massive drop in Airbnb income in various markets. This guy is pretty much the chief of the housing doom prophets. He has built a massive following. Today I want to talk about some of his thoughts. This isn’t about throwing shade or real estate gossip, but interacting with ideas that are becoming a part of the housing narrative. This is REALLY important to talk about.

THE DATA NEEDS TO BE QUESTIONED

One of the struggles with short-term rental data is it’s not easy to get unless you pay for the information. My sense is the Airbnb crash narrative sometimes relies on individual stories like, “My sister’s boyfriend’s uncle can’t find renters any longer, so the market is collapsing.” All I’m saying is it can be difficult to fact check the trend in light of a lack of publicly available information. However, here is some analysis from a different data source that some would call the definitive source for short-term rental data. As can be seen, there is a massive difference between the viral doom tweet and what AirDNA’s Chief Economist is saying. Anecdotally, the stories I’m hearing from Airbnb investors in Sacramento are lining up so far with the image below. There has been a hit to income for sure from last year, but it’s not 40%.

THE PREMISE IS OFF

The viral tweet goes on to talk about how scary it is for the United States housing market to have nearly one million Airbnb / VRBO rentals. The idea is it could be a big problem that there are nearly one million short-term rentals compared to only 570,000 homes for sale right now. Look, we need to pay attention to the short-term rental trend, and I expect for this submarket to take a hit if the economy sours. Bottom line. But it also feels a bit awkward to compare the number of short-term rental units with total active listings because the juxtaposition leads to sensationalism. Keep in mind if there was an Airbnb issue, these units would NOT all list at once. I recall Nick Gerli saying it could be a problem when Zillow failed as an iBuyer because those listings would flood the market. Yet, it wasn’t a problem and these listings didn’t hit at once either. Remember, many investors don’t just have one option. Economic pain or a change in short-term rental laws could lead to carnage, but some investors could still rent monthly instead of selling. Ironically, wouldn’t it be great to see some of these listings hit the market? We are starving for more.

By the way, if you really want to make a sensational graph, just tell people the housing market could crash if all investors listed their units. In California it’s said about 44% of all residents rent, which means we have a massive number of rentals. Imagine how a graph like that would look with the number of investor-owned properties compared to current active listings.

JUMPING FROM TOPIC TO TOPIC

A few months ago, I recall this same person talking about the problem of vacant houses in the United States, and how that could crash the market. Look, I don’t have an edge against this guy (really), but at some point, we have to question credibility if he keeps repackaging crash predictions like this. And on a serious note, nobody should be turning a blind eye to the struggle of affordability, inflated home prices, or potential red flags in the future. Ultimately, there is value in discussing topics, but it’s best done with objectivity rather than a paradigm that’s starved to invent new ways to say the sky is falling.

MARKETS GO UP AND DOWN

I’ve been writing for years about how normal it is for markets to go up and down. Housing markets are like my waist line. The numbers are constantly changing. Haha. In truth, prices don’t stay the same. On that note, a critique of a rosy real estate narrative is that things aren’t always super positive and glowing. That’s why I reject the rosy side of real estate too (I’m on team stats).

DOOM STARTER KIT LEXICON

If I were selling a doom lexicon starter kit, I’d include phrases like, “just wait,” “It’s coming,” and “It’s going to be delicious.” I can’t tell you how many times I’ve heard these things on Twitter especially. It’s like people are hungry for a crash, and that’s all they can see and talk about. Or maybe that’s just an image they’re projecting. I really don’t know.

GETTING RICH ON FEAR

The doom narrative has an obsession with fear, and the biggest voices are often earning serious money by sucking people into the narrative. Sometimes I wonder about mindset. Like, do they really believe what they’re saying? Is it just a social media persona to earn money? Or is it a big game?

ROOM FOR DIFFERENT OPINIONS

It’s okay if you think the market is going to implode. And it’s okay if you think prices are only going to rise. We should listen to data and let the stats form our narrative. I respect people on both sides of the aisle, though the truth is often found in the middle on so many issues. Yet, I don’t respect it when someone imposes a narrative on the stats. No thanks.

DOOM & MENTAL HEALTH

First, everyone is responsible for their own mental health, and we cannot blame other people for the way we think and feel. But I want to challenge those who perpetuate housing doom online because there are many people listening who might walk away thinking there is no hope in life, everything is going to collapse, all is lost, and there is only death and destruction ahead.

I talked with someone last year who was struggling with suicidal thoughts when the housing market saw a major shift. The sharp loss in value was a massive issue for this person. Look, this guy needed to talk to someone and work through some issues, and I tried to help. It certainly wasn’t the doom narrative’s fault here either, and I’m not implying that at all, so save your hate mail. However, listening to some doom voices on social media was taking a real toll on this guy’s mental health, so words and narratives do matter. If all people hear is, “We’re going crash hard,” it’s bound to have an effect.

Do you know what I rarely hear from anyone pushing out doom? Things like take care of yourself, step back if this is too much, or there are deals to be had in real estate in any market. Just in case you needed a reminder, it’s possible to have joy even in difficult economic times. It’s possible to be successful in real estate no matter what the market is doing. You are not your paycheck. You are not your Zestimate. Good markets don’t last forever, and neither do the bad ones.

In closing, take care of yourself. Cultivate peace in your life. When it comes to real estate data, listen to voices spewing objectivity rather than fear. And stop following real estate so closely if it’s too much for you (including my blog).

I hope this was helpful.

Questions: What do you think about the Airbnb market? What has been your experience with the doom or rosy perspective in real estate?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

Okay, now an interview with

Okay, now an interview with