We’re seeing more price reductions lately. Does this mean the market is starting to collapse? Are things beginning to turn? Is this 2008 all over again? I’ve been getting great questions like this lately, so let’s talk shop.

Teaching my favorite class: On September 28th from 9am-12pm I’m teaching my favorite class at SAR called How to Think Like an Appraiser. It’s three hours, which sounds painful, but I love this one because we have space to dig deep into comp selection and adjustments. Sign up here.

5 THINGS TO KNOW ABOUT PRICE REDUCTIONS

1) Price reductions are normal: It’s normal to see more price reductions from the summer through the fall season. The danger is it’s easy to observe normal trends through a doom and gloom lens. The issue is demand changes from the spring and there is less attention from buyers as people are focused on school, vacation, and getting into a fall rhythm. It then takes sellers a bit to adjust their expectations and find proper pricing in a cooler market.

2) Anything can be overpriced: Over the past week in Sacramento there were price reductions in every single price range. This tells us it’s possible to overprice at any segment of the market.

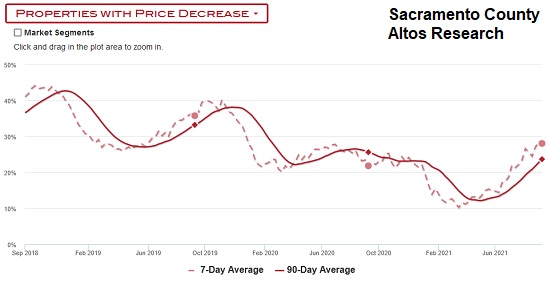

3) Technically the market is NOT way overpriced: The local housing market is seeing more price reductions, but I don’t think it’s fair to say we have an overpriced market. Like I said last week, stats are still not normal as the market is more aggressive than it normally is for the time of year. According to Altos Research 28% of recent listings have price reductions in Sacramento County. Anyway, check out Altos and see Placer, Yolo, and El Dorado too. I don’t pull stats like this regularly, but a figure at 28% sounds about right as it fits with other stats I do pull. I can bore you with details in the comments if you wish.

4) Be careful about judging: The danger in real estate is to think whatever we are seeing with a few properties is what the entire market is experiencing. Maybe. Maybe not. It’s like me noticing several people wearing overalls. Is it a trend or did I just happen to see a few friends reliving their glory days from the 90s? Look, personal experience is really valuable, but it’s important to be sure we’re looking at stats on a bigger level beyond what is in front of us.

5) A closing note for sellers: It’s critical to nail the list price right now and I advise being in touch with the current climate of fewer offers, taking longer to sell, and more price reductions. It’s easy to be infatuated with hot headlines or cling to the idea of fetching a massive cash offer from an out-of-town whale. My advice? Price for the market and see what happens. Don’t price for the unicorn. It’s still a competitive market, so you may be able to get a few strong offers, but it’s not what it was four months ago. Oh, one more thing:

Anyway, I hope this was helpful.

Thanks for being here.

Questions: What are you seeing out there with price reductions? What advice would you give for pricing a property right now?

If you liked this post, subscribe by email (or RSS). Thanks for being here.