What’s the housing market going to do in 2025? Nobody has a crystal ball, but here are some things on my mind. Scroll quickly by topic or digest slowly. Anything to add?

UPCOMING SPEAKING GIGS:

1/15/25 Mike & Joel Event (free online (register Eventbrite))

1/16/25 Sac Real Producers event (details TBA)

1/22/25 Windermere El Dorado Hills / Folsom (private I think)

1/24/25 PCAR Market Update (details TBA)

1/31/25 Prime Real Estate (private)

2/6/25 She Invests event (TBA)

2/11/25 MLS Meeting TBA

2/12/25 Coldwell Banker EDH (private I think)

2/12/25 NARPM (private)

2/18/25 Travis Credit Union TBA

3/6/25 Yolo Association YPN Event

3/12/25 Windemere Sierra Oaks

3/20/25 HomeSmart iCare Realty (private I think)

4/10/25 Yuba-Sutter Association (details TBA)

4/15/25 Culbertson and Gray (private I think)

5/8/25 Private event (details TBA)

5/13/25 PCAR

6/5/25 Auburn Marketing Meeting

9/26/25 PCAR

11/4/25 SAR Main Meeting

SWEET 16 BLOG MIXER IN 2 WEEKS:

SWEET 16 BLOG MIXER IN 2 WEEKS:

My blog is turning 16, so it’s a good excuse to bring people together. I’d love to have you at the mixer on January 22. If you feel connected to me, you’re invited. Click on the image for details. Please RSVP since I need to buy enough appetizers.

NOTE: The housing market isn’t the same in every part of the country. I hope you get some value here, whether you’re local or not.

THINGS TO WATCH IN 2025:

Sellers will continue to thaw out: Last year we saw more listings come to the market. In fact, we had about 3,500 more new listings than 2023 in the region. But the wild part is we were still missing over 11,500 new listings from the pre-2020 normal level. Can you see why prices have remained higher? Anyway, right now it looks like 2023 was a bottom for seller inactivity, which is a good thing. This year I expect for new listings in 2025 to outpace 2024 levels as lifestyle moves come up for sellers. We still won’t be anywhere close to a normal number of listings though.

New construction will do well again this year: Locally, I expect new construction to still do well. That may not be the vibe in some markets around the country, but 2024 was one of the strongest years we’ve seen over the past decade locally. Part of the success comes from buyers aching for quality inventory, so builders have a captive audience. But let’s be real that the huge x-factor is builders offering incentives.

Buyer demand will thaw out more: In 2024, we did better than 2023 and 2007. I know that’s not a huge flex, but having about 6% more closed sales in the region feels like a real win. What this means is we had over one thousand more buyers purchase homes last year. Look, the math still won’t work for many people, so don’t expect the floodgates of volume to open up in 2025, but we should get more buyers as long as rates hover around 7% instead of going higher.

Expect buyer hypersensitivity to continue: Since mortgage rates basically doubled 2.5 years ago, we’ve seen buyers become very sensitive to price, condition, and location. Sellers have been slow to understand this unfortunately, but buyers are picky about getting into contract, staying in contract, and paying the right price. This hypersensitivity stems from a lack of affordability, and it’s poised to persist in the marketplace as long as long as affordability remains a struggle. Sellers, did you hear that? My advice? Be like builders and listen to buyers, price it right, and offer concessions if needed.

Gen Z is rising: It seems like older narratives about Millennials are starting to be repackaged for Gen Z. The idea for years was Millennials would never buy homes because they were more focused on avocado toast, but here we are seeing Millennials as the largest group of buyers in the United States. Part of me wonders what the “avocado toast” for Gen Z is going to be though. Maybe Chipotle? Haha. Anyway, Gen Z will eventually be the top buyer group despite the ideas people are spinning about the generation. On a related note, don’t sleep on Gen Z real estate professionals. They are hungry to learn, and they aren’t coming to the market with baggage since they don’t know what normal supply or volume looks like. It’s honestly refreshing.

Obsession with gray is dead: I like that we’re seeing more color out there in real estate instead of being stuck in a drab world of only gray. This year Pantone’s color of the year is called Mocha Mousse. I’m not saying brown is going to show up everywhere, or that we don’t see gray any longer (we do), but I’m down with more color, and I think we’re past those years of an intoxication of gray everything. What are you seeing right now from designers and in new construction?

Obsession with gray is dead: I like that we’re seeing more color out there in real estate instead of being stuck in a drab world of only gray. This year Pantone’s color of the year is called Mocha Mousse. I’m not saying brown is going to show up everywhere, or that we don’t see gray any longer (we do), but I’m down with more color, and I think we’re past those years of an intoxication of gray everything. What are you seeing right now from designers and in new construction?

Insurance will continue to be a problem: It’s hard to imagine insurance issues being solved this year, so I would say to buckle up and expect for these problems to persist, whether we’re looking at FAIR plan policies or condos / HOAs facing higher association insurance.

No price crash in 2025 & rates are the x-factor: The truth is sellers came back to the market more than buyers last year in Sacramento, and we’ve been seeing flat prices lately. While prices overall are up from one year ago (as seen below), there is no mistaking a flattening happening. When pulling market stats and doing appraisals, I’m noticing very modest growth at best in many neighborhoods. In short, I expect to see a spring seasonal market ahead like usual, but if we continue to see listings grow more than sales over the course of the year, I would expect for flat prices at best or to see a dip. Ultimately, the feel of the market will likely come down to what happens with rates. If rates did actually reach 6% like some people are predicting, that could promote modest price growth. But if rates remain at 7% or go higher, that’s where we could likely see more seller growth instead of buyers, which would help soften the market. Some people are saying it’ll be a price crash in 2025, but that’s clickbait rhetoric because we don’t have a supply imbalance to see a 2007-level event. Check out these visuals.

Not all parts of the market will be the same: Volume at the highest prices has been vibrant, and that’s poised to continue as buyers at the top of the market are less sensitive to what is happening with mortgage rates. The 55+ community in Placer County has been glowing to say the least as both Sun City neighborhoods have had very normal volume (which is basically unheard of locally). But the hottest property in the market has been (and will be) the home that is priced well and checks all the boxes of what buyers are looking for. Expect multiple offers on that property. In contrast, the condo market is poised to struggle as HOA fees have been rising and associations are getting hit with larger insurance bills. I’ve noticed downward price pressure in some condo/HOA communities, and I expect that to be an issue in 2025.

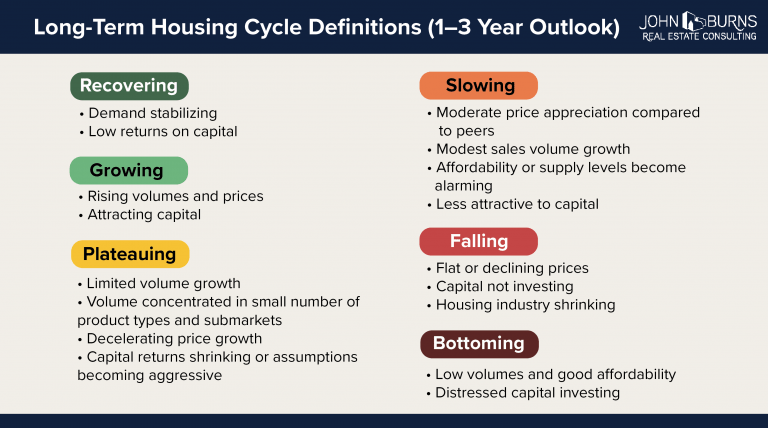

Not all states will be the same: We’re hearing about declining prices in portions of the Sunbelt, while there has been more strength in the Northeast and West. In short, the housing market temperature won’t be the same everywhere. That’s always true of course, and it’s why I tend to be less interested in “national” home prices and inventory levels.

It’s going to be challenging to pull comps in 2025: One of the biggest struggles since mid-2022 has been pulling comps. In 2024, the regional market was missing about 34% of the normal number of closed sales, and that essentially means there were 34% fewer comps to select. Basically, as long as volume remains low, it’s going to continue to be more challenging to pull comps since there isn’t much data. My advice? Give strong weight to actives, pendings, and recent sales, but don’t be afraid to look at much older sales if needed as well as competitive neighborhoods.

More appraisal waivers coming your way: Based on information from FHFA, we are poised to see more appraisal waivers and more hybrid appraisals where someone else does the inspection (and then the inspection is sent to an appraiser to do the “value part” so to speak). For my agent fiends, ask for the person’s business card because the person you meet at a property may not be an appraiser. I know I sound biased, but I’m not convinced this is a great move for the health of the housing market as we are starting to get some declining markets in portions of the country. I’m not personally a fan of the hybrid product either.

A quick note to appraisers: For my appraiser colleagues, buckle up. I’m an optimist in life, but I’m not optimistic about robust lender work – especially if rates remain high and refinances stay dead. My advice? Focus on private work also. There isn’t any quick method to obtaining private work, but take the marathon approach of building relationships in your community (and with the real estate community especially). Send me an email if you want to watch a one-hour private work webinar I did last year (free). Nothing but love for my colleagues. I feel like I haven’t been on the forums as much this past year because my head has been down. I’ve been very focused on work and life. I’m still here though.

Economic carnage will show up in more escrows: It’s no secret that consumers have been getting into credit card debt, auto delinquencies have been rising, and people are really feeling the pain of inflation. In short, expect for some owners to need to sell to deal with financial carnage. It’s important to recognize so many property owners have options though beyond letting their homes go into foreclosure since equity can solve their financial problems right now.

Realizing we’re in this for longer: Buyers and sellers sitting out of the market is not a temporary thing for just a year or two. This is going to be a longer process, and 2025 is likely going to reinforce that (even though we hope to get more activity than last year). For now, we are in a season where supply is poised to be subdued until there is more affordability or a mechanism to cause owners to sell.

Practical advice for real estate friends: Okay, a few quick things on my mind for my real estate friends.

- Don’t wait for low mortgage rates to save your business.

- Focus on building a bigger network.

- Find ways to cultivate joy in life because it’s been missing in action in the real estate profession lately.

- Come to my blog mixer party on January 22nd.

- Build deep relationships. That’s what this business is about.

- Run toward the challenge of the market. Don’t get stuck or paralyzed in fear.

- Keep hanging on because volume has improved a bit.

- Think about how you can diversify into portions of the market that are doing better than others. On that note, study neighborhoods and price ranges so you know which portions of the market are doing better and worse.

- Don’t lose credibility by promising the future. Nothing with sharing ideas, but we just don’t want to promise something we cannot control.

- Stay committed to pushing out regular content that focuses on answering questions consumers have.

- Who is buying and selling? Find those people this year.

- Study the local market and cultivate local expertise. Interact with local data more than ever because you’ll get clues for how to talk about the market and where to focus business. Local data can be super interesting to consumers also.

- The good news is there isn’t just one way to do this.

- Be yourself. You don’t have to do things like anyone else.

Taking mental health seriously: I want to end on this, which is something I shared the last two years in my housing outlook. I think some people this year are going to need to opt out of real estate conversations for the sake of mental health. If you’re feeling depressed after reading articles or social media housing posts, maybe it’s time to distance yourself, do some inner work, or unsubscribe (even from my blog). My advice? Take your mental health seriously by cultivating contentment regardless of what the housing market is doing. If you’re only happy if the market is up too, that’s something to figure out. I find it’s hard to stay grounded in today’s world with so much sensationalism and such a lopsided focus on what the future holds. The wild part is mostly everyone is wrong about their predictions, so there is so much worry wasted on stuff that often doesn’t even pan out. The sobering part is people are losing joy today because of what the future may or may not bring. Moreover, if you’re listening to voices promoting real estate doom, maybe it’s time to step back and assess the credibility and intent of that message. If it’s one thing after another that’s going to potentially crash the market, maybe there is an agenda and you are the target. Friends, let’s keep our eyes and minds open, but please be intentional about taking care of yourself. Nobody else can do that for you.

Thanks for being here.

Questions: What do you think is going to happen this year? What stood out to you most above? And hey, are you coming to my blog party? I hope so.

If you liked this post, subscribe by email (or RSS). Thanks for being here.