Is the market starting to tank? Or is it just a seasonal slowing? I’m getting asked this question all the time, so I wanted to share some thoughts. Then I have a big local market update for anyone interested.

How would you know if the market was sliding? I wish this was a 10-second answer, but it’s a big conversation, so let’s unpack some thoughts.

1) Change in inventory: It’s normal for housing inventory to increase as a market begins to cool for the season, but when a market starts to make a big turn we’d likely notice new listings aren’t being absorbed and the number of listings keeps growing beyond a normal pace.

2) Change in sales volume: Sales volume usually slows down as the market cools, but during a big shift we’d expect to see a more substantial change in sales volume over time. I’m talking about a market where buyers put on the brakes and properties stop selling. Currently in many areas throughout the country we’re seeing some smaller changes in sales volume. Could it be the start of something? Sure. But in my mind we need more time to see if this is a consistent pattern or just a slower end of the year.

3) Word on the street: What are people saying? How does the market feel in the trenches? We can learn so much when talking with informed local buyers, sellers, agents, appraisers, and other real estate professionals. Ask things like, “What are you seeing out there?”, or “What’s the market doing?” This is important because before we see a change in stats we’ll hear of change in the trenches. As an FYI, here’s a Twitter poll from a few days ago.

4) Less pendings: When a market starts to slide we can expect to see less pending sales, which is a big sign of waning demand. Let’s just remember though around this time of year we usually see fewer pendings as the market cools. This means we have to be cautious about saying the market is crashing just because pendings soften. My advice? Look for abnormal changes beyond a regular seasonal dip in pending sales.

5) Price changes aren’t the big issue: When a market shifts directions we often look to prices to tell us if things are changing, but it takes time for prices to catch up with the trend. For example, in Sacramento in 2005 we saw housing inventory triple and sales volume drop 43% in one year. Yikes! Those are insane stats, but price changes weren’t all that dramatic during this time period.

6) Other metrics: Lots of experts say to watch the number of new homes built as an indicator of the market changing. That’s huge. Others say it’s the GDP or economy, easy credit, housing affordability index, or flux capacitor sales (kidding on that one). There are definitely important indicators out there, and we should tune in, but for a local market I might suggest paying the most attention to inventory, sales volume, and the word on the street. If new construction is booming in your market though, definitely watch that too.

7) A closing dating analogy: Just like a dating relationship needs time to figure out what it’s going to be become, the same thing happens in real estate. Right now in many areas of the country we’re seeing inventory increase and sales volume starting to slump. At the least these are signs of a slowing market for the season, but it also makes us wonder if it’s something more. What does it really mean? Where will things go? The truth is we don’t fully know yet because the future hasn’t happened and we need more time to see how things unfold. I realize that’s frustrating to hear, but it’s honest.

CLOSING TIPS:

1) Crystal balls: If you don’t have a crystal ball that works, be careful about making very specific real estate predictions.

2) Watch local data closely: More than ever it’s critical to watch local data. Lots of articles are talking about “national” trends, but what’s happening locally?

3) Don’t just regurgitate headlines: It’s easy to read headlines and let the titles become our talking points. Be careful of that since headlines are designed to get clicks and they may or may not reflect the market.

4) Know the season: It’s not always easy to understand what a market is doing at this time of year when things usually slow down. My advice? Understand normal seasonal trends by studying past years. What does the market normally do at this time of year? This will help us spot normal vs abnormal trends.

I hope that was helpful.

—–——– Big local monthly market update (long on purpose) —–——–

The market has been slowing for the past few months in Sacramento. We’re seeing what we’d expect to see at this time of the year like softer prices, more price reductions, a lower sales-to-list price ratio, and it’s taking longer to sell. We’ve had a hefty uptick in housing inventory though, and that’s something to watch – especially if it continues over time (that would be a problem). But for context, housing inventory is actually still historically low, so it’s not like we have a crazy high level right now. Some have wondered if the market is a bit stalled right now, but sales volume is still looking pretty strong and so are pendings. But I’d say there is some shock in the market because of the rise in inventory. Keep in mind one of the problems is so many sellers are overpricing, and that only makes inventory increase because these properties end up sitting instead of selling. On the other hand homes that are priced well are moving quickly, and 48% of all sales in the region last month had more than one offer. So despite a slowing narrative, the market isn’t painfully dull either.

The market has been slowing for the past few months in Sacramento. We’re seeing what we’d expect to see at this time of the year like softer prices, more price reductions, a lower sales-to-list price ratio, and it’s taking longer to sell. We’ve had a hefty uptick in housing inventory though, and that’s something to watch – especially if it continues over time (that would be a problem). But for context, housing inventory is actually still historically low, so it’s not like we have a crazy high level right now. Some have wondered if the market is a bit stalled right now, but sales volume is still looking pretty strong and so are pendings. But I’d say there is some shock in the market because of the rise in inventory. Keep in mind one of the problems is so many sellers are overpricing, and that only makes inventory increase because these properties end up sitting instead of selling. On the other hand homes that are priced well are moving quickly, and 48% of all sales in the region last month had more than one offer. So despite a slowing narrative, the market isn’t painfully dull either.

I could write more, but let’s get visual instead.

DOWNLOAD 64 graphs HERE: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

JULY 2017 vs JULY 2018: So how did this past month do? One of the ways we find the answer is to compare last month with the same month in 2017.

JUNE 2018 vs JULY 2018 (NEW CHARTS): The problem is if we only look at July this year versus July last year, we’ll miss what the market is doing right now. So that’s why I have new charts to show the previous month vs the most recent month. But there’s still an issue because if we only look at this chart and don’t understand that the market normally softens around this time of year, we might walk away with the idea that the market is utterly tanking when it’s normal to see inventory increase, sales volume decline, etc… Look at graphs below to help see seasonal changes (or check out this older YouTube video where I talk about seeing the seasonal market).

SALES VOLUME: One of the things we need to watch is sales volume because if we start to see a trend of slumping sales, it could be a sign the market is in trouble. The truth is we’ve technically had a couple of months in a row of lower sales volume in the region. But volume was only off by 4% in June and it was barely off at all this past month (which is why I said “technically”). When you really look at it, sales volume this year in 2018 so far has been stronger than last year. But when we look at the past 12 months as a whole it’s clear volume is down (still only slightly though). Ultimately volume is not crashing right now based on the stats, so let’s be careful about saying it is.

NOTE on Trendgraphix: I have some thoughts on the way Trendgraphix is pulling stats. This month their stats show sales volume in Sacramento County is down by 6%, but that’s not accurate. I can explain why if anyone wants to know. And I love Trendgraphix. What an incredible resource. I just find when we’re looking at the market carefully in a time like this, it’s critical to know how the numbers work.

2005 vs CURRENT: In case you wanted to compare current price metrics with 2005, here you go. A couple of months ago I talked about peak prices because some metrics were showing 2005 levels. But with the market softening right now we’ll expect over the fall season to see current prices grow further apart from the “top” so to speak.

SACRAMENTO COUNTY (more graphs here):

SACRAMENTO REGION (more graphs here):

PLACER COUNTY (more graphs here):

I hope that was helpful.

DOWNLOAD 64 graphs HERE: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

Questions: What would you look for to know the market was turning? What are you seeing out there right now? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

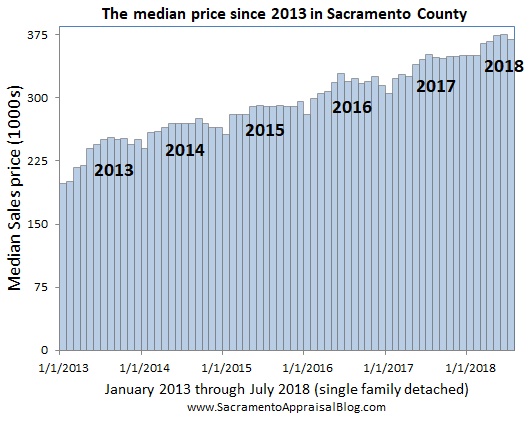

Glowing and slowing. That’s a good way to sum up the market. The stats are generally glowing, but we’re starting to see subtle signs of a seasonal slowing. Price stats in Sacramento County increased by about 1% last month and they’re up 8-10% from last year (that doesn’t mean actual values are up that much in every neighborhood and price range). Though if we look closely, especially in the region as a whole, prices dipped by 1% last month, inventory is up slightly, and sales volume sloughed off last month (which isn’t a surprise). Properties have been selling very quickly still in only 9 median days in Sacramento County and 11 in the region. For perspective, on average it was taking about a week longer to sell a home last year. The market actually tends to normally show a slowness in days on market between June and July, but we didn’t see that this year, which is a reminder the market feels a bit more aggressive right now compared to last year. Overall housing inventory increased last month, but the bigger story is it’s down about 14% in the region from last year. Despite all the glorious stats, the market is still price sensitive, which means buyers aren’t willing to pull the trigger at any price (did you hear that sellers?). Oh, and by the way, the median price in Sacramento County is now 10% from the peak in 2005. I could go on and on with words, but let me share some graphs to show the market visually.

Glowing and slowing. That’s a good way to sum up the market. The stats are generally glowing, but we’re starting to see subtle signs of a seasonal slowing. Price stats in Sacramento County increased by about 1% last month and they’re up 8-10% from last year (that doesn’t mean actual values are up that much in every neighborhood and price range). Though if we look closely, especially in the region as a whole, prices dipped by 1% last month, inventory is up slightly, and sales volume sloughed off last month (which isn’t a surprise). Properties have been selling very quickly still in only 9 median days in Sacramento County and 11 in the region. For perspective, on average it was taking about a week longer to sell a home last year. The market actually tends to normally show a slowness in days on market between June and July, but we didn’t see that this year, which is a reminder the market feels a bit more aggressive right now compared to last year. Overall housing inventory increased last month, but the bigger story is it’s down about 14% in the region from last year. Despite all the glorious stats, the market is still price sensitive, which means buyers aren’t willing to pull the trigger at any price (did you hear that sellers?). Oh, and by the way, the median price in Sacramento County is now 10% from the peak in 2005. I could go on and on with words, but let me share some graphs to show the market visually.