The market is hot. But it’s not so hot that you can command any price you want. Today I have a quick post to show a few trends. These are brand new visuals with some great takeaways (I think). Enjoy if you wish.

1) MULTIPLE OFFERS

Huge change this year: There were 39.3% more multiple offers this October compared to last year at the same time. This speaks to how much more competitive the market has been lately. While we are experiencing a slight seasonal slowing right now, the market is far more competitive than it should be for the time of year.

Not everything: Last month 32% of listings had price reductions. In short, even though the market is super aggressive it doesn’t mean everything is selling above the list price.

10-20 Offers: This year we’ve seen substantially more properties with 10-20 offers compared to last year. The highest number of offers last month was 37 too (just in case you want to sound super smart).

Here’s a look at 5-10 offers too. What a difference!!

NOTE: Our MLS has two fields called “multiple offers” and “number of offers.” This is how I’m extracting the data.

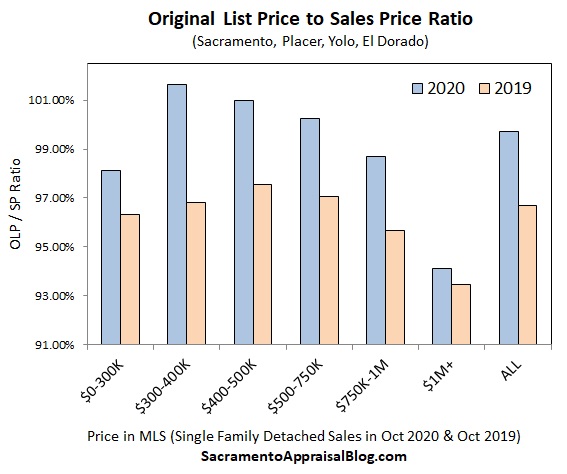

2) THE MOST AGGRESSIVE PRICE RANGES:

This is geeky stuff, but it’s so important for understanding the market isn’t the same in every price range or neighborhood.

The most aggressive: The most aggressive price range in the Sacramento region is between $300,000 to $400,000 (not a shocker). The sales price to original list price ratio is 101.65%, which basically means properties in this range sold on average 1.65% above the original price. In short, the lower the price, the more aggressive the market is. Keep in mind there are few sales below $300,000, so don’t write home over that lower stat.

The most overpriced range: This year we’ve had explosive growth with the number of million dollar sales as there have literally been twice as many over the past four months compared to last year. But this price range is also the most overpriced. On average sales above one million dollars last month closed about six percent lower than their original list price. At times million dollar listings are literally priced hundreds of thousands of dollars too high (or even millions).

And one more visual to show last year vs this year…

Market update: In this market update video I talk quickly through eleven trends. I hope you walk away with some insight. Enjoy if you wish.

Free webinar next week: I’m doing a big market update next week for SAFE Credit Union on November 19th from 9-10am PST. It’s free to anyone and it’ll hopefully be some good background noise while working. Register here.

Free webinar next week: I’m doing a big market update next week for SAFE Credit Union on November 19th from 9-10am PST. It’s free to anyone and it’ll hopefully be some good background noise while working. Register here.

QUICK CLOSING ADVICE:

1) Price reasonably and you should be able to get at least a few offers.

2) Price too high and you’ll likely get zero offers (seriously).

3) Sellers, you don’t need to aim to get twenty offers. I suggest aiming for a few solid offers. My stats even show you don’t need 20 offers to get the highest price.

4) Sellers, aim for the market instead of that mythical unicorn Bay Area buyer who will mysteriously overpay for some reason.

5) Buyers, study your competition in your price range and offer accordingly. There is a good chance you may need to offer above list and have cash to pay any difference between the contract price and a lower appraisal. This is not easy on buyers, but it’s the dynamic out there right now.

6) Buyers, start looking at properties that have been on the market for 30 days or more. These ones are likely overpriced and it may be easier to get into contract on something like that.

7) Other. What else?

I hope this was interesting or helpful.

Questions: What are you seeing in various price ranges? I’d love to hear your take from your vantage point in the trenches.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

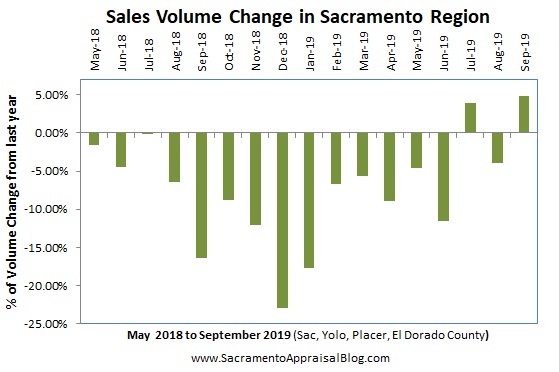

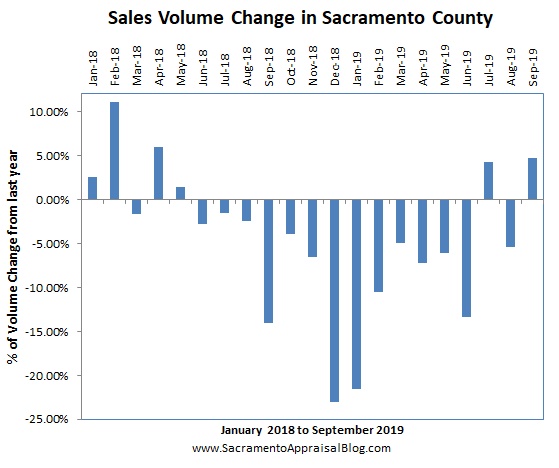

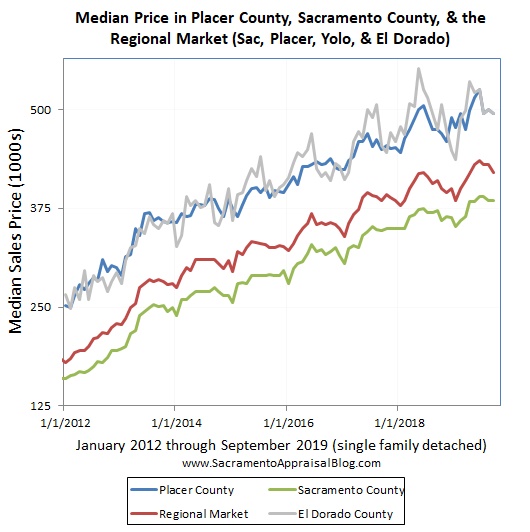

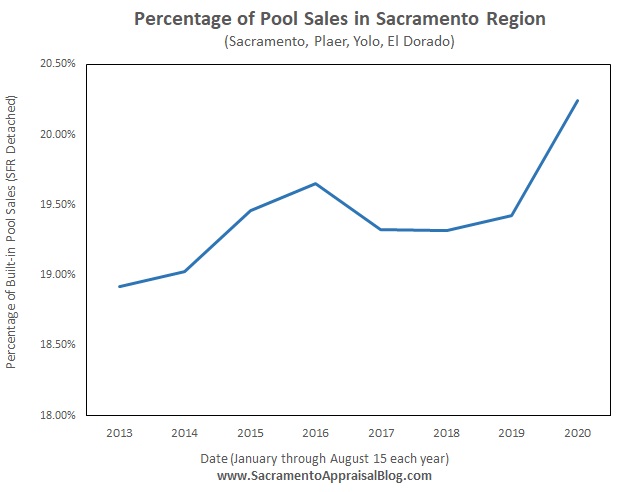

This is where it gets interesting, so bear with me. Noticeably larger homes have shown up in sales stats from June to August this year, but a big part of that comes down to buyers focusing more heavily on Placer County & El Dorado County. In fact, over the past three months compared to last year Placer County sales volume is up 16.8% and El Dorado County volume is up 31.5%. Why does this matter? If you didn’t know, monthly sales in these two counties are routinely 400+ square feet larger in size than Sacramento County (mostly due to having newer homes through the years that were built larger). This data does NOT include brand new homes currently being sold from builders – only MLS sales. Anyway, when we consider why the home size in the region has jumped so much lately, a huge reason looks to be buyers flocking to these two counties in search of more space.

This is where it gets interesting, so bear with me. Noticeably larger homes have shown up in sales stats from June to August this year, but a big part of that comes down to buyers focusing more heavily on Placer County & El Dorado County. In fact, over the past three months compared to last year Placer County sales volume is up 16.8% and El Dorado County volume is up 31.5%. Why does this matter? If you didn’t know, monthly sales in these two counties are routinely 400+ square feet larger in size than Sacramento County (mostly due to having newer homes through the years that were built larger). This data does NOT include brand new homes currently being sold from builders – only MLS sales. Anyway, when we consider why the home size in the region has jumped so much lately, a huge reason looks to be buyers flocking to these two counties in search of more space.