Was last year the most aggressive housing market we’ve ever had? I’m going to go out on a limb and say HECK YES based on the stats. But what do you think, whether you’re local or in a different market?

January public speaking gigs:

- January 12: Top Producer Panel in Granite Bay

- January 18: SAR Big Market Update (sign up here)

- January 19: PCAR WCR Big Market Update (details TBD)

- January 25: Joel Wright’s Market Event

Post outline (since this is longer):

1) Records were broken

2) Sacramento region recap

3) Sacramento County recap

4) Placer County recap

5) El Dorado County recap

6) Yolo County recap

STATS: Annual stats include the entire year (Jan to Dec). These stats are not just a comparison of Dec 2020 with Dec 2021.

1) RECORDS WERE BROKEN:

A) Fastest-moving market ever: This is no surprise to stressed buyers and a stressed real estate community, but we had the fastest-moving market ever in the region. It took an average of 17 days to get into contract, which is the lowest annual number on record. The wild part is the median days on market was only 7, which means half the market got into contract in a week or less.

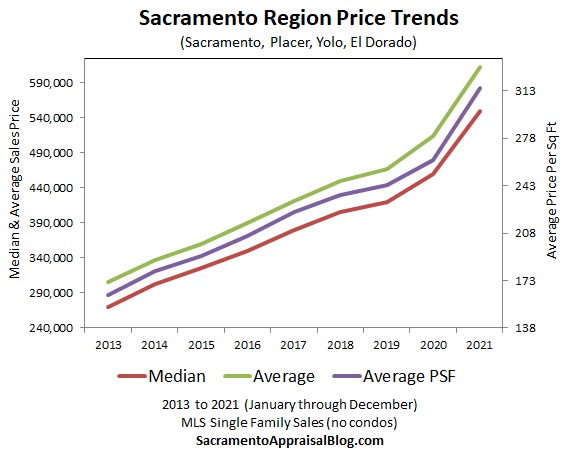

B) Highest dollar growth ever: Prices increased more than ever this year in terms of dollars. The median price increased by $90,000 and the average sales price was up about $99,000. These are both records. The stunning part is this took place in our tenth year of price growth in this cycle.

What about percentage growth? Percentage growth was NOT a record even though price metrics were up about 20%. The truth is we’ve seen this type of percentage growth before, though when prices were lower it was so much easier to see higher percentages. This is why noting the dollar amount is so important. All that said, let’s remember part of the glowing numbers here has to do with more sales at higher prices (which pads the stats).

C) 18 months of less than one month of supply: Since July 2020 we’ve had less than one month of housing supply in the Sacramento region. There has never been a stretch this long. It wasn’t even this bad during 2013 when investment funds were gutting the market. Having one month of inventory means if no other listings came to the market we would only have enough for one month’s worth of buyers.

D) Highest percentage of multiple offers ever: In April we reached the highest percentage of multiple offers we’ve seen in the region at 76%. It’s easy to say 100% of sales are getting bid up with multiple offers, but that’s not true. Check out how disconnected a figure like 76% is from normal though. The real shocker though is 57% of sales in DECEMBER had multiple offers, which is higher than any other SPRING market besides 2021. Read that again. By the way, this stat has only been available for five years (though it’s likely April 2021 was the highest ever still). We can debate in the comments or cage fight if needed.

E) One year of paying at or above the list price: Every month this year buyers paid at or above the list price. I know, this sounds a bit dull or obvious, but it’s truly sensational. Take a look at the image to show how far off the orange line (2021) is from the rest of the pack. In a competitive year we might see a few months where buyers on average pay at or above the list price, but last year this happened ALL YEAR LONG. Even in December buyers on average paid right at the list price. In a normal year we should’ve seen 3% or more below the list price in December. Keep in mind we did see seasonal slowing for the second half of the year, but it didn’t feel like slowing to many since the market basically “slowed” to a really elevated level.

NOTE: This is the average. There are many examples of buyers paying well above the asking price and even 15% of buyers last month paid below.

F) More million dollar sales than ever: This past year 7% of sales were above one million dollars and that’s the highest percentage on record. Well, I should say this is the highest percentage without adjusting for inflation, so there is an asterisk here. If someone wants to adjust for inflation, please do so. Also, there were twice as many million dollar sales compared to 2020.

CONCLUSION: In short, the stats are insane. Can you see why I’m saying it was our most aggressive year ever? You don’t need to agree with me, but if you disagree, I’d love to hear why. Also, I don’t have stats for 1853 during the Gold Rush, so I’m really just talking about recent history.

Any thoughts?

——————— huge market recap below ———————

THE SHORT VERSION:

THE SHORT VERSION:

The market in 2021? Prices went way up, housing supply was anemic, volume was slightly higher in most counties compared to the previous year, and properties sold as fast as they ever have. Most of the year the market really felt like an auction due to supply and demand being so lopsided. We have a supply problem with sparse listings and we have a demand problem fueld in large part by mortgage rates around 3%. When looking at the past two years it’s apparent the market sped up again after years of slower growth. Ultimately while the stats are glowing, how many think having another year or two of growth like seems sustainable? I’m guessing few hands went up since affordability has been declining and mortgage rates are presumably going to rise. Anyway, enjoy an offensive amount of visuals and feel free to share some images too.

Thanks for reading my sharing policy so we’re on the same page.

THE LONGER VERSION:

I’ve outlined lots of recap stats below by county and I hope you find these useful. Keep in mind these are ANNUAL visuals that compare a year’s worth of sales to the previous year. This is why some of the visuals don’t have a normal up and down rhythm during the spring and fall. What do you see though? What stands out to you?

2) SACRAMENTO REGION (Sac, Placer, Yolo, El Dorado)

3) SACRAMENTO COUNTY:

4) PLACER COUNTY:

5) EL DORADO COUNTY:

6) YOLO COUNTY:

Thanks for being here.

SHARING POLICY: I welcome you to share some of these images on your social channels or in a newsletter. In case it helps, here are 6 ways to share my content (not copy verbatim). Thanks.

Questions: What stands out to you the most above? What are you seeing out there in the market?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

The market is often dull during the fall, but that’s not the case this year. I mean, we’re definitely seeing slightly lower prices, it’s taking longer to sell, and sales volume is sloughing, so clearly the signs of a slower market are here. Yet this fall season isn’t really incredibly slow or painfully dull either.

The market is often dull during the fall, but that’s not the case this year. I mean, we’re definitely seeing slightly lower prices, it’s taking longer to sell, and sales volume is sloughing, so clearly the signs of a slower market are here. Yet this fall season isn’t really incredibly slow or painfully dull either.

The market has continued to soften, though it’s not really all that soft. Inventory is up, price reductions have increased, sales volume has been dropping, it took three days longer to sell last month in the region, and price metrics are down about 1% from the height of summer. Overall the market is clearly slowing down for the season, though it’s not painfully dull like it was in 2013 or 2014 during the fall. This is a key to understand because when saying values are “softening” some interpret that to mean the market is really slow or crashing. But that’s not what I’m saying.

The market has continued to soften, though it’s not really all that soft. Inventory is up, price reductions have increased, sales volume has been dropping, it took three days longer to sell last month in the region, and price metrics are down about 1% from the height of summer. Overall the market is clearly slowing down for the season, though it’s not painfully dull like it was in 2013 or 2014 during the fall. This is a key to understand because when saying values are “softening” some interpret that to mean the market is really slow or crashing. But that’s not what I’m saying.