Are buyers finally gaining more power? Yes. The truth is the market is still ultra-competitive, but there is a slightly better chance buyers can get into contract these days and maybe not pay as much above the asking price (maybe).

Big (Free) market update: On September 23rd from 11am-12pm I’m giving a market update for CornerStone Title Company. This is for the real estate community only. Sign up here.

Teaching my favorite class: On September 28th from 9am-12pm I’m teaching my favorite class at SAR called How to Think Like an Appraiser. It’s three hours, which sounds painful, but I love this one because we have space to dig deep into comp selection and adjustments. Sign up here.

BRAND NEW VISUAL:

I’m excited about this visual because it focuses on a dollar amount. I could be wrong, but I don’t think anyone has published this in my area.

FOUR TAKEAWAYS:

1) Freakishly high: Over the past few years buyers on average were NOT paying above the original list price, but that changed this year. In fact, in June buyers paid $25,000+ over the original list price in the region. I know that almost seems low because we’ve been hearing stories about properties selling $200K over asking, but this is the average and it represents over 2,800 sales.

2) An average of $11,211: Last month buyers on average paid $11,211 above the original asking price in the Sacramento region.

3) Fall prediction: In a normal year buyers pay less during the fall and it looks like that’s what we’re heading toward since two months in a row we’ve seen a softening from the height of the seasonal market in June. Ultimately unless something unexpected happens to reverse the seasonal slowing we’re experiencing, we should continue to see buyers on average pay less above the asking price over the next few months. This doesn’t mean it’s not competitive though (see #4).

4) Still not normal: The good news for buyers is the market is slowing for the season, but the harsh news is the trend is still more aggressive than it should be for the time of year. So it’s like the car was going 130 mph and now it’s going 90 mph. It’s still speeding. For instance, buyers paid above the original list price in August even though that’s not common (see above). As I keep saying, the market is showing seasonal slowing, but that doesn’t mean the market is slow. In short, buyers ought to enjoy having just a little more power in today’s marketplace, but it’s important to realize the market is still tilted toward sellers.

MORE VISUALS:

I hope this was helpful. Thanks for being here.

Questions: What are you seeing out there with buyers and sellers? What advice would you give for pricing a property right now?

If you liked this post, subscribe by email (or RSS). Thanks for being here.

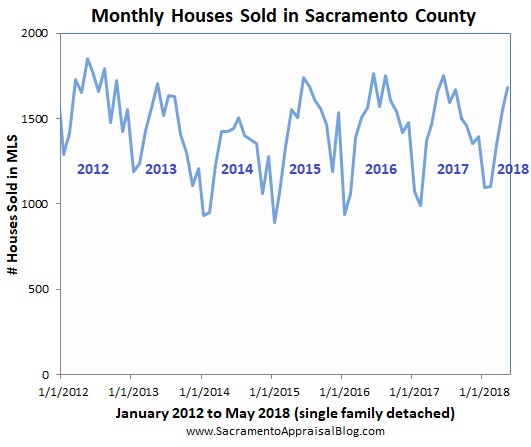

2) SACRAMENTO COUNTY:

2) SACRAMENTO COUNTY:

Normal seasonal slowing: Right now the market is slowing, and some are saying, “It’s starting to turn. Pop. The Bubble is happening!!!” Here’s the thing though. Markets tend to have a seasonal cycle where things are hot and then they cool off. When the market begins to

Normal seasonal slowing: Right now the market is slowing, and some are saying, “It’s starting to turn. Pop. The Bubble is happening!!!” Here’s the thing though. Markets tend to have a seasonal cycle where things are hot and then they cool off. When the market begins to

We saw what we would expect to see last month. It felt like a normal May. Well, actually it was the strongest May of sales volume since 2013. Prices ticked up again, it took three less days to sell, and inventory remained sparse. Overall the stats are glowing, but it’s important to recognize the market is starting to slow for the season. We are seeing way more listings hitting the market, and this is transferring some power from sellers to buyers. We are also seeing more price reductions. In a few months we will likely see this slowness in the stats, but for now check out some glowing numbers below.

We saw what we would expect to see last month. It felt like a normal May. Well, actually it was the strongest May of sales volume since 2013. Prices ticked up again, it took three less days to sell, and inventory remained sparse. Overall the stats are glowing, but it’s important to recognize the market is starting to slow for the season. We are seeing way more listings hitting the market, and this is transferring some power from sellers to buyers. We are also seeing more price reductions. In a few months we will likely see this slowness in the stats, but for now check out some glowing numbers below.

We’re at that time of year. Sales volume has likely peaked for the season. The median price probably climaxed in the summer. Housing inventory is increasing, and each month it’s taking longer to sell in Sacramento. Overall the market has a slower feel compared to a few months ago, values have begun to soften in many areas, and even rents have been flat for a few months according to

We’re at that time of year. Sales volume has likely peaked for the season. The median price probably climaxed in the summer. Housing inventory is increasing, and each month it’s taking longer to sell in Sacramento. Overall the market has a slower feel compared to a few months ago, values have begun to soften in many areas, and even rents have been flat for a few months according to