On paper it looked like value was going to be so much higher. Why? Because comps to the north were easily 10-20% higher, and even Zillow came in $100,000 above the appraisal (ahem). The big cause of such a legitimately lower appraisal boiled down to one thing. Location. Today I want to show a situation where a small section of the neighborhood was blocked off from the rest, and it was a big deal for value. Have a look below and let me know what you think. Anything to add?

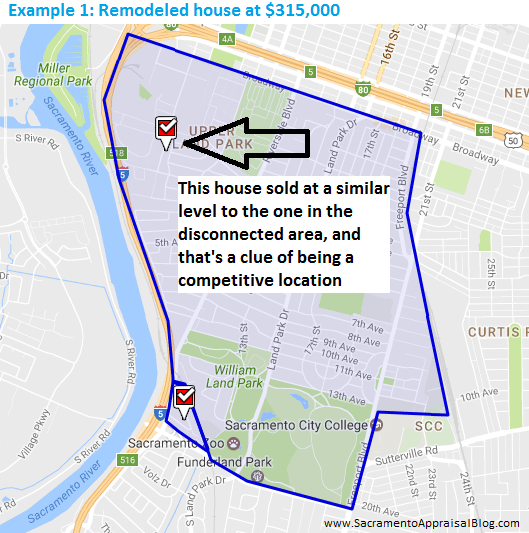

The value issue: As you can see, this pocket of housing in the Land Park neighborhood isn’t accessible from the rest of the neighborhood besides a frontage road next to I-5. In other words, this section is disconnected. What sort of impact is there (if any) for being cut off from the rest of the neighborhood?

Methodology when only 5 sales in 5 years: When appraising something in this section, there were zero sales over the past 2 years and otherwise only 5 sales in the previous 5 years. This means I had to really study older sales to understand how value works. Here are the five sales:

What I ended up doing was comparing sales in this small pocket with similar sales at the same time in other areas of Land Park. Also, my goal was to find other patches of housing in the expanded neighborhood that seemed to sell at the same level. If I could find other areas selling at similar price points through the years, then current sales in those areas are probably my best comps for today.

Conclusions: After looking through all five sales I observed the following:

1) Some of the lowest prices: This small housing patch has some of the lowest prices in the neighborhood as shown with the yellow dots in the graph below.

2) 10-20%+ easily: If I were to cherry pick “comps” directly to the north, there is easily a 10-20%+ price difference for otherwise similar houses. The truth? Location matters. So does being connected to the rest of the neighborhood. In some cases a few streets that are disconnected might not sell differently than the rest of the market, but it could also be a big deal like the example above. The truth is if we cherry-picked nearby higher sales, the value would’ve been inflated by $60-80K+.

3) Limited by 90 days: It’s tempting to only look at the past 90 days of sales, but that can be far too limiting – especially in a situation like this. Also, a 5-minute comp check isn’t realistic. At times we might spend hours researching before beginning to understand how the immediate neighborhood compares to the rest of the market. We might even call colleagues and seek out other opinions too.

4) True comps: Other patches of housing in Land Park that tended to command similar prices were very busy streets or homes having a huge influence from nearby commercial properties (or heavy fixers that would have otherwise sold at much higher levels in average condition). I don’t say this to be negative about any of Land Park, but only to be objective as an appraiser trying to explain how value works in some areas compared to others.

I hope that was helpful.

Two classes I’m teaching in May: By the way, I’m teaching a class at SAR in a few weeks called How to Think Like an Appraiser. I’m also doing a blogging class. Click here for details.

Questions: What point above stands out to you most? Anything else to add? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.