Travis Kelce, Taylor Swift, and mortgage rates. So much drama this week. Let’s talk about it. Today I have some thoughts about believing the Fed, Chuck Norris, and building a bigger network. This post is all over the place, but hopefully something resonates.

UPCOMING (PUBLIC) SPEAKING GIGS:

9/28/23 Yuba City Big Market Update (in Yuba City (register here))

10/4/23 KW Sac Metro Big Market Update (register here)

10/6/23 How to Think Like an Appraiser at SAR (register here)

10/27/23 AI Fall Conference (San Francisco) (register here)

11/30/23 Safe CU “Preparing for a Successful New Year”

BELIEVE THE FED ABOUT HIGHER FOR LONGER

This isn’t my meme, but I think it’s perfect when talking about the Fed Funds rate (I don’t remember where I saved it from). Look, nobody knows what will happen with rates exactly, but the Fed has been saying higher for longer, so I recommend believing the Fed. My advice? If you work in real estate, plan on low volume, low supply, and higher rates unless something changes the trajectory of the trend. I like the idea of being realistic by planning for the worst and rejoicing if something else happens. The MBA has an optimistic outlook that the 30-year fixed rate will be 6.3% in Q4 2023, and that’s the rosiest projection I’ve seen. Look, I don’t predict rates because almost nobody gets it right, but like body weight, it’s been much easier to go up instead of down, so I’m not quick to embrace this projection. Time will tell.

THE MARKET WILL FIGURE IT OUT

No matter what rates do in coming months, the truth is the market will figure it out. That’s what markets do. Sellers, if buyers continue to lose purchasing power though, it’s time to be quick to listen and adjust accordingly. Purchase applications have been at 1995 levels lately. If you don’t remember 1995, that’s when movies like Toy Story, Braveheart, Billy Madison, and Clueless were out. Sellers, there is a smaller pool of buyers out there, lower the price if you’re not getting offers, and be open to giving buyers concessions if needed. And remember, Chuck Norris eats 8% rates for breakfast, but ordinary buyers aren’t Chuck Norris.

Okay, a few other things on my mind.

IT’S EASY BEING AN EXPERT DURING GOOD TIMES

I’ve been thinking about expertise quite a bit lately. When a market is good, it’s easy to feel like an expert, but real expertise shows up most when things aren’t so good. Know what I’m saying?

STAYING AFLOAT

Scroll to the bottom for some thoughts on building a bigger network and staying afloat in today’s market.

MOVING FAST IF PRICED RIGHT

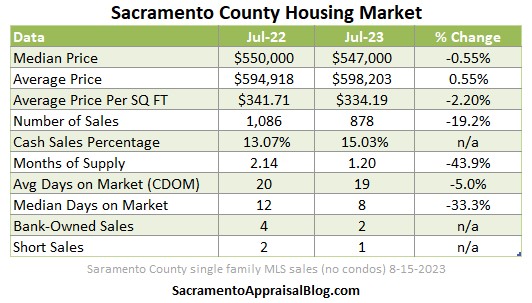

With so much talk about the housing market slowing, I think it’s important to recognize things have still been moving historically fast in Sacramento at least. It’s just not a 2021 speed. Keep in mind if rates start to spike, we could see a sharp change in days on market and lots of metrics. Remember, we see change first in active listings, mortgage applications, and the sentiment in the trenches of real estate. If we wait for closed sales before spotting a trend, we’re going to be way behind the market.

ALL SHIPS RISE AND FALL WITH THE TIDE

HOLY BATMAN, LOOK AT SAN FRANCISCO

I made this visual a few days back, and it’s stunning to see how close the price trend in San Francisco used to be to California in the early 1990s, but then it pulled so far away. This just goes to show that some areas don’t have the same exact trend (even though all ships tend to rise and fall with the tide).

And some local counties with California.

Okay, other stuff on my mind.

GROW YOUR NETWORK TO STAY AFLOAT

In my talks lately I’m sharing stats of course, but I’m also talking about the importance of increasing the size of your network. This is something I work hard at personally, and every day I push out perspective on purpose in order to be a resource and build relationships with people. Anyway, in light of volume contracting so heavily this past year, it’s vital to cultivate a bigger network to sustain business since we’re in a market with less movement.

Some questions to brainstorm:

– How do you plan to increase the size of your network this year?

– Who do you need to get to know?

– Who are the gatekeepers to the types of work you want to do?

– Who do you need to get in front of this week?

– How do you need to diversify?

– What do people need from you right now?

– How are you going to build good relationships and show up for people in today’s market?

APPRAISER COLLEAGUES

I know it’s been tough on many appraisers lately, and there is no sugarcoating that. I only do private work, so if you ever have questions, please reach out. Earlier this year, I did a free webinar thingy on Zoom to talk about private work, and I’d be open to that again if there is demand. I just can’t pull that off this month, but November could work. I’m starting to get the itch to bring some colleagues together, so let me know if you’d be interested.

Thanks for being here. I hope this was helpful.

Questions: What do you think of Taylor and Travis? Or what about anything I talked about in the post? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.