Not sensational, but fairly normal. That’s a great way to describe last year’s real estate market in Sacramento. There was a nominal uptick in value during the first part of the year, but otherwise values were very flat. Let’s take a look at the year as a whole below and delve into some December trends too.

Two ways to read this post:

- Scan the talking points and graphs quickly.

- Grab a cup of coffee and spend a few minutes digesting what is here.

Email me for the graphs: If you would like all the graphs in this post (and many more), send me an email. You can use these in your newsletter, some on your blog, and some in other social spaces. See my sharing policy for ways to share.

Sacramento County Year-End Stats:

1) Median Price ended at $265,000

2) Average Sales Price ended at $293,646

3) Average Price per sq ft ended at $170

4) Sales volume was down 7.7% in 2014 compared to 2013.

5) FHA sales increased by 11.3% from 2013.

6) There were 38% less cash sales this year.

7) Short sale volume was down 64% from 2013 level.

8) Bank-owned sale volume was down 18.9% from 2013.

1) Values increased only a few percent over the year:

How much did values rise last year? The median price increased 6% from December 2013 to December 2014, the average price per sq ft increased by 3.5%, and the average sales price increased by 4.5%. It’s easy to look at the median price at 6% and think, “Sweet. Values increased by 6%”, but an increase in median price at 6% doesn’t necessarily translate into an actual 6% boost in value to every property. When we look at other metrics such as price per sq ft and average sales price, those metrics are even lower than 6%. All things considered, the actual increase in value was modest at probably 3-4% at best.

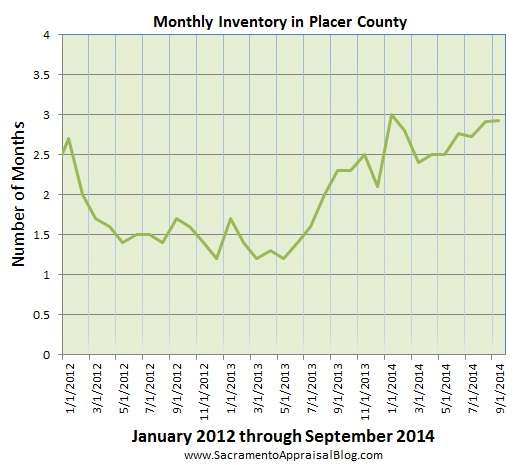

2) Inventory increased this year (declined in December):

Housing inventory was flirting with 2 to 2.5 months for much of the year. This means there were generally 2 to 2.5 months worth of houses for sale at any given moment. The peak was 2.75 months in November, and the low was last month at 1.79 months. Remember, inventory almost always declines during December, so don’t make too much of the low number (it doesn’t mean buyers flooded the market).

During November and December people tend to be thinking of turkey and gifts instead of real estate, so it’s not a huge surprise to see sparse inventory. Moreover, it’s natural to see a lower inventory right now since many owners do not want to list their properties until February or March when the market begins to heat up. As January unfolds though, listings are slowly starting to come back on the market. As you can see, inventory is not the same at every price level, and it was very low in December other than above the $1M range.

3) Sales volume was down 7.7% in 2014 compared to last year:

Sales volume was down by 7.7% this year, which translated to 1,310 less sales on MLS this year compared to 2013. As you can see by the graphs above and below, volume this year was much lower than previous years. There were more sales in December than November, but that’s not a surprise since November had a sluggish sales volume (and December often has more sales than November, but technically many of these sales got into contract in November).

4) FHA purchase volume increased by 11% this year:

FHA has been making a big come-back in the market. Why? There are less cash investors, and FHA has been one of the strongest options for many buyers trying to purchase with little money down. This year FHA sales represented about 24% of all sales, whereas last year FHA was just under 20% of the market. Remember that FHA used to represent over 30% of the market from 2009 to 2012, so there is room for continued FHA growth. This year there are bound to be some more competitive conventional products hit the market, and the 90-day flipping rule will thwart some FHA buyers, but otherwise FHA should still be a relevant force to reckon with in housing in 2015.

5) The Fall showed a normal real estate seasonal cycle:

It’s easy to get alarmed when prices soften during the Fall, but that’s normal. There are simply fewer sales, and inventory tends to be a bit higher too.

6) There were 38% less cash sales this year:

Having 38% less cash sales in 2014 made the market feel a whole lot different than 2013. This dynamic really cooled off values and brought about a more “normal” feel. In 2012 and 2013 there was an extraordinarily high level of cash investors playing the market, but without the investors this year it gave us a picture of what demand really looks like in the Sacramento market. It’s a healthy sign to see more conventional sales this year too compared to 2013.

I mentioned above that having less investors has helped FHA buyers get into contract more often, and these graphs really prove the point. The same is true with conventional and VA buyers. This past year owner occupant buyers were actually able to get into contract without having to try to outbid investors with deep pockets.

7) It’s taking 20% longer to sell a house in today’s market:

It took 50 days on average to sell a home last month in Sacramento County, which is 20% longer than it was taking one year ago (40 days in December 2013). Keep in mind it was taking easily 80-90 days at the end of 2011 and beginning of 2012, which was only three years ago. Ultimately well-priced properties are still selling very quickly and receiving multiple offers in some cases, but properties that are overpriced are sitting on the market. This is the classic example of what Jay Papasan says about “being on the market” vs. “being in the market”.

8) Distressed sales were hardly a force in 2014:

Both short sales and REO sales hovered around only 6% of the market for the past two quarters. There are still distressed sales to buy out there, but they are far and few in between.

9) Interest rates are boosting purchasing power for buyers:

All the experts keep saying rates are going to increase, but then the Fed keeps surprising us with lower rates. Obviously this cannot continue forever, but for now lower rates are going to help buyers afford more house for their money (and afford to purchase in a market with higher prices).

10) Trends to Watch: Job Market, Interest Rates, and Inventory

Three factors to watch this year include interest rates, the health of the local and national job market, and housing inventory. These are three of the biggest players in the market right now since cash investors and freakishly low housing inventory are no longer driving factors.

a) Interest Rates: Rates moving up and down will impact values to a certain extent as buyers will be able to either pay higher prices or not.

b) Job Market: Our economy has been inching forward, but we need local buyers to have higher incomes. Relief at the gas pump will certainly help free up some funds, but that is an external temporary boost for buyers instead of wage growth.

c) Housing Supply: Inventory has been flirting with 2.5 months, and it was poised to grow this coming year (but we’ll see what lower rates do to inventory as more buyers may enter the market). Remember that the market in Sacramento showed declining values any time in the past 15 years when inventory was higher than 4 months of housing supply. We like to say “5 months is a normal supply of houses”, but that’s not the norm for today’s market. In short, let’s keep our eye on how high inventory goes because the market is very sensitive to increases in inventory.

Questions: How would you describe the market in 2014? Anything else you’d add? If you are not in Sacramento, are there some similarities here that also resemble your market? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

3) The Reality of Less Cash: We no longer have a foreclosure epidemic both locally and nationally, which means there are fewer houses being flipped. Thus a rule like this carries far less impact in today’s market compared to the beginning of 2010 when it was absolutely beneficial. For reference, when FHA first eased their 90-day rule in 2010,

3) The Reality of Less Cash: We no longer have a foreclosure epidemic both locally and nationally, which means there are fewer houses being flipped. Thus a rule like this carries far less impact in today’s market compared to the beginning of 2010 when it was absolutely beneficial. For reference, when FHA first eased their 90-day rule in 2010,

The Wright Report: By the way, I contributed a few thoughts to

The Wright Report: By the way, I contributed a few thoughts to