Volume is down and inventory is up. Is that a problem? It sounds like a question for a high school Economics class, but here we are talking. Today I want to kick around two quick thoughts and then dive deeply into trends. I hope this helps – whether you’re local or not. Anything to add?

Here are the two big ideas to talk through right now.

This could be a problem: If sales volume continues to slump and inventory rises without buyers absorbing new listings, it could be a sign the market is changing in a big way. No matter how we look at it sales volume has been down lately in Sacramento. This was the weakest September since 2007 as volume was 14% lower than last year, and quarterly volume was down about 6% too. But keep in mind overall the year as a whole has actually seen strong volume, so it’s not like sales have fallen off the face of the earth (but it’s a concern we’re seeing the numbers change over the past few months). Housing inventory is also up and we haven’t seen it this high since 2014.

This could also be a dull fall: Despite the numbers seeming gloomy right now, they’re actually really consistent with what the market showed in 2014 when we had an extremely dull fall season. In fact, quarterly volume that year was down 6% and September volume was weak too. Does that sound familiar? Also, we have a nearly identical level of inventory right now compared to then too. I don’t say this to sugar coat any red flags in the market, but only to give pause and say what we’re seeing right now could simply be a very dull fall season.

We need more time: The truth is we need time to see how the market will pan out. For now we live in the tension of not knowing the future and interpreting trends for the present. My advice? Watch closely, be careful of hyped headlines, and be sure to take a wider view of the market too (let’s not forget 2014).

I hope that was helpful.

—–——– Big local monthly market update (long on purpose) —–——–

Prices actually went up last month. What the? Yes, the market is softening, but prices saw an uptick from August to September. That might seem confusing since we’re talking about the market cooling, but it highlights exactly what I’ve been talking about lately in that you don’t often see a market changing by looking at prices. You see change first in the listings and sales volume – and then prices eventually. This is exactly what’s happening right now.

Prices actually went up last month. What the? Yes, the market is softening, but prices saw an uptick from August to September. That might seem confusing since we’re talking about the market cooling, but it highlights exactly what I’ve been talking about lately in that you don’t often see a market changing by looking at prices. You see change first in the listings and sales volume – and then prices eventually. This is exactly what’s happening right now.

Normal fall stuff: Last month it took longer to sell, the number of listings increased, and we saw a dip in sales volume. This is what we’d expect to see at this time of year, though the dip in volume was definitely sharp, which is something we’ll watch over time to see if it’s a byproduct of a dull fall or the start of a bigger trend. Beyond volume being down 6% this quarter, all the metrics look fairly normal for the fall. Well, they look normal for a dull fall season, that is.

Momentum slowing: Beyond a seasonal slowing we’re also seeing momentum slowing. I explain it here in a presentation I gave yesterday.

Interest rates rising: One of the reasons why we’re seeing volume slough could be due to interest rates rising. Earlier in the year it seemed buyers ran to the market in light of news of rising rates, but right now it doesn’t seem like buyers have their running shoes on any longer.

Buyers have more power, but not all power: The market is shifting to favor buyers, though sellers still have lots of power. Some buyers hear about a softening market and think they can make lowball offers, but that’s just not realistic. For instance, last month 40% of all sales had multiple offers in the region. That tells us the market isn’t dead despite softening. Buyers, did you hear that? Enjoy your newfound power, but you still have to bring strong reasonable offers.

Listings may have peaked: Overall housing inventory is up as I mentioned above, but it looks like the number of listings is starting to crest for the year. I’ve been watching listings closely over the past few weeks and it seems like they maybe peaked. We’ll know for sure in a month or so. This is exactly what we’d expect to see happen around this time of year, but it maybe seems like more welcome news right now. Let’s keep watching to know for sure.

Being technical about weak volume and inventory: Here’s the thing, we saw a very weak sales volume in September, and it ended up really impacting inventory levels. In fact, when looking at graphs the trend line shot up dramatically last month (see below). But technically what happened was the sales that normally would’ve sold were basically piled on to the number of listings instead, and that’s making the housing supply figure look much more dramatic. Ultimately the number of listings isn’t all that abnormal for the time of year, though if sales continue to dry up over time, then it becomes a much bigger deal to have even this number of “normal” listings.

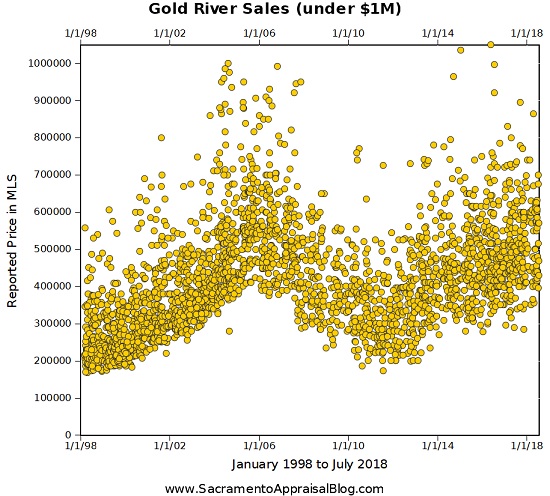

Pricing lower this fall: Right now at the least it looks like we’re poised to have a dull fall like we had in 2014. These past couple of fall seasons the market simply felt a little more flat, but this year I expect we’ll see a more pronounced price difference between sales in the spring and the fall. Remember, if listings aren’t attracting offers, it’s because the market is no longer biting at that level. What is similar and getting into contract? That’s the big question, and when a fall season is more dull it’s important to be realistic about the need to potentially price lower. In other words, it’s probably not going to be enough to price a property 1% below the height of spring and expect a flood of buyers. Remember, it doesn’t matter what other listings are priced at if they’re not selling. The only thing that matters is what is actually getting into contract. That’s where we see the market.

I could write more, but let’s get visual instead.

DOWNLOAD 63 graphs HERE: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

BIG QUESTIONS:

1) How did the market change from last year?

2) How did the market change from August to September?

3) What’s happening with inventory?

4) What’s happening with sales volume?

SACRAMENTO COUNTY VOLUME:

Key Stats:

- September volume down 14%

- 2018 volume down 1% (January to September)

- Annual volume down 2% (past 12 months)

- Volume has been strong this year, but it’s definitely down lately.

SACRAMENTO REGION VOLUME:

Key Stats:

- September volume down 16%

- 2018 volume down 1.4% (January to September)

- Annual volume down 1.8% (past 12 months)

- Volume has been strong this year, but it’s definitely down lately.

PLACER COUNTY VOLUME:

Key Stats:

- September volume down 19%

- 2018 volume down 3% (January to September)

- Annual volume down 3% (past 12 months)

- Volume has been strong this year, but it’s definitely down lately.

SACRAMENTO COUNTY (more graphs here):

SACRAMENTO REGION (more graphs here):

PLACER COUNTY (more graphs here):

I hope that was helpful.

DOWNLOAD 63 graphs HERE: Please download all graphs here as a zip file. See my sharing policy for 5 ways to share (please don’t copy verbatim).

Questions: What do you see happening with volume and inventory right now? What are you hearing from buyers and sellers? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.