Two weeks ago I talked about seeing the forest through the trees in real estate. The big point was it’s easy to look so closely at the most recent stats that we don’t see the bigger picture of the market. It’s sort of like noticing only the trees instead of the forest (hence the title). Anyway, in today’s big monthly market update I wanted to show how this concept actually works in real life when crunching numbers in the Sacramento area. Whether you’re local or not, I hope this will be interesting or even provocative for how you think about and share housing trends. I’d love to hear your take in the comments below.

Interest Rates & Nerf Battle: Before diving in, I have two quick things to share. Unless you’ve been in a bunker without internet access, you’ve probably heard the Fed finally increased rates. There is some good discussion unfolding on a post on my Facebook page. I’d love to hear your take there or here. Also, in non-real estate news, I recently built a Nerf gun battlefield out of pallet wood for my son’s birthday. Check out a quick video tour at the bottom of the post (or here).

Recommendations for reading THE BIG MONTHLY POST: Compare the numbered bullet points to get a sense of the latest numbers (the trees) with older stats (the forest). If you’re short on time, just skip the graphs or download them for later use. The big question today: What difference does it make to look at both recent numbers and year-old numbers? If you’re new here, once a month I do an in-depth market update, whereas other posts are short and sweet. I know the post is long, but it’s on purpose (thanks for reading).

SACRAMENTO COUNTY:

The Latest Numbers (Trees):

- DOM: It took 3 more days to sell a house last month than two months ago.

- Volume: Sales volume declined 18% from the previous month.

- Inventory: Housing inventory stayed about the same as the previous month.

- Median Price: The median price has been the same for 7 months.

Last Year’s Numbers (Forest):

- DOM: Last year in November 2014 it was taking 6 days longer to sell.

- Volume: It’s normal for volume to decline from October to November, so highlighting an 18% “decline” is silly. The bigger story is volume this November is actually 12% higher than last November.

- Inventory: Current inventory is 36% lower than last year at the same time.

- Median Price: The median price was 5.8% lower last year, which reminds us values have seen a modest uptick this year.

Some of my Favorite Graphs this Month:

DOWNLOAD 61 graphs HERE: I have many more graphs you can download for study, use in your newsletter, or share some on your blog. See my sharing policy for ways to share (please don’t copy this post verbatim).

SACRAMENTO REGIONAL MARKET:

The Latest Numbers (Trees):

- DOM: It took 4 more days to sell a house last month than two months ago.

- Volume: Sales volume declined 20% from the previous month.

- Inventory: Inventory increased by 3% from the previous month.

- Median Price: The median price is down 1% from a few months ago.

Last Year’s Numbers (Forest):

- DOM: It took 5 days longer to sell a house the same time last year.

- Volume: Sales volume in 2015 is actually 9% higher than last year. Also, in 2014 sales volume declined 23% from October to November, so let’s not freak out about the 20% “decline” above.

- Inventory: Current inventory is 28% lower than last year at the same time.

- Median Price: The median price was 9.7% lower last year at the same time.

Some of my Favorite Regional Graphs:

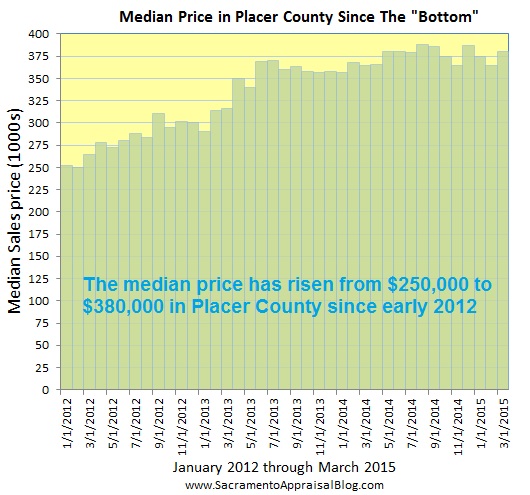

PLACER COUNTY:

The Latest Numbers (Trees):

- DOM: It took 4 more days to sell a house last month than two months ago.

- Volume: Sales volume declined 22% from the previous month.

- Inventory: Inventory increased by 10% from the previous month.

- Median Price: The median price has been jumping up and down for the past few months (generally hovering between $390-400K).

Last Year’s Numbers (Forest):

- DOM: Last year it took an average of 5 days longer to sell.

- Volume: Sales volume this November was 12% higher than last November.

- Inventory: Current inventory is 23% lower than last year at the same time.

- Median Price: The median price was 5-7% lower last year at the same time.

Some of my Favorite Placer Graphs this Month:

Quick Market Summary: On one hand the market in Sacramento has been slowing down. This is normal to see during the fall, and we see a slowness with less sales volume compared to a few months ago, increased days on the market, and a slight increase in housing inventory. The bigger story though is how much different the market is this year compared to last year. In 2014 the fall was extremely dull and incredibly overpriced (as evidenced by 300-400+ price reductions every day). This year housing inventory is over 20% lower, sales volume has been roughly 10% higher, it’s taking 5-6 days less to sell a house, and price reductions have been far less of an issue. However, even with strikingly low housing inventory and more glowing numbers this fall, if the price is not right, buyers are not pulling the trigger. Bottom line. Well-priced listings are tending to attract multiple offers, but otherwise there are homes that are being priced higher that are sitting instead of selling. Sellers would be wise to remember prices tend to soften in the fall, which means pricing like it’s the spring probably isn’t a good move.

Nerf Battlefield I built: Okay, now let me give you a quick tour of a pallet wood Nerf battlefield I built for my son’s birthday. Yes, an epic war happened just two weeks ago in my backyard. Check it out below (or here). Locals, if you want to borrow it for a birthday party, feel free to reach out (you have to pick it up, return it, sign a liability waiver, and of course be trustworthy). 🙂

DOWNLOAD 61 graphs HERE: I have many more graphs you can download for study, use in your newsletter, or share some on your blog. See my sharing policy for ways to share (please don’t copy this post verbatim).

Questions: What stands out to you when comparing the latest numbers with older stats? What impact do you think an increase in rates will have on the housing market? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.