It feels like chaos out there. The housing market is on steroids and it’s mind-blowing to see such rapid growth lately. Today I want to unpack ten things I’m watching in today’s market. For my out-of-area readers, I’m guessing you are probably seeing the same trends. But please let me know. What is similar or different in your area?

MARKET UPDATE PRESENTATION: I’m giving a big presentation next week by Zoom for SAFE Credit Union. It’s free and you are invited to sign up here. It could be useful for background noise while working. Hope to see you there.

10 THINGS TO KNOW ABOUT THE MARKET

Skim or read in depth. The following post is organized around ten points.

1) PRICES ARE INSANE:

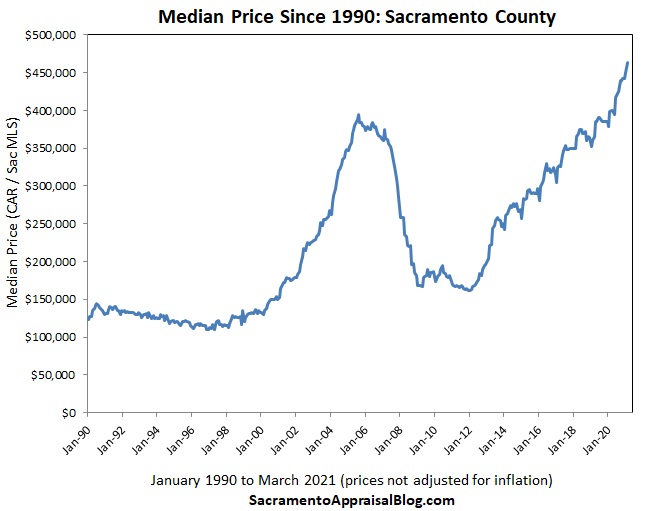

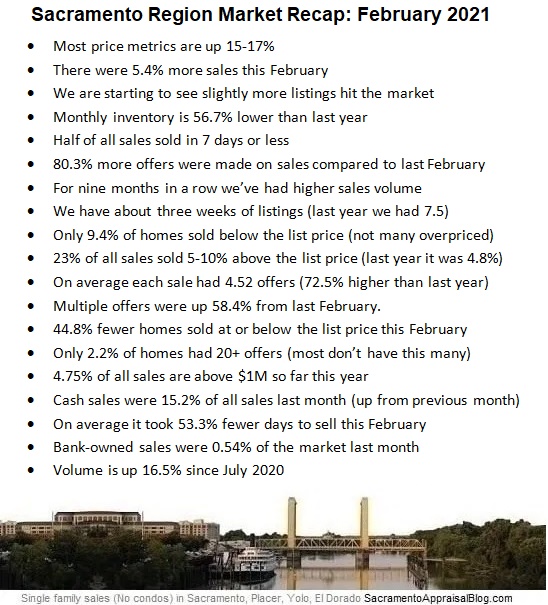

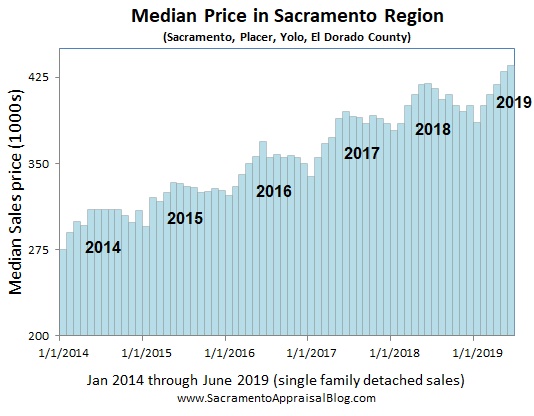

We’ve seen enormous price increases lately. It’s mind-blowing to see 20% increases because the market really was slowing down in recent years. Also, the median price in the region is up nearly 9% from two months ago in January.

Here’s a different way to look at prices. The orange line represents 2021. It’s an outlier market, right?

2) BUYERS MADE TWICE AS MANY OFFERS LAST MONTH:

Buyers made twice as many offers last month compared to the previous year. These figures are based on closed sales and MLS data.

3) MORE BUYERS ARE OFFERING 5-10% ABOVE THE ORIGINAL PRICE:

Here’s a look at what buyers are paying right now in relation to the original list price. One of the glowing stats is we’ve seen about five times as many buyers paying 5-10% above the original list price this year. Wild times, right? Of course only six percent of sales sold below the original list price last month too, which reminds us very few properties are overpriced. Yet nearly one in five sales sold at the original list price. I know, that almost seems like an error, but it’s really not because take a look at last year which represents what should be happening. As you can see if we were having a normal year we’d probably be seeing about half of all sales selling at the original list price.

Takeaway: Be cautious about saying everything is selling 20% above the list price. The stats don’t support that claim.

4) HOUSING SUPPLY HAS BEEN CHOPPED IN HALF:

I feel like a broken record. Housing supply is about half of what it was last year. The truth is we have weeks of listings and months of buyers.

5) SALES VOLUME HAS BEEN UP FOR TEN MONTHS IN A ROW:

There aren’t enough listings out there to satisfy demand, but for ten months in a row buyers have been buying basically everything, which means we’ve been able to surpass numbers from last year. Some people don’t believe it when I tell them this, but it’s the truth. In short, it is not easy out there, but buyers are getting it done.

NOTE: I have images like these for Placer, El Dorado, and Sacramento County too. Send me an email if you need something.

6) MORE LISTINGS ARE FINALLY COMING:

We are starting to see more listings hit the market. It really is a normal seasonal amount so far, so it’s nothing to write home over, BUT during a pandemic anything that feels close to normal is something we covet. Granted, there are not enough listings to satisfy crazy demand yet or slow down the market, but at the least we’ve seen more lately.

Mortgage applications drop: Speaking of shopping for homes, for three weeks in a row we’ve seen mortgage applications drop. This seems to be a reflection of rising rates and prices lately and it’s one small metric to watch to get a sense of demand in the market.

7) THE REST OF THE COUNTRY FEELS LIKE SACRAMENTO:

I love this image from Altos Research because it helps show depleted inventory is something happening across the entire country. This is a good reminder because it’s tempting for locals to blame the aggressive market on Bay Area buyers when in fact many markets feel just like this. I’m not diminishing the reality of what seems like increased Bay Area migration, but let’s not forget we’re seeing an ultra-competitive market almost everywhere due to crazy low rates and anemic housing supply during the pandemic.

8) IT’S NOT A DISTRESSED MARKET:

There is so much talk about a coming foreclosure wave, but for now it doesn’t look like there is one on the horizon as forbearance rates are heading in the right direction. We are still in the thick of the pandemic of course, so we are certainly not out of the woods. All I’m saying is I’d recommend being cautious about embracing a doom and gloom narrative because so far the stats don’t support this idea. Let’s stay tuned though. And for the record I will be the first to change my narrative if the stats change… In terms of distressed sales at the moment, we really have bottomed out. It’s hard to get too much lower than 0.39% of sales being bank-owned and 0.30% of sales being short sales.

9) HUGE GROWTH AT THE TOP:

The market is very much top heavy right now. What I mean is we’ve seen explosive growth at higher prices – especially above $1M. This is a dynamic being mirrored in many markets across the country too.

BIG TAKEAWAY: When talking about price stats being 20% higher it’s important to realize some of that growth has to do with the types of homes selling. In short, less at the bottom and more at the top naturally elevates price stats.

10) CONVENTIONAL IS MORE DOMINANT THAN CASH:

The narrative is that cash buyers are gutting the market, but it’s not technically true. Cash really isn’t king these days because it’s so cheap to borrow money. Locally we’re seeing 7 out of 10 sales go conventional. BUT cash is absolutely winning when conventional buyers can bridge the appraisal gap and offer other incentives to the seller. It’s not so easy to get an FHA offer accepted either, but at least 1 out of 10 sales were FHA last quarter.

BONUS: Here are two visuals to show what the median price looks like over the past few decades. In one visual I adjusted for inflation too (which can be an important consideration when comparing today with 2005). Here are some thoughts on how long this market can keep going.

Other visuals: Not that you needed more, but check out my social media in coming days and weeks for extra visuals and commentary. I am posting daily stuff on Facebook, Twitter, and LinkedIn. Oh, and sometimes Instagram.

Thanks for being here.

Questions: What stands out to you about the market lately? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.

DOWNLOAD 70+ visuals

DOWNLOAD 70+ visuals

Two ways to read the BIG POST:

Two ways to read the BIG POST: