Some sellers today are being stubborn, and it’s really backfiring. Not only are sellers tending to overprice, but they’re also not in sync with buyers getting more concessions. Buyers are routinely getting credits for closing costs, repairs, and rate buydowns. In short, it’s time for sellers to listen and pony up to get deals done. In today’s post, I have some fresh perspective about concessions, and I have a huge market update too.

Scroll quickly by topic or digest slowly.

UPCOMING SPEAKING GIGS:

9/10/25 Windermere Sacramento

9/16/25 Culbertson & Gray (private)

9/18/25 Realty One Group (ROG Talks) register here

9/24/25 Keller Williams Roseville

9/25/25 Further Together (register here)

9/26/25 PCAR

9/30/25 Elk Grove Regional MLS Meeting

10/15/25 EDH Coldwell Banker (private)

10/21/25 Orangevale MLS Meeting

10/23/25 CREB Meeting (TBA)

10/24/25 Fusion Rally in Denver, CO

11/4/25 SAR Main Meeting

11/5/25 KW Elk Grove

12/9/25 Downtown Regional MLS Meeting

12/10/25 SAFE Credit Union (TBA)

1/14/26 Windermere EDH / Placerville

2/11/26 San Joaquin County presentation (TBA)

1) WELCOME BACK CONCESSIONS AMOUNT FIELD

When the NAR lawsuit happened, the MLS field for the commission amount to the buyer side was removed, but there was also a separate concessions field that was taken away. It was collateral damage from the lawsuit even though the concessions field had nothing to do with compensation. Well, this concessions amount field is thankfully back as of a few weeks ago (thank you Metrolist). Agent friends, PLEASE fill this out because it makes pulling comps helpful for everyone. Knowing what the seller gave the buyer is so important when choosing comps. This field has nothing to do with compensation either. It’s all about stuff like closing costs, credit for repairs, buying down the rate, etc… Here’s what the new field looks like:

2) SELLERS PLAYING HARDBALL OVER $9,000

Some sellers are really stubborn right now, and they’re not negotiating with buyers. These sellers are stuck in 2021 thinking they hold all the cards, and they’re not realizing that buyers have more power today. Over the past month, the average concession amount listed in MLS has been $9,168 (or 1.6%). There are obviously much larger concessions in some instances, but on average it’s been pretty minor. In short, some sellers are playing hardball and causing buyers to walk over a minor amount. It’s important to note that we’re in a market where many properties only get one offer (and so many listings have zero offers).

Kudos to the sellers above for listening to the market and getting it done. In today’s world, buyers might want a lower price and concessions. Meanwhile, some sellers are dreaming of a higher price only. Don’t be this seller below.

3) MORE CONCESSIONS AT LOWER PRICES

Counties with lower prices have tended to have more concessions (not a shocker). These numbers are based on MLS data, and if anything, I think these stats are conservative since not every agent checked “yes” or “no” in MLS for whether concessions were present or not. By the way, I don’t include “Call Listing Agent” as a “yes” in my stats (it probably is a yes though).

One more thing. Concessions don’t happen in every transaction (key point).

4) EXPECT MORE CONCESSIONS IN THE SECOND HALF OF 2025

The percentage of sales with concessions is currently higher than we’ve seen in recent years in our largest county – Sacramento. This isn’t a shocker since the market is softer today. The interesting part about this graph is it shows concessions increase during the second half of the year as a normal seasonal trend, so I would expect for sellers to have to give more to buyers for the rest of 2025 unless something unexpected happens with the market. Sellers, did you hear this? Historically, sellers give more to buyers during the second half of the year (see white space and ignore 2020).

NOTE: Some might interpret this stat as agents inputting compensation as a concession, but I don’t think that explains it. It seems like the seller is paying for the buyer’s agent commission most of the time (based on conversations I’m having), so if agents were inputting the commission as a concession, this number should be so much higher than it has been since the NAR lawsuit.

5) APPRAISERS HELPED BRING THIS CHANGE TO MLS

Props to a group of appraisers from REAA Sacramento for opening up conversation with MLS about the missing concessions amount field and pitching the idea for how this field could work in a post-NAR lawsuit world. MLS liked the idea with the drop-down menu and adopted it. I was part of the initial conversation to help make this happen, but Joe Lynch and Amy Parker did the heavy lifting here by joining the MLS board (thanks guys).

—————— big market update for anyone interested ——————

BIG MARKET UPDATE

If your self-esteem is based on sales volume, you’re in a world of hurt. Closed sales volume was lackluster in the entire region in August. While we’ve seen an increase in the number of purchase applications nationally, it just has not yet translated to an increase in pendings or closed sales. The reality is the pile of buyers today has continued to flirt with historic lows. Traditional price metrics have been hovering around last year, give or take 1% or so. In short, prices have been pretty flat with some brewing downward pressure. When pulling comps, I’m noticing the same thing with flat prices or down a little from one year ago. Yet, condos can be down much more.

ACTIVES AREN’T GROWING ANY LONGER

In the background, we’ve seen the pile of active listings decrease lately in light of sellers backing off the market a few months ago. I’ve been talking about how increased uncertainty has led to buyers backing off the market since April, but this has been a vibe for sellers also. And this means the gap between sales and listings is closer today, which can affect market temperature. I don’t think the housing doom narrative has caught up to this trend yet because it’s all about explosive growth for listings. Okay, I get it, but that growth has tapered in recent months due to seller uncertainty (and now seasonality).

MOST PROPERTIES ARE GOING BELOW

The bulk of sales are selling below the original list price, and this is great news for buyers!!! This speaks to sellers overpricing and prices softening too.

SOME NEW COOL STATS (SPREADSHEET COMING SOON)

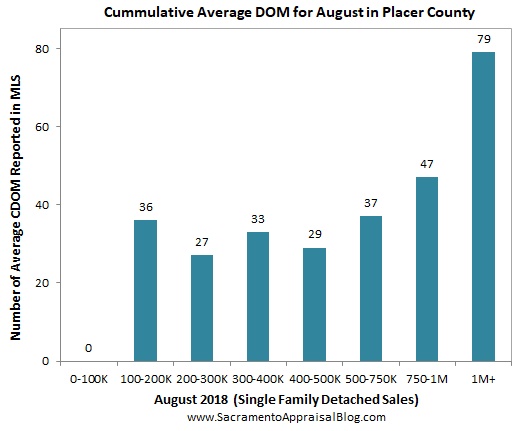

Here are some new stats I’ve been tinkering with lately. I built a spreadsheet that can instantly create these visuals. I’ll introduce the spreadsheet hopefully next month, and I’d like to do some training ahead on how to use it. I’ve put out free spreadsheets before, but this one is the best one I’ve done since it’s basically automated. My goal is to help people understand the market. It’s actually really amazing when using the spreadsheet in neighborhoods and zip codes. You can really see what the market is doing and how different it is by location and price point. Imagine having someone ask you a question about the market and being able to instantly push out stats like this. Anyway, stay tuned for more information. I am going to be selling the spreadsheet and my time for training. The fee will be modest, and the result can be career-changing. Oh, I’ll have more visuals too. I’m not done with the spreadsheet yet.

YEAR OVER YEAR STATS

Take some smaller counties with a grain of salt since the numbers can bounce around from month to month depending on what has sold (El Dorado especially).

JULY TO AUGUST STATS

Thanks for being here.

LEAVING COMMENTS: The captcha is not working perfectly. If you open up a new browser, that should solve the issue. It’s been a problem to comment when clicking from my weekly email. My apologies.

Questions: What stands out to you about the stats today? Anything to add? I’d love to hear your take.

If you liked this post, subscribe by email (or RSS). Thanks for being here.